Economy

Buffett lunch fetches record price

Updated: 2011-06-17 11:56

By Lu Chang and Ariel Tung (China Daily European Weekly)

|

|

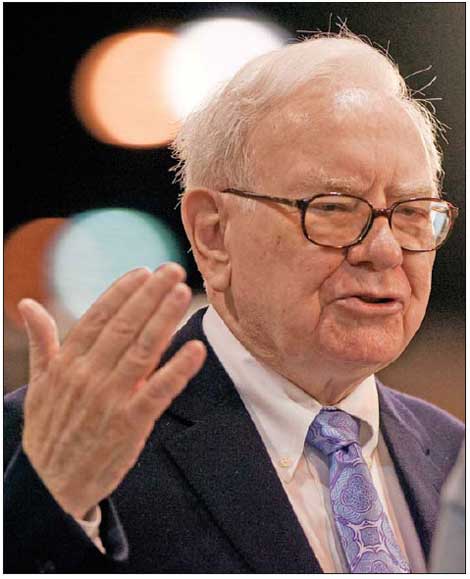

This is the 12th year Warren Buffett has volunteered to hold the charity auction lunch. Nati Harnik / Associated Press |

Strong speculation that winning bid of $2.63 million is by Chinese

Notwithstanding the gloom in Europe and the US, the "Oracle of Omaha" still seems to be shining bright on the global financial landscape.

Eye-popping numbers are nothing new to billionaire investor Warren Buffett. With a net worth of over $50 billion (35 billion euros), Buffett is also known for his uncanny sense of picking out big-ticket winners and predicting the economic pitfalls well in advance.

With such a wealth of financial acumen and aura around him it would come as no surprise that his words are the gospel for legions of investors and financial experts.

But in what promises to be eye-popping, an anonymous bidder is believed to have submitted a $2.63 million bid for a luncheon with the 80-year old Buffett at Smith & Wollensky, a steak house in New York.

"For many business tycoons, a private lunch with the 'stock god' can be an ideal strategy to promote themselves and also an occasion to gain tips on promoting their business," says Yuan Wenzhao, deputy general manager of the Beijing-based Hanji Investment Group.

When the online bidding war ended on June 10 with eight bids, the highest bid had fallen short of last year's record $2.63 million at $2,345,678, according to eBay. But according to Bloomberg reports, the eventual winner offered to kick in an extra $281,000 just to top last year's record.

Though organizers did not release the identity of the winner, there has been plenty of speculation that the winning bid came from China, since two Chinese business tycoons who attended previous Warren Buffett auction lunches raised more than half of the proceeds at the time.

Plunking down millions for a steak lunch might seem a tad excessive, but combining Buffett and investment strategy, it is unique and always inspiring.

Past winners have said their incentives to bid were Buffett's influence and the charitable cause to support the poor and homeless.

Zhao Danyang, the Hong Kong-based hedge fund manager who won the bid in 2008 with a pledge of $2.1 million - three times larger than the previous record - found that the price of the lunch was a small price to pay to dine with Warren Buffett, the man whose strategy Zhao studied to make sense of the investing world.

"His views will benefit me my whole life," says Zhao.

|

Each year, many Buffett admirers flock to his hometown of Omaha, Nebraska. This is also the location for the annual shareholders meeting of Berkshire Hathaway, an insurance-to-ice-cream conglomerate of which Buffett is the CEO. People line up for hours to hear him field questions on finance, public policy and life. The winner of this year's auction and up to seven friends will meet Buffett on a mutually agreed upon date, with free rein to steer several hours worth of table talk.

This is the 12th year that Buffett has volunteered to hold the charity auction fundraising lunch with whoever pays the highest price. The money goes to the Glide Foundation, a nonprofit organization that provides social services to the poor and homeless in the San Francisco Bay Area.

Yuan from the Hanji Investment Group says that it's very likely that the winner is Chinese, as there has been a strong "Buffett influence" going on in China and many are just keen to use his recognition to open doors to new business contracts. But he doesn't think "learning from the master" will make their fortune soar, because "there's only one Buffett in the world that can't be duplicated".

"It is beyond reason to pay such an extravagant sum only to listen to a few remarks over dinner. One can always buy the books and extract what is suitable for his own path to financial success," Yuan says.

However, Richard Xu, senior managing director of Genesis International Capital LLC in New York, says he could understand why a Chinese entrepreneur or investor would want to spend some personal time with Buffett.

"Whether from the US or China, a successful investor would want to seek guidance from and talk to the legendary investor about the problems they face," Xu says.

Xu says he admires Buffett for making value choices in his investments. Although Buffett has not made that many Chinese investments, he has been successful in those he has picked, such as PetroChina, a Chinese oil and gas producer, and Chinese automaker BYD.

"Warren Buffett only invests in what he knows and understands," Xu says. "During the tech bubble in 1999 and 2000, he did not make any investments in high-tech companies. Right now, he's interested in China, but he's not too familiar with it. I think he will spend a small percentage of his money on China, but his investments will be focused in the US and European countries."

Calling it a "fine wine" effect, Kevin Pollack, managing director of Paragon Capital LP in New York, says the lunch bid will only get higher and higher each year.

"With each passing year, Warren Buffett has even more experience and wisdom to share," says Pollack who believes that the newest winner will "end up with plenty of valuable advice, investment ideas and contacts, and an experience that they'll remember for the rest of their life."

Specials

Mom’s the word

Italian expat struggles with learning English and experiences the joys of motherhood again.

Big win

After winning her first major title, Chinese tennis star could be marketing ace for foreign brands

Markers of memories

Axe comes down on historical buildings as part of Harbin government’s baroque programs