Economy

Sowing the seeds of doubt

Updated: 2011-08-03 11:10

By Zhou Siyu (China Daily)

In April, the State Council, China's cabinet, issued guidance on the development of the industry, which "encourages mergers and acquisitions between seed companies", and aims to "foster companies with international competitiveness".

The new guidance was interpreted by many as signaling the government's intention to establish a large domestic seed company to compete with the international giants in the Chinese market.

However, to distributors such as Zhang and Zhao, the new guidance seems to have put the counterfeit producers on their mettle and they've fought back vehemently. "They will make use of every minute before their production licenses expire," said Zhang.

The government is almost certainly aware of the reaction of the illegal producers. In order to promote the protection of intellectual property rights and combat fake seeds, the Ministry of Agriculture has extended 2010's special one-year campaign against the sale of counterfeit seeds into this year.

The market will improve with time and as the new regulations take effect, Zhang and Zhao believe. So do the multinationals.

The wheat from the chaff

Despite the deluge of fake seeds on the market, international giants such as Pioneer are still expanding at a rate that is alarming to many Chinese observers.

"We achieved a double-digit increase in corn-seed sales nationwide this spring, but even we felt the impact of the fake seeds," said William Niebur, Pioneer's vice-president and general manager in China.

The overall increase in sales nationwide has exceeded the losses from fake seeds, the company said.

Recent years have seen a steady increase in the number of cornfields planted with Pioneer's seeds. One of the company's major varieties, Pioneer 335, is China's third-most-popular corn seed, with more than 2 million hectares under cultivation by 2010. The area devoted to growing Pioneer's corn seeds is estimated to be 4 million hectares, accounting for nearly 13 percent of the total area sown with corn, according to industry data.

"Multinational players such as Pioneer have great technological advantages and seed resources, and they invest heavily in research and development every year," said Ma Wenfeng, a senior analyst at Beijing Orient Agribusiness Consultant Ltd, one the largest consultancies in the industry.

"By comparison, most Chinese companies are small- or medium-sized. They cannot compete with them (the multinationals) in either respect," he added.

And Pioneer's business will continue to expand. The company will boost its presence in northwestern and southwestern China through further investment over the next few years, Niebur told China Daily.

In addition to continual investment, the company will also "launch a new pipeline of corn seeds into China's market", said James Borel, executive vice-president of DuPont de Nemours, which bought Pioneer in 1997.

Ma said that the presence of foreign seed companies in China has had a positive influence.

"The international industry giants can bring advanced technologies, management and service expertise into China. They will help improve the professional standards of Chinese seed companies," he said.

However, given the sensitive nature of the seed industry, Ma suggested that the government should "keep an eye on the movements of the foreign companies" to avoid a worst-case scenario where overseas companies control the domestic industry.

Whoever controls the seeds controls the whole nation, he said.

Chinese regulations mean that foreign outfits specializing in field-crop seeds, such as soybeans and rice, are not allowed to hold more than 49 percent of joint ventures, according to the Ministry of Commerce.

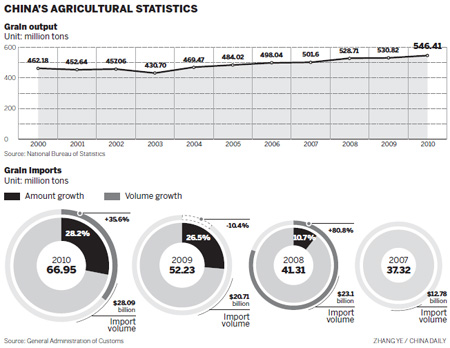

But in the eyes of the global players,China's current low rate of food production is far more threatening than their growing market share. China has to feed more than 22 percent of the global population, with 7 percent of world's arable land and 8 percent of its water resources. This is a country where the multinationals' advanced technologies can be employed to benefit both farmers and consumers.

"China's problem in terms of agriculture is nothing short of profound. We need to increase agricultural production and we need to do it over a predetermined time period. This requires collaboration (between government and the private sector)," said John Ramsay, chief financial officer of Syngenta AG.

The Swiss company is the world's largest producer of crop-protection chemicals, the third-largest vendor of seeds by sales, and one of the companies making inroads in China's agriculture sector.

Specials

Carrier set for maiden voyage

China is refitting an obsolete aircraft carrier bought from Ukraine for research and training purposes.

Photo

Photo  Video

Video

Pulling heart strings

The 5,000-year-old guqin holds a special place for both european and Chinese music lovers

Fit to a tea

Sixth-generation member of tea family brews up new ideas to modernize a time-honored business