Sales rebound, but year-end outlook remains cautious

Updated: 2011-09-26 07:53

By Jenny Gu (China Daily)

|

|||||||||

Reported high luxury dealer inventories could signal overall slowdown

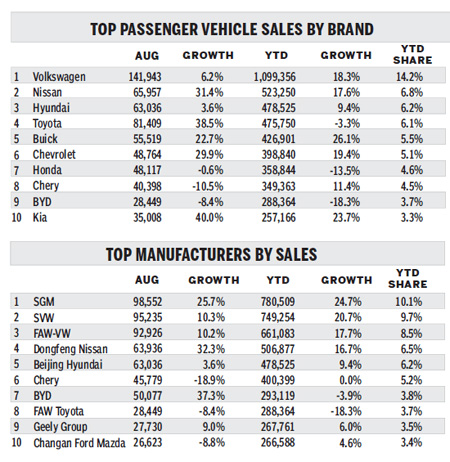

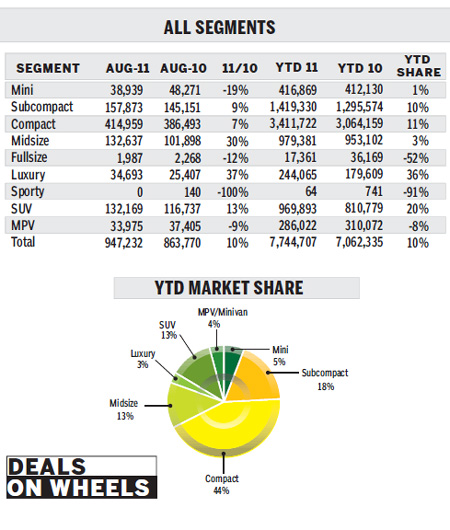

Following the pattern of previous months, passenger vehicle sales in China grew in August while light commercial vehicles registered declines.

Passenger vehicle sales increased 10 percent to 1.02 million units for the month as light commercials posted a 6 percent decline to 339,000 units.

But when adjusted for seasonal fluctuations, sales of both passenger and commercial vehicles rebounded.

JD Power projections now foresee total light vehicle sales for the year of 13.3 million units, indicating the market is doing better than previously thought for both passenger and light commercial vehicles - but for different reasons.

Contributing to passenger vehicle sales growth was full recovery of production by Japanese automakers that resulted in an increase in their wholesale business.

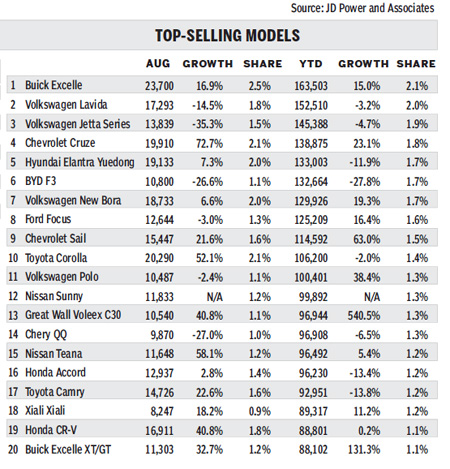

Toyota sold a record-high 85,000 units to dealers in August, up 38 percent year-on-year, with its Corolla once again ranking second among the top 10 best-selling models.

In the light commercial vehicle market, growth was driven by SAIC-GM-Wuling minivans offered at discounted prices. Sales of the Wuling minivan grew 13 percent and accounted for nearly 30 percent of the total in the segment, helping the segment avoid a steep decline.

Despite the positive numbers, we still expect demand to be moderate in the coming months.

Demand for luxury vehicles has been slowing since July and some models have shown declines in sales since the start of the second half of the year.

We have learned that inventory levels for some luxury cars are quite high, putting pressure on dealers to cut prices and sacrifice their profit margins.

This weakening demand for luxury cars may well signal a slowing overall market.

Tightening subsidies

A factor overshadowing the outlook is government tightening of policies on fuel-efficient vehicles starting in October.

Only 22 models will be eligible for the 3,000-yuan subsidy compared to the current 121.

We could see a sudden rise in sales before the end of September as consumers buy before the old policy expires.

Yet buyers might delay their purchase until after October and wait for new models to become eligible for the subsidy. They may even delay their purchases until next year unless automakers provide incentives.

As a result, we expect more price cuts.

The market is quite different this year from 2010, when demand dynamics were more influenced by model availability. Producers struggled to maintain the output needed for popular vehicles.

Production this year has been much higher than wholesale sales for several months, forcing automakers to reduce prices to meet their full-year sales targets.

Because of the many variables, we have a cautious outlook for 2011. The overall market forecast remains unchanged from last month at 17.7 million units for the year, up 3 percent from 2010.

We still project 11 percent growth for 2012, when sales should begin to take off in the second half.

Growth is expected to come from solid demand in smaller cities, capacity expansion, easing monetary and fiscal policies and possible new investment programs after the change in government leadership due in 2012.

We have also taken into account such negative factors as rising oil prices, credit rates, the deteriorating global economy and traffic restrictions in some areas of China.

The author is a senior market analyst of JD Power Asia Pacific. Her email address is jenny_gu@jdpa.com

(China Daily 09/26/2011 page19)