Insurance resolution draws mixed reaction

Updated: 2011-11-17 11:07

By Chen Xin (China Daily)

|

|||||||||

Employees favor receiving coverage from employers, businesses worry about costs

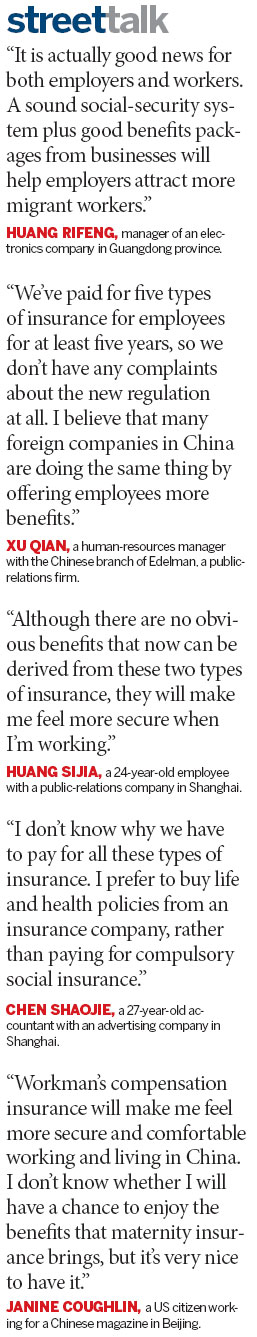

BEIJING - Much debate has arisen recently over a draft regulation that would force employers to pay for two additional types of insurance for their employees.

|

|

The proposal, which the Ministry of Human Resources and Social Security posted to the website of the State Council's Legislative Affairs Office on Tuesday, would make employers responsible for providing five varieties of insurance to workers.

The two additions will be workman's compensation and maternity insurance. The public has a month to comment on the proposal.

Workman's compensation insurance will enable workers who have been injured at their jobs to receive compensation and help in paying their treatment bills. Maternity insurance will allow working women to obtain subsidized medical treatment and will give them various benefits during pregnancies. It will also allow future fathers to take a couple of days off work to accompany their wives to the hospital for childbirth and to receive subsidies.

The year 1999 saw the adoption of a social insurance regulation asking employers to pay for their workers' pension insurance, medical insurance and unemployment insurance.

"The new Social Insurance Law, which took effect in July this year, ensures that all employees have the right to those five types of insurance," said Lu Quan, a social security expert at Renmin University of China. "This draft is a timely supplement to the law and could help better protect workers' interests."

Lu said most State-owned enterprises give their employees those five types of insurance. At many small businesses, though, workman's compensation and maternity insurance remain beyond the reach of workers.

In China, both workers and employers are now responsible for paying for pension, medical and unemployment insurance.

The cost of compensation insurance varies from industry to industry and place to place. In Guangzhou, capital of Guangdong province, a business in the banking industry can buy it for an amount equal to 0.5 percent of an employee's monthly wages, while the rate is 1.5 percent for a petroleum processing firm.

The fees for maternity insurance also vary but always remain below 1 percent of a worker's wages.

Many employers, especially those who run small and medium-sized businesses or private businesses, said they fear that the cost of the two additional types of insurance will prove to be a burden.

"We are already under huge pressure at this time, when business is not good," said Zhao Lingxi, who runs an advertisement company in Shenzhen, Guangdong. "I'm worried that the additional insurance fees will make the situation worse."

Zhao said her company, which employs about 30 workers, pays to provide employees with four types of insurance, but not maternity insurance.

"I think the government should take care of maternity insurance, rather than the employer," she said.

"If the new rule is adopted, the expanded range of social insurance will definitely increase labor costs at my company," said Zheng Zhe, general manager of Gulifa Group, a hardware and tools maker in Zhejiang province.

"If small and medium-sized enterprises have to pay extra social insurance fees for workers, that will bring more pressure on employers, who are currently having financial problems because of inflation and higher labor costs," said Song Xiaohui, a senior officer with the Shanghai Small and Medium-Sized Enterprise Development and Service Center.

Many workers, for their part, praised the change, saying it should have come much earlier.

"My company has not bought us compensation insurance," said Chen Xianlian, a worker at a motor-component plant in Southwest China's Chongqing municipality.

"My colleagues and I are hoping to get it and I'm glad that the insurance will become a requirement and that workers can get easier access to compensation and medical treatment in the future."

Chen said she and her fellow workers do their jobs in a hazardous environment every day. Those who have been injured at that workplace often have only one avenue to obtain compensation - through negotiations with their employers.

On Oct 15, foreign workers in China were placed into the country's social security system, meaning that every business that employs them must pay for their insurance.

Previous reports said the European Union Chamber of Commerce in China has encouraged the Ministry of Human Resources and Social Security to give foreign companies more leeway to choose how they will deal with insurance matters.

Philip McMaster, co-founder of the Beijing-based McMaster Institute for Sustainable Development in Commerce, praised the policy change.

"We should bear in mind that businesses run well only when workers are well protected," he said. "Workman's compensation insurance is a must."

Lu Quan said workers at small businesses, especially migrant workers in the mining and construction industries, will benefit the most if the draft rule is passed. They, he explained, work in dangerous workplaces and rarely have employers who give them workman's compensation insurance.

Yu Ran contributed to this story.