Weak world, domestic demand depress PMI

Updated: 2011-11-24 09:08

By Chen Jia (China Daily)

|

|||||||||

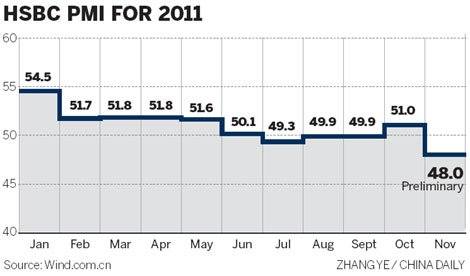

Index in biggest fall since March 2009, a signal of gloomy outlook

BEIJING - Weaker domestic and foreign demand is chilling the outlook for China's manufacturing sector, which is expected to slow to a 32-month low in November, as indicated by the preliminary HSBC Purchasing Managers' Index (PMI) released on Wednesday.

|

|

Workers assemble air conditioners at a factory in Zhuhai, Guangdong province. The preliminary HSBC Purchasing Managers' Index dropped to 48 from 51 in October, indicating gloomy prospects for China's economy. [Photo / Bloomberg] |

The PMI dropped to 48 from 51 in October, the sharpest fall since March 2009, indicating gloomy prospects for the world's second-largest economy, said HSBC Holding PLC.

The index is a prediction of activity in the manufacturing sector, published a week ahead of the monthly official data. A reading below 50 signals contraction, while a number above 50 means expansion.

Qu Hongbin, HSBC chief economist in China, said in a research note that external demand is set to weaken as the contagion of Europe's debt crisis infects more continents.

China is likely to see a decline in new export orders and further reduce manufacturing output in the coming months, he said.

Domestic demand may tend to fall in the final two months of this year, influenced by the cooling of the real estate industry - the largest engine of China's economy, according to Qu.

Demand for building materials, such as steel, cement and glass, as well as in other sectors related to the housing industry, may suffer from a contraction because the real estate market has reached a tipping point, said Zhang Zhiwei, chief China economist at Nomura International (Hong Kong) Ltd.

"It is possible that the housing sector will quickly deteriorate in the coming months," said Zhang, who predicted a reading of 49 in the November official PMI.

The HSBC manufacturing output indicator, a sub-index of the PMI, declined to 46.7 in November, compared with October's 51.4, indicating manufacturers' falling confidence amid a credit squeeze.

Industrial output growth is likely to slow further to 11 percent in the near future, compared with the 13.2 percent gain in October, said Qu.

According to the HSBC report, the sub-index of input prices dropped to 43.2 this month, adding to evidence that inflationary pressure was on a downward track.

In October, the consumer price index, a key indicator of inflation, slid to 5.5 percent from 6.1 percent in September, after July's figure of 6.5 percent posted the fastest gain in 37 months.

"To stabilize economic growth, instead of curbing inflation, will be the top policy concern for the government in 2012. Both fiscal and monetary policies are likely to ease in the next three months to ensure a GDP increase of more than 8 percent next year," Qu said.

Wang Tao, chief economist in China with UBS Securities Co Ltd, didn't expect "too much policy ease", because the slowdown in China's exports and economy has been "gradual".

"The current mode of policy fine-tuning may continue," she said, forecasting more bank lending and increasing fiscal spending.

Wang forecast the credit quota would increase to 8 trillion yuan ($1.26 trillion) in 2012 from about 7.4 trillion yuan this year.