Equities driven lower by slowdown worries

Updated: 2011-12-01 07:39

By Li Xiang (China Daily)

|

|||||||||

|

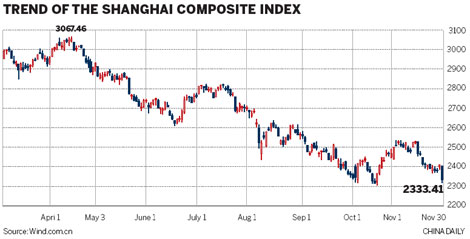

A shareholder monitors prices in Fuyang, Anhui province, as the benchmark Shanghai Composite Index tumbled 3.27 percent, or 78.98 points, to close at 2333.41 points on Wednesday. [Lu Qijian / For China Daily] |

BEIJING - Chinese equities posted their largest declines in nearly four months on Wednesday, reacting to investors' concern over a possible sharp economic slowdown and potentially negative economic data for November.

The benchmark Shanghai Composite Index tumbled 3.27 percent, or 78.98 points, to close at 2333.41 points.

Financial stocks were weighed down by IPO plans announced by several urban commercial banks, which investors speculated might flood the market with an oversupply of stocks.

The B-share market sank 6.13 percent on talk that China will soon launch the international board, which will allow overseas companies to raise capital in the domestic A-share market. The rumor was denied by the China Securities Regulatory Commission.

"The sharp decline shows that market sentiment is so fragile that any rumor could result in a big sell-off," said Zhang Qi, a Shanghai-based analyst with Haitong Securities Co Ltd.

"It will take time to restore market confidence because it is still uncertain whether the risk of a sharp economic slowdown has been completely factored in by the market," Zhang said.

China is due to release official November manufacturing data on Thursday, which is expected to show a contraction for the first time since February 2009.

The HSBC flash Purchasing Managers' Index (PMI) slid below the 50 threshold to 48 in November from 51.1 in October, the lowest since March 2009.

"The weak HSBC flash PMI reinforces our view that the risk of GDP growth below 8 percent in the first quarter of 2012 has increased," Zhang Zhiwei, an economist with Nomura Securities, wrote in a research note.

Zhang forecast the official PMI data would show a fall below 50 to 49, noting that China's housing sector has reached a tipping point, which is likely to deteriorate in the coming months and drag down related sectors including steel and power.

Goldman Sachs Group Inc has reportedly warned of the potential downside risks in the Chinese economy and advised clients to reduce holdings of Chinese companies listed in Hong Kong.

Premier Wen Jiabao said in October that the government will fine-tune economic policies, triggering market speculation the central bank will cut the reserve requirement ratio or interest rates to support cash-strapped small businesses.

Some analysts interpreted the market plunge as a kind of move by investors to force the policymakers in Beijing to loosen the monetary reins.

But Xia Bin, an adviser to the monetary policy committee of the People's Bank of China, said that policy fine-tuning doesn't mean a loosening of credit or changes in interest rates.

"Unless there are surprises in growth or inflation, policymakers will reconfirm and retain the neutral policy stance at the Central Economic Work Conference in early December," said Chang Jian and Huang Yiping, economists with Barclays Capital.

China Daily