Big cities' home prices slide again

Updated: 2012-01-05 08:00

By Wang Ying (China Daily)

|

||||||||

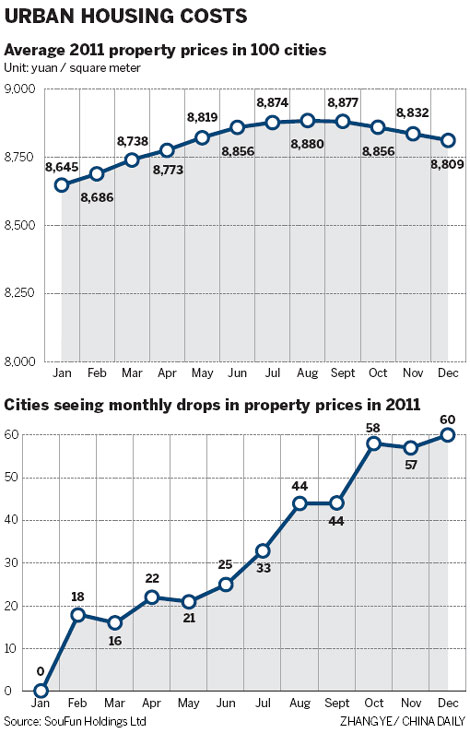

SHANGHAI - A new report shows average property prices in the country's 100 biggest cities fell further last month, sliding 0.25 percent from November.

Analysts said that further declines were likely as long as the central government maintained curbs on housing purchases.

December was the fourth consecutive month in which the average home price weakened across the country.

Property prices in the 100 cities averaged 8,809 yuan ($1,399) a square meter (sq m) in December, according to a report released on Wednesday by SouFun Holdings Ltd, which says it is the nation's largest real estate website.

Among the 100 cities monitored, 60 saw a month-on-month price drop, and three cities' home prices were unchanged. Year-on-year, the 100 cities' home prices rose 2.86 percent in December, 1.2 percentage point less than in November.

Average prices in the top 10 cities stood at 15,588 yuan a sq m, a month-on-month drop of 0.48 percent.

Property prices in Beijing fell 0.25 percent month-on-month, while those in Shanghai slid 0.42 percent.

Chengdu in Sichuan province had the largest month-on-month fall of 1.1 percent among the 10 major cities, a category that includes Beijing, Shanghai, Guangzhou and Shenzhen.

Since the second half of 2011, home buyers have sought larger discounts as the situation is going well for them, which is in line with the SouFun findings, said Song Huiyong, a research director at Shanghai Centaline Property Consultants.

During the latest Central Economic Work Conference, an annual gathering of Chinese leaders to decide economic policy for the next year, the government reiterated its resolution to make home prices return to a reasonable level.

In the coming months, more and more cities will see average housing prices decline and a comparatively larger home price adjustment, said Chen Jie, executive director of Fudan University's Housing Policy Studies Center.

Analysts have said that during the first half of 2012, the volume of housing transactions would remain low and there will be mild price adjustments.

"For China's property market, the era of demand driven by panic buying, and making profits from buying and selling, is over," Chen Huai, former director of the policy research office of the Ministry of Housing and Urban-Rural Development, was quoted as saying in the Shanghai Evening Post.

However, opportunities for property investment might still exist in a few small and mid-sized cities, Song added.

National economic conditions would be comparatively difficult during this quarter, reported the Xinhua News Agency, citing Premier Wen Jiaobao on Tuesday.

Wen said the country is facing an export slump and rising costs and is looking for steady growth.

Barclays Capital and Bank of America Merrill Lynch said lenders' reserve requirements might be reduced before the week-long Lunar New Year holiday, which starts on Jan 23.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|