Time to launch deposit insurance, economists say

Updated: 2012-01-12 07:53

By Chen Jia (China Daily)

|

||||||||

BEIJING - Domestic economists have called for the quick launch of a deposit insurance system, which they said would reduce potential default risks and help drive market-oriented interest rate reform for commercial banks.

"Now is the time to establish insurance for depositors" with accounts in commercial banks, Zheng Xinli, deputy head of the economic sub-committee of the National Committee of the Chinese People's Political Consultative Conference, said on Wednesday.

"That will promote the free float of deposit and loan rates and reduce credit burdens for businesses, especially small ones," Zheng said.

Following three interest rate hikes in 2011, the one-year benchmark deposit rate stands at 3.5 percent, while the loan rate is 6.56 percent, yielding an interest margin of 3.06 percent.

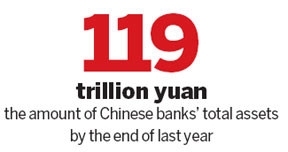

Compared with banking systems in free-market, developed economies, China has a relatively high interest margin. That margin did much to lift banks' total assets to 119 trillion yuan ($18.84 trillion) by the end of last year, according to Zhang Jianhua, chief of the research bureau of the People's Bank of China, the central bank.

"Once bank interest rates can float freely on a market basis, the interest margin is expected to contract under competition, and it may shrink lenders' profits," said Zhang. "Bankruptcy is normal in a competitive situation, so an insurance system is necessary to protect depositors' assets."

Competition would also help small and medium-sized companies get cheaper loans and increase their profit margins, he added.

Market forces are expected to play a more important role in fund allocation, and the government's role will be more clearly defined, Premier Wen Jiabao said on Saturday at the end of the two-day National Financial Work Conference.

The conference mapped out a five-year plan for financial reform.

According to a statement released at the conference, the non-performing loan ratio fell to 0.9 percent in 2011 from 7.1 percent in 2006.

The statement also said that banks' overall capital adequacy ratio increased to 12.3 percent as of Sept 30 from 7.3 percent at the end of 2006.

"China's financial system is healthy and running steadily so far," Zhang said.

Wei Jianing, deputy head of the macroeconomic research department at the Development Research Center of the State Council, said that allowing private capital to invest in the banking system might accelerate the move to market-oriented interest rates.

Such investment could also act as a channel for more investors and funds that might have previously participated in the shadow banking system, Wei said.

China Daily

(China Daily 01/12/2012 page13)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|