Worries rise as spending power shrinks

Updated: 2012-03-16 08:04

By Wu Yixue (China Daily)

|

||||||||

How much monthly income do people need to feel secure?

Different respondents, of course, will give different answers based on where and how they live.

But the admission by Cui Yongyuan, a member of the National Committee of the Chinese People's Political Consultative Conference, that he feels he doesn't have enough, is symptomatic of a growing sense of economic anxiety among ordinary Chinese people in today's society.

"There is no problem with my current monthly income exceeding 10,000 yuan ($1,578), even more, but still, I often feel I cannot cover my daily needs," Cui, who is also a well-known anchor with the China Central Television (CCTV), recently revealed on a People's Daily website forum channel.

"I felt like a millionaire in 1986 when I just started working and I was paid about 80 yuan a month. At that time, I usually scrambled with colleagues to pay for meals."

As a popular CCTV anchor with a reasonable income, Cui's self-disclosed financial worries caused a stir on the Internet.

"If a person with a considerable income like yours suffers financial difficulties, what about people who earn less?" was a common response.

Another piece of news, spreading almost concurrently on the Internet, was that an employee in Beijing with a monthly income of 7,500 yuan has no sense of financial security. After tax and pension reductions and the necessary outlays on rent, food and transportation, the employee could save less than 2,500 yuan every month.

It is an indisputable fact that high prices and non-guaranteed social welfare are exacerbating the sense of anxiety that is spreading through all income groups.

Compared with China's annual per capita disposable income of 21,810 yuan in 2011, the incomes of Cui and the Beijing employee are undoubtedly much higher. So why do they still feel financially insecure?

"The main reason for the lack of a sense of economic security among ordinary people is that income growth has failed to match the pace of price rises," Cui said.

His words go to the heart of the problem.

According to the State Bureau of Statistics, China's per capita disposable income for urban residents grew 8.4 percent year-on-year in 2011, lower than the 9.2 percent GDP growth, and far lower than the 24.8 percent growth in the country's fiscal revenues.

The lower-than-GDP income growth has not only eroded the sense of dignity among middle-income groups, but also caused more people to identify themselves as disadvantaged. According to a survey conducted by the People's Tribune magazine affiliated to the People's Daily in late 2010, 45 percent of Party and government employees believe they are disadvantaged, and more than 50 percent of intellectuals and 60 percent of while-collar workers feel the same. The survey shows an expanding sense of inferiority, although it does not necessarily represent an objective picture.

Wealth depreciation is also weakening people's sense of financial security. Statistics show that China's consumer price index was 5.4 percent in 2011, much higher than the 3.5 percent one-year deposit interest rate. The 1.9 percent gap means that residents will have suffered a 1.9 percent economic loss if they kept their money in the bank. According to data from the central bank, by the end of 2011, residents had deposited 35.2 trillion yuan in financial institutions. If calculated at a minus 1.9 percent interest rate, their total wealth dwindled by 660 billion yuan, or 500 yuanon average.

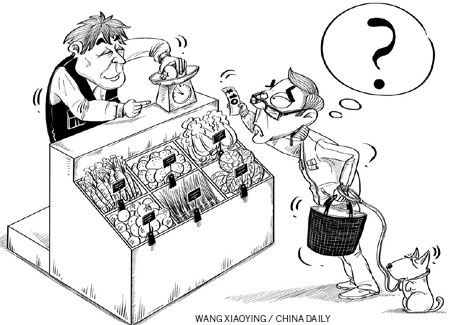

Lin Daofan, a National People's Congress deputy from Guangdong province, recently conducted a survey at a vegetable market in Beijing on the purchasing power of 10 yuan, Lin found he could only buy three apples, five cucumbers or seven tomatoes.

Declining purchasing power in the context of inflation, along with the unendurably high prices for housing, education and healthcare, are making more and more people anxious about their financial security.

Besides individuals' own efforts to make more money, the government needs to reduce taxes and establish a more developed and all-inclusive social security network.

The author is a reporter with China Daily.

wuyixue@chinadaily.com.cn

(China Daily 03/16/2012 page9)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|