Solar panel tariffs 'harm green sector'

Updated: 2012-03-22 07:53

By Du Juan (China Daily)

|

||||||||

|

The United States' preliminary decision to impose punitive duties on Chinese imports of solar panels will harm the interests of both sides, and negatively affect the development of the green energy industry in the US as well as cooperation between the two countries in the sector, the Ministry of Commerce said on Wednesday.

The ministry urged the United States to take a prudent attitude when handling the dispute to safeguard the stable and sound growth of bilateral trade, according to a statement on the ministry's website.

Earlier in the day, the China Chamber of Commerce for Import and Export of Machinery and Electronic Products said the US move is unfair and the support the Chinese government gives to domestic companies does not violate World Trade Organization rules.

"The decision by the US Commerce Department wasn't made in accordance with the facts," read a statement issued by the chamber.

The chamber said it hopes the US will be fair when it conducts its investigation.

"Chinese producers of photovoltaic solar panels neither receive illegal governmental subsidies nor dump their products on the US market," said the statement.

The US Commerce Department announced on Tuesday that it will impose tariffs at rates ranging from 2.9 percent to 4.73 percent on Chinese photovoltaic solar panels.

The decision was called for by SolarWorld Industries America LP, a provider of solar-electric systems, and six other US companies whose names have not been disclosed. They said Chinese companies were selling solar panels in the US at prices lower than the cost of those products and were receiving illegal government subsidies.

Industry insiders said they were surprised by the tariff rates set by the US and said many companies had expected the rates to range from 20 to 30 percent.

"The punitive tariffs are lower than we expected, but that doesn't mean that it's right for Chinese producers to be punished," said Li Junfeng, secretary-general of the Chinese Renewable Energy Industries Association.

Li noted that the US decision was preliminary and said he believes solar companies will probably ask for higher punitive tariffs in subsequent legal proceedings.

"It will still be a long time before a final decision is made," he said. "So Chinese companies need to be prepared. At the same time, we are requiring the US to be clear and transparent about the subsidies it gives to its domestic solar industry."

Li said the Chinese government should continue its negotiations with the US to protect the interest of Chinese companies.

Hong Lei, spokesman for the Foreign Ministry, said on Wednesday that China does not want to see the trade dispute affect bilateral relations.

All large Chinese solar companies have made official comments about the US decision.

"As we stated in our testimony to the International Trade Commission, we are not dumping, nor do we believe that we are unfairly subsidized," said Robert Petrina, managing director of Yingli Green Energy Americas Inc, the operating subsidiary of Yingli Green Energy in the US.

"We will continue to fight for affordable solar energy and further growth of the tens of thousands of US solar jobs that we help to create."

The company said it remains dedicated to the US solar market regardless of the proceeding's outcome.

"The important thing to remember is that tariffs are bad for the entire solar industry," said Miao Liansheng, chairman and chief executive officer of Yingli Green Energy.

Trina Solar Ltd and Suntech Power Holdings Co said that they will continue to provide high-quality products and services to the US market.

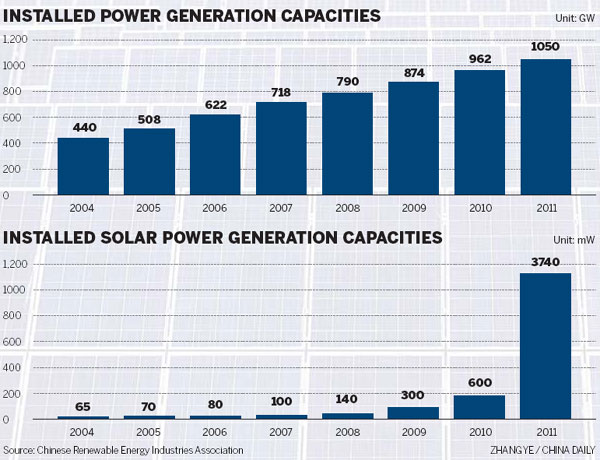

Li said the Chinese domestic market for solar panels is growing rapidly. "The market size was five times as big in 2011 as it was in 2010. We expect the domestic market for solar panels will triple this year."

dujuan@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|