Bats CEO blames code problem in IPO debacle

Updated: 2012-03-27 08:06

By Bloomberg News in New York (China Daily)

|

||||||||

|

|

Software bug highlights concerns about electronic markets: Traders

The software error that derailed the initial public offering of Bats Global Markets Inc, where 11 percent of all US stock trading occurs, rattled investors concerned about the growing complexity of financial markets.

Joe Ratterman, the chief executive officer, canceled the company's IPO on Friday after a computer malfunction kept Bats from trading on its own platform and forced a halt in the trading of shares of Apple Inc, the world's biggest company by market value. Transactions in Apple and trades for more than 1 million Bats shares were later canceled.

While engineers at the third-largest US exchange owner reacted in seconds to restore order, the failed debut revealed concerns about electronic exchanges at a time when regulation of financial markets is increasing after the worst crisis since the Great Depression.

"The electronic market operates very efficiently and it can accommodate many more trades than a human-only market, but I think what happened Friday shows that you still need boots on the ground," said Walter Hellwig, who helps manage $17 billion at BB&T Wealth Management in Birmingham, Alabama. "The fact that it was corrected quickly helped. But the fact that it happened at all makes people just stand back."

Chaos erupts

Bats priced 6.3 million shares on March 22 and was ready to begin trading a day later when one of its computers malfunctioned, triggering events that ended with the IPO's cancellation.

Compounding the confusion, a single transaction for 100 shares executed on a Bats venue briefly sent Apple, which has a market value of $555.7 billion, down more than 9 percent, setting off a circuit breaker that halted the stock everywhere in the country for five minutes.

The shares rebounded and the errant trade at 10:57 am, along with all transactions in Bats shares, were later voided.

"There are going to be isolated events at the different market centers over time," Ratterman said on Saturday. "We've had historically very few instances where our systems have gone down, but they have gone down in different ways in the past like every other venue. I don't think this is anything new as much as it was under a bright spotlight

The US Securities and Exchange Commission is in discussions with Bats to determine the cause of the incident and review the steps the company is taking to remedy the issues, according to SEC spokesman John Nester.

To Andrew Ross, a partner at the New York-based proprietary trader First New York Securities LLC, technical problems that affect trading are becoming routine.

"Situations like this happen so frequently that I almost ignored it on Friday, which is a testament to the issue of these technological failures," Ross said on Sunday.

"People who trade every day realize that these kinds of errors happen. But it looks awful for Bats, given that they're an exchange that claims to have technological prowess as a platform for high-frequency trading," he said.

About 11 percent of American share volume occurs on venues run by Bats, which called itself "a technology company at our core" in the IPO prospectus.

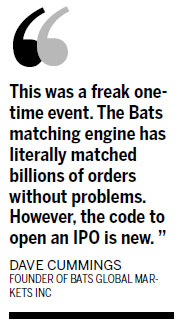

"This was a freak one-time event," Bats founder Dave Cummings wrote in an e-mail. "The Bats matching engine has literally matched billions of orders without problems. However, the code to open an IPO is new. It has been tested in the lab, but until this week not in real-world production."

Bats sent a notice about 10 minutes before the Apple halt saying it was investigating "system issues".

More than three hours after trading closed, the company said in a statement that a computer that matches orders in companies with ticker symbols starting with A to BFZZZ "encountered a software bug related to IPO auctions".

The glitch made existing customer orders for those securities unavailable for trading.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|