NDRC lowers retail gas, diesel prices 3%

Updated: 2012-05-10 09:07

By Liu Yiyu (China Daily)

|

||||||||

|

A worker copies a gasoline price list at a gas station in Guiyang, Guizhou province. Gasoline and diesel prices will be reduced by 330 yuan and 310 yuan per ton respectively from Thursday. [Photo/China Daily] |

Reduction comes in response to declines in crude on global market

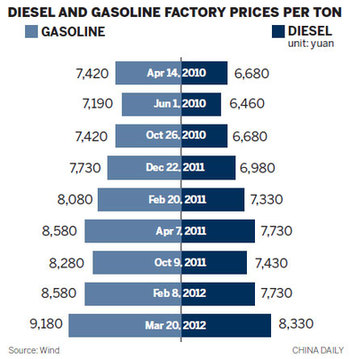

China's top economic planning agency said on Wednesday it will cut gasoline and diesel prices by 3 percent per metric ton for the first time since October after international crude price declines since late March.

Gasoline and diesel prices will be reduced by 330 yuan ($52) and 310 yuan per ton respectively from Thursday, said the National Development and Reform Commission.

The latest cut means China's gasoline and diesel prices will be 9,650 yuan per ton and 8,820 yuan per ton.

By Tuesday, the weighted average price of Brent, Dubai and Cinta crude oil had fallen 4.01 percent from the average price on March 19, according to the report by C1 Energy, a Guangzhou-based consulting firm focusing on the oil sector.

|

|

Under the current oil pricing mechanism set by the NDRC in 2009, domestic oil product prices will be adjusted when the international benchmark changes by 4 percent over a period of 22 consecutive working days.

The NDRC last adjusted wholesale gasoline and diesel prices on March 20, raising them by 600 yuan per ton, a 6 to 7 percent increase, the biggest hike since June 2009, in response to rising international prices.

In February, the NDRC raised oil product prices by 300 yuan per ton.

PetroChina, the country's largest oil firm, reported a 5 percent drop in net profit last year partly due to its refining business suffering an operating loss of 60.09 billion yuan.

The loss was partly because China's domestic fuel-pricing system prevents it from fully passing on increased raw material costs to downstream oil consumers, squeezing refining margins.

Sinopec also experienced huge losses in its refining business last year, with 34.8 billion yuan of losses from the sector.

However, analysts expect that the government is unlikely to issue a new oil pricing scheme soon given inflationary pressures.

The government is slated to release its latest consumer price index for April on Friday. As the main gauge of inflation, China's CPI expanded 3.6 percent year-on-year in March, according to the National Bureau of Statistics.

The growth represents a climb from the 3.2 percent registered in February, the slowest pace in 20 months.

The country's goal this year is to bring the inflation rate down to within 4 percent, according to the central government's 2012 work report.

"Ultimately, a truly transparent, open and competitive market-based mechanism is required for price formation," said Jeff Huang, managing director for China at the Intercontinental Exchange, where Brent oil futures are traded.

The industry needs to be further opened to private investment before a market pricing regime is introduced, allowing more enterprises into the oil products export and import business, industry experts suggested.

liuyiyu@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|