China's oil demand to rise as economy picks up

Updated: 2012-11-09 07:52

By Du Juan (China Daily)

|

||||||||

Higher consumption comes as refineries finish maintenance, stockpile for winter

China's demand for oil is likely to show its largest increase in two years in the fourth quarter as the country's economic growth begins to pick up, according to industry experts.

"Most domestic refineries completed maintenance work in the first three quarters and started to stockpile for the winter," said Liao Na, information and operating director of ICIS C1 Energy, a Shanghai-based energy consultancy. "As a result, the demand for oil has been increasing in the fourth quarter."

|

|

Workers from the Jinglou oilfield in Henan province tighten an oil brake on March 22. In the fourth quarter, China is expected to use 9.64 million barrels of oil a day as the country's economic growth picks up. [Photo/China Daily] |

The international price of oil meanwhile remains relatively low - around $80 a barrel - making now an opportune time for China to import more of the resource, she said.

According to official figures, the price of light sweet crude oil, a benchmark used for oil prices, was about $85 a barrel on Thursday.

In the fourth quarter, China is expected to use 9.64 million barrels of oil a day, which would result in the largest quarterly increase since the same period of 2010, according to the International Energy Agency and Sanford C Bernstein & Co.

The price of crude oil and of China's crude imports will both rise in the long run, Liao said.

In fact, China's "apparent oil consumption", defined as its domestic output plus its net imports, began to increase late in the third quarter following a decline for several months.

In September, the country's consumption of crude oil went up by 9.1 percent year-on-year, showing its strongest increase since February 2011, according to statistics from Platts, an energy information provider.

For the entire month, 40.12 million metric tons of oil were used in the country, an amount equal to about 9.8 million barrels a day.

China's oil use came to 8.95 million barrels a day in August, 9.2 million in July and 9 million in June, according to Platts.

"Refineries' output and net imports indicated a steady rise in oil demand in the third quarter in China," said Song Yenling, senior analyst at Platts.

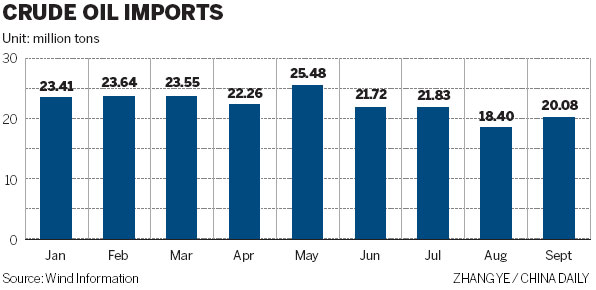

China imported 20 million tons of crude in September, up 9.13 percent from August.

That was the first rebound seen in China's crude imports and processing in four months, a time in which industrial activity increased, according to government data.

Song estimated that the demand for gas oil - a fuel mainly used in transportation and industrial production - will continue to rise in the fourth quarter and into the following year.

In September, the amount of gas oil consumed increased by 4.7 percent month-on-month to 13.8 million tons, ending a three-month decline that lasted through August.

C1 Energy said the government, by the end of the month, will award import quotas allowing five refineries run by ChemChina Petrochemical Corp, a wholly owned subsidiary of China National Chemical Corp, to bring in 10 million tons of crude oil a year starting in 2013.

That will mark the first time in China that such quotas have gone to refineries that are owned by companies other than the industry giants PetroChina Co and China Petroleum and Chemical Corp, Liao said.

She said CNOOC Ltd, the predominant explorer for offshore oil in the country, will also obtain a quota allowing it to import 1 million tons of crude next year.

"Compared with total crude imports, the quantity permitted by the quota is small, but it has a great amount of significance," she said.

"This shows that China will be more open to crude imports and will gradually allow private companies and even foreign companies to share the market with companies with government affiliations."

The five ChemChina refineries are Huaxing Petrochemical Group, Changyi Petrochemical Corp, Zhenghe Group, Qingdao Anbang Petrochemical Corp and BlueStar Petrochemical Corp, according to C1 Energy.

The world's second-largest user of crude, China imported 253 million tons, or about 1.9 billion barrels, of the oil in 2011, an amount up 6 percent year-on-year, according to customs figures.

dujuan@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|