Golden opportunities for California

Updated: 2012-12-18 08:01

By Chen Jia and Joseph Boris (China Daily)

|

||||||||

Competing for cash

Ed Lee, the Chinese-American mayor of San Francisco, is preparing to visit China next year, according to Darlene Chiu Bryant, executive director of ChinaSF, an economic development initiative of the city.

As more Chinese companies set up offices and expand operations in the US, San Francisco aims to guide those considering a move through each stage of decision-making and relocation. ChinaSF has a bilingual staff and offices in San Francisco, Shanghai and Beijing that support an exchange of ideas.

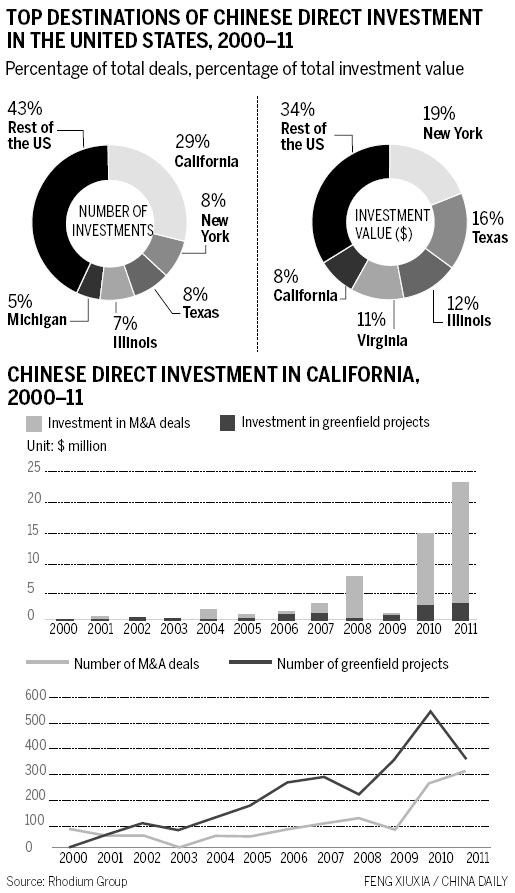

"Entrepreneurs and small and medium-sized enterprises value California for its advanced legal structures, openness to new products and partners, worldliness toward non-Americans and strong business facilitation services, among other advantages," according to the Rhodium Group report.

It highlights the efforts of public-private partnerships such as ChinaSF as well as business groups like the Bay Area Council and the California governor's GO-Biz agency, which aims to simplify companies' entry into the state.

Chinese investment in the US has taken various forms. One local politician even made it a key plank of his election platform.

Stewart Chen, a chiropractor who ran for one of two open seats on the city council in Alameda, near Oakland, lost his bid for office in the Nov 6 elections. But his third-place finish among voters could suggest support for his effort to involve Chinese investors in redeveloping Alameda Point, a former US navy air station in the city.

San Francisco media reports said talks have been underway for months between Miami-based home builder Lennar Corp and State-owned China Development Bank to invest $1.7 billion to restart the long-delayed conversion of two mothballed US naval bases, Treasure Island and Hunters Point, into large-scale housing.

"Chinese investment has helped spur growth in the California economy at a time when it was in the midst of a recession," said Kevin Johnson, dean of the law school at the University of California, Davis. "California political leaders at all levels realize this and are looking for investment into local economies. Investment, capital and jobs are all needed."

In February, Governor Jerry Brown announced at a US-China economic forum in Los Angeles his plan to form a China-California task force to spur cooperation, investment and trade.

Later in the year, Brown re-established a state trade and investment office in Shanghai. California had closed a dozen such offices around the world in a budget-cutting move eight years ago, including in Shanghai, Hong Kong and Taiwan.

Restoring California's presence in China took place nearly 40 years after Brown, during his first two terms as governor (1975-83) called for "increased normalization" in US-China relations. Brown, who was out of politics until being elected to two terms as Oakland's mayor, has been serving again as governor since 2011.

China is the world's No 1 exporter and third-biggest importer, behind the US and the European Union. Most Chinese exports to the US go through California's ports, and nearly all US exports to China pass through the state.

In 2010, China surpassed Japan as California's No 3 export market, posting a 20 percent increase over the previous year.

Californian advantage

California has competitive advantages in high-tech sectors including software, information technology, electronics design and renewable energy. Historically strong cross-Pacific ties to China complement the state's other attributes, such as an ethnically diverse, highly educated workforce. If it were a country, California would have the eighth biggest economy in the world.

Although the Rhodium report sees Chinese direct investment in California soaring to between $50 billion and $60 billion by 2020, it cautions that the state will need a focused strategy to reach that goal.

"California ... is in a position to lead the nation in attracting Chinese investment in the decade to come," according to the report's authors, Daniel Rosen and Thilo Hanemann of Rhodium.

The state, they said, must pitch its assets: quality of life, a creative workforce and diverse economic centers in the San Francisco Bay and Los Angeles areas. Other US states have been more aggressive in organizing trade missions and other forms of outreach, the report said.

China's escalating direct investment in the US, the report noted, "has rekindled old arguments about foreign firms and the national interest". It said that although screening of foreign investment on security grounds is necessary and legitimate, "concerns can be politicized for protectionist ends".

"California has more self-interest than any other state to offer solutions based on its experience with successful, and failed, deals and a sophisticated understanding of cutting-edge industries."

Robert Berring, a University of California, Berkeley, law professor, expressed concern that "parochial and backward interests within the United States may see increasing Chinese investment as a threat.

"Chinese capital can provide a much-needed boost for the California economy," he said. "If the 21st century is to be a good one, the US must see China as a partner in progress."

Chinese investment is a boon to the US economy and can help draw the two countries closer, Berring said.

Contact the writers at chenjia@chinadailyusa.com and josephboris@chinadailyusa.com

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|