Baby formula price probe to shake or reshape industry?

Updated: 2013-07-05 14:07

(Xinhua)

|

||||||||

Chinese from the mainland have since flocked to Hong Kong and other overseas markets to buy foreign-brand baby formula over safety concerns about domestic dairy companies.

Statistics from AC Nelson, a New York-based market survey and research company, showed that four foreign brands, including Mead Johnson and Wyeth, accounted for about half of the total sales of baby formula in the Chinese market in 2012.

Some foreign brands have increased their prices by up to 30 percent since 2008, with some prices reaching nearly twice as much as domestic brands, according to the NDRC data.

At supermarkets in big cities like Beijing, a 900-gram container of baby formula made by an international firm costs between 200 yuan ($32.4) and 280 yuan, compared to about 100 yuan for domestic baby formula in smaller cities.

The NDRC probe is a warning for foreign formula companies whose practices have hindered market competition, as well as consumers' interests, Wang said.

However, the investigation will not necessarily ensure a promising future for domestic dairy companies, said Chen Lianfang, a senior dairy analyst with CnAgri, a Beijing-based agriculture consulting company.

"Price cuts for foreign baby formula will only create a limited profit margin for domestic companies, as the cost of production is still rising and domestic productivity remains low," Chen said.

As of May, China had 127 baby formula producers with a combined annual output of 600,000 tons of formula. Only three of the companies produce more than 30,000 tons annually.

China imported 240,000 tons of infant formula in the first quarter of this year, up 23.7 percent from the same period of last year, indicating consistently huge demand from Chinese parents for foreign-branded baby formula, data from the General Administration of Customs showed.

To reduce the country's reliance on foreign infant formula, Chen said, the price probe should be followed by industry consolidation and government supervision in order to restore market confidence in domestic baby formula.

China Mengniu Dairy Co Ltd has taken the first step to regain consumer confidence in the wakes of safety scandals surrounding the country's milk and infant formula industry.

The company signed a deal in mid-June to buy Guangdong-based Yashili International Holdings Ltd for over HK$11 billion ($1.42 billion), marking the most costly merger in China's domestic dairy sector.

Also, the government has taken a series of measures, such as encouraging technological restructuring and establishing a quality assurance system, to improve the quality of domestic baby formula.

"The most effective way to boost the dairy sector is to improve the quality of its products and raise public confidence in domestic formula producers," Chen said.

- China launches anti-trust probe into baby formula

- Baby formula industry to consolidate

- Fears linger decade after fake baby formula tragedy

- Chinese parents buy foreign baby formula

- Baby formula scare highlights supervision loopholes

- Foreign baby formula off shelves

- Baby formula pulled off shelves after problems exposed

- China to issue new baby formula regulation

Joey Chestnut wins 7th contest with 69 dogs

Joey Chestnut wins 7th contest with 69 dogs

Lisicki, Bartoli to vie for new Wimbledon crown

Lisicki, Bartoli to vie for new Wimbledon crown

Muscle Beach Independence Day

Muscle Beach Independence Day

Tough workout for Li Na in war of words

Tough workout for Li Na in war of words

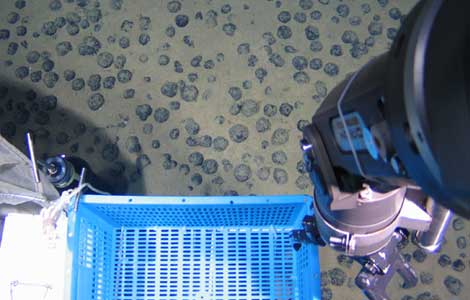

Submersible taps mineral deposits in S China Sea

Submersible taps mineral deposits in S China Sea

Ecuador finds spy mic for Assange meeting

Ecuador finds spy mic for Assange meeting

US martial artists arrive at Shaolin Temple

US martial artists arrive at Shaolin Temple

July 4 in Prescott: Balance of grief, patriotism

July 4 in Prescott: Balance of grief, patriotism

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Gunman shoots two, commits suicide in Texas

Baby formula price probe to shake or reshape industry?

Passenger detained over bomb hoax in NE China

High rent to bite foreign firms in China

Egypt's prosecution imposes travel ban on Morsi

Russia more impatient over Snowden's stay

Mandela still 'critical but stable'

Figures show shifts in US, China economies

US Weekly

|

|