How Samsung is beating Apple in China

Updated: 2013-07-26 16:01

(Agencies)

|

||||||||

|

|

Samsung Galaxy and Iphone[Photo/Reuters] |

Guangzhou - Apple Chief Executive Tim Cook believes that China is a huge opportunity for his pathbreaking company. But luck seems to be on the side of rival Samsung Electronics Co Ltd, which has been around far longer and penetrated much deeper into the world's most populous country.

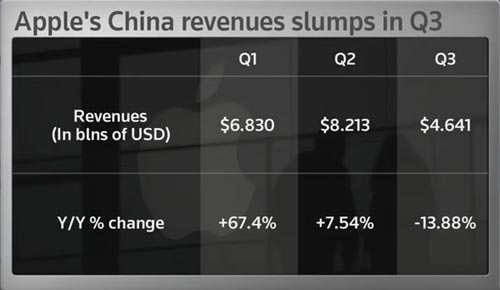

Apple Inc this week said its revenue in Greater China, which also includes Hong Kong and Taiwan, slumped 43 percent to $4.65 billion from the previous quarter. That was also 14 percent lower from the year-ago quarter. Sales were weighed down by a sharp drop in revenues from Hong Kong. "It's not totally clear why that occurred," Cook said on a conference call with analysts.

|

|

Apple's revenues in China.[Photo/Reuters] |

Neither is it totally clear what Apple's strategy is to deal with Samsung - not to mention a host of smaller, nimbler Chinese challengers.

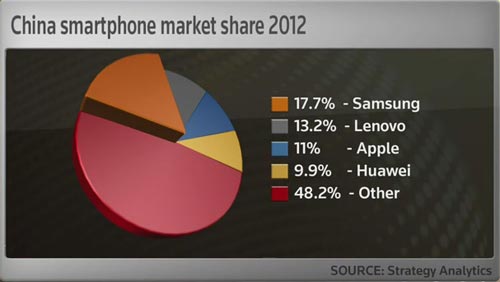

Today, in the war for what both sides acknowledge is the 21st century's most important market, Samsung is whipping its American rival. The South Korean giant now has a 19 percent share of the $80 billion smartphone market in China, a market expected to surge to $117 billion by 2017, according to International Data Corp (IDC). That's 10 percentage points ahead of Apple, which has fallen to 5th in terms of China market share.

|

|

China smartphone market share.[Photo/Reuters] |

Cook said Apple planned to double the number of its retail stores over the next two years - it currently has 8 flagship stores in China and 3 in Hong Kong. But, he added, Apple will invest in distribution "very cautiously because we want to do it with great quality."

Samsung, with a longer history in China, now has three times the number of retail stores as Apple, and has been more aggressive in courting consumers and creating partnerships with phone operators. It also appears to be in better position, over an arc of time, to fend off the growing assault of homegrown competitors such as Lenovo Group Ltd, Huawei Technologies Co Ltd and ZTE Corp, former company executives, analysts and industry sources say.

LeBron frenzy grips Guangzhou

LeBron frenzy grips Guangzhou

Police to question driver for Spanish train crash

Police to question driver for Spanish train crash

Top DPRK leader meets Chinese vice-president

Top DPRK leader meets Chinese vice-president

US does not plan decision on Egypt coup

US does not plan decision on Egypt coup

Bo Xilai indicted for corruption

Bo Xilai indicted for corruption

Korean War veterans return to peninsula

Korean War veterans return to peninsula

Tourist safety a priority in S China Sea

Tourist safety a priority in S China Sea

Death toll in Spain train crash rises to 77

Death toll in Spain train crash rises to 77

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Scholars provide a tour 'around the world'

GM says weakness in Asia leads to profit drop

Details of GSK China's alleged violations revealed

Syrian rebels ask Kerry to send US arms quickly

Flights over sea 'routine training'

US does not plan decision on Egypt coup

Congress approves NSA spying program

Japanese PM unlikely to visit Yasukuni Shrine

US Weekly

|

|