Slowdown seen in petroleum use

Updated: 2013-12-13 00:22

By DU JUAN (China Daily)

|

||||||||

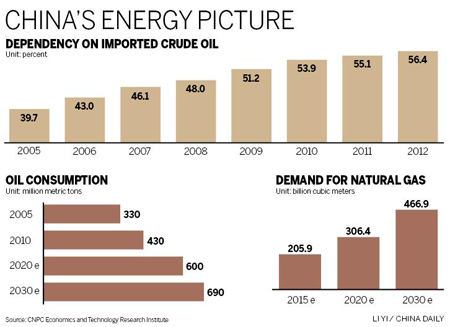

The average annual rise in China's petroleum use will drop to 2.5 percent during the years 2013 to 2020 as the government tries to slow down economic growth and reduce carbon emissions, said experts.

|

|

Workers man an oil drill at the Dagang oilfield in Tianjin. A study has found that China will consume 590 million metric tons of petroleum in 2020 and about 690 million tons by 2030. LIU HAIFENG / XINHUA |

The figure will keep declining to 1.5 percent from the year 2020 to 2030, predicted Dai Jiaquan, deputy director of the Oil Market Research Office with the CNPC Economics and Technology Research Institute, on Thursday.

"Because of the energy-saving and environmental protection policies, as well as technological development of substitutes for vehicle fuel, there will be a tendency for the consumption growth for petroleum to slow down," said Li Li, research director at ICIS C1 Energy, a Shanghai-based energy information consultancy.

China will use 590 million metric tons of petroleum in 2020 with a smaller growth rate. By the year 2030, the country's petroleum use will be about 690 million tons, according to estimates of the CNPC institute.

China used 490 million tons of petroleum in 2012, a 4.7 percent increase year-on-year.

Meanwhile, China's natural gas use last year reached 144.5 billion cubic meters, up 12.8 percent year-on-year — much higher than the growth in petroleum use.

During the 11th Five-Year-Plan (2006-10), China's annual use growth of petroleum was as high as 7.7 percent on average.

China Petroleum and Chemical Industry Federation estimated in a previous report that China's petroleum annual growth in use will be lower than 5 percent on average during the years 2011 to 2015.

"As China further improves its economic structure, the energy consumption for unit GDP will continue to be reduced, which leads to slower petroleum consumption growth," said the report.

The International Energy Agency's newly released outlook echoed the trend, saying that India will become the country with the fastest growth in petroleum use after 2020.

The outlook also mentioned that renewable energy will embrace its rapid development in the next decades.

By 2035, renewable energy will account for half of power generation globally with China owning the largest share of new renewable power generation, according to the outlook.

In addition to renewables, Li said a boom in natural gas use will also be behind the slower growth in petroleum use.

It is expected that the number of vehicles using natural gas as fuel will reach 2.1 million in 2015 in China and continue to grow to 3.2 million in 2020, which will result in a soaring use of natural gas in the following years, according to Dai.

"China has a huge potential for natural gas use in the transportation sector as the number of clean energy vehicles continues to grow," he said.

Dai estimated that China's natural gas consumption in the transportation sector will reach 32 billion cubic meters in 2015 and grow to 56 billion cubic meters in 2020, which means it will replace 26 million tons of petroleum in 2015 and 46 million tons in 2020.

China has witnessed an increase in natural gas use among the primary energy mixture.

Between 2000 and 2012, China's natural gas use grew from 900 million cubic meters to 16.6 billion cubic meters.

The transportation sector accounted for only 4 percent of total natural gas use in 2000. The figure grew to 11 percent in 2012.

dujuan@chinadaily.com.cn

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Japan told to stop Diaoyu Islands provocation

NSA: surveillance best way to protect US

US and China not enemies, report says

NTSB holds Asiana 214 hearing

BAIC races to new goals

Lee named head of Patent Office

Explose bank loan rise may spark tightening of credit

'Containing China' Japan's strategy

US Weekly

|

|