Fonterra challenged in China's milk powder market

Updated: 2013-12-17 10:56

(Agencies)

|

|||||||||

US, europe making moves

Chinese firms, too, have been putting out feelers.

Over the past year, Inner Mongolia Yili Industrial Group Co Ltd has set up an alliance with Dairy Farmers of America Inc, while China Mengniu Dairy Co Ltd has announced tie-ups with Danish dairy group Arla Foods.

Dairy Farmers of America is set to open a whole milk powder processing plant in the United States in the first half next year, with estimated annual output of 40,000 tons. It would be the first in the United States specializing in whole milk powder, an important step for targeting China, where whole milk powder consumption is seven times that of skimmed powder, according to the US Department of Agriculture.

"The new plant is significant as it could establish the US as a viable supply option to New Zealand," said Shaskey. He estimated around half the plant's output would go to China.

Dairy Farmers of America declined to comment.

Irish dairy firm Glanbia PLC is developing a 150 million euro ($206 million) milk powder plant in southeast Ireland to tap the export boom to markets such as China once the European Union scraps a 30-year-old limit on output in 2015. A Glanbia spokeswoman said China had become the firm's Asia hub, but she declined to comment on supply contracts.

Arla Foods has increased its range of offerings at global auctions as the cooperative looks to gain access to China. "We have primarily had our eyes on China as it's the fastest growing market for child nutrition products," said Finn Hansen, head of international operations.

Some Chinese buyers are also building their own facilities in New Zealand, which could help them bypass Fonterra.

But analysts said breaking Fonterra's dominance would not be easy, and it remained to be seen if Europe and the United States could significantly raise their export capacity.

New Zealand exports more than 90 percent of its output and controls a third of the global dairy trade. Most of those exports come from Fonterra, which is owned by its 10,500 farmer suppliers.

"There may be a shift to other suppliers," said David Mahon, managing director of Mahon China Investment Management. "But there's not enough capacity in Europe or even the USA for a shift away from Fonterra to be significant or long term."

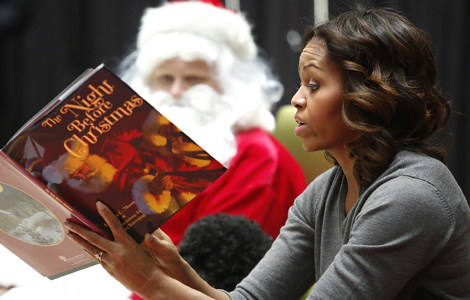

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Kerry offers Hanoi aid in maritime dispute

Kerry offers Hanoi aid in maritime dispute

Cuddly seal enjoys some me time

Cuddly seal enjoys some me time

Shoppers dropping department stores

Shoppers dropping department stores

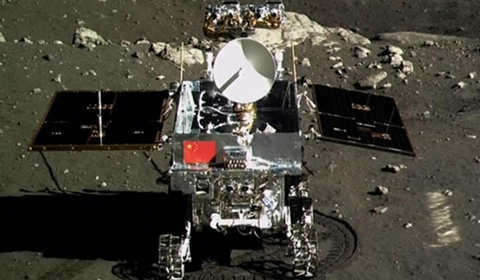

Moon rover, lander photograph each other

Moon rover, lander photograph each other

Snow hits SW China's Yunnan province

Snow hits SW China's Yunnan province

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Japan to bolster

military build-up

Continuity in DPRK policies expected

China keen on natural gas

China outlines diplomatic priorities for 2014

China's US debt holdings pass $1.3 trillion

Clashes with US can be avoided: FM

Kerry offers Hanoi aid in dispute

14 terrorists killed in Xinjiang

US Weekly

|

|