Less control on cross-border yuan investment

Updated: 2013-12-17 11:00

(Xinhua)

|

||||||||

BEIJING - The Ministry of Commerce (MOC) announced on Monday that it will further loosen control on cross-border yuan direct investment in an effort to facilitate investment.

Under the new MOC regulation, approval procedures for yuan-denominated direct investment from overseas investors will be further simplified. The new regulation takes effect on Jan 1, 2014.

In cross-border yuan direct investment, foreign investors use legally acquired yuan to make investments in China by founding companies, increasing investment, or participating in mergers and acquisitions of domestic enterprises, the MOC said in a statement.

Foreign investors are still not allowed to invest in negotiable securities, financial derivatives, and entrusted loans in yuan.

The existing regulation, which took effect in 2011, requires provincial bureaus to report to the MOC for further approval if foreign investors' yuan investment hits 300 million yuan ($49 million) or more, or if their investment is in sectors such as financing guarantee, financial leasing, micro credit, auctions, cement, steel, electrolytic aluminum or shipbuilding.

The new regulation raises no such requirements. Overseas investors also include those from Hong Kong, Macao, and Taiwan, according to the regulation.

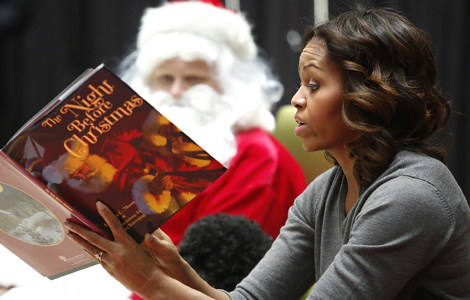

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Kerry offers Hanoi aid in maritime dispute

Kerry offers Hanoi aid in maritime dispute

Cuddly seal enjoys some me time

Cuddly seal enjoys some me time

Shoppers dropping department stores

Shoppers dropping department stores

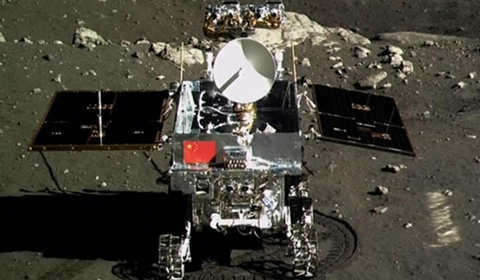

Moon rover, lander photograph each other

Moon rover, lander photograph each other

Snow hits SW China's Yunnan province

Snow hits SW China's Yunnan province

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Continuity in DPRK policies expected

China keen on natural gas

China outlines diplomatic priorities for 2014

China's US debt holdings pass $1.3 trillion

Clashes with US can be avoided: FM

Kerry offers Hanoi aid in dispute

14 terrorists killed in Xinjiang

Warehouse fire extinguished

US Weekly

|

|