Court to issue guide on private loan cases

Updated: 2013-12-18 01:09

By Cao Yin (China Daily)

|

||||||||

|

|

A plate ranks excellent agents dealing with private loans in a private loan service center in Wenzhou, on Apr 27, 2013. Under a 2011 regulation issued by the Supreme People's Court, Chinese law only protects private lending whose interest rate does not exceed four times the central bank's benchmark lending rate.[Photo / Xinhua] |

Beijing's top court is to issue a guideline for judges on how to handle cases involving private loans to standardize rulings.

The city established a tribunal to deal with disputes rising from private lending in 2011.

Last year, courts in the capital tackled 7,812 loan disputes, about 20 percent of all commercial cases.

"Private lending is a double-edged sword," said Chen Hai'ou, presiding judge of the high court's commercial department. "Sometimes it can help banks alleviate loan pressure, sometimes it disrupts the lending market."

Chen confirmed the high court is working on a guideline, saying the main goal is to refine a method from typical verdicts and give a clear reply on what laws or rules should be adopted in similar cases.

He did not reveal when the guideline will be released.

Various courts have different methods to deal with such cases, according to Sun Xiaoping, a judge at Beijing No 1 Intermediate People's Court.

In her court, judges collect articles involving private loans in Chinese law, such as Civil Law and Contract Law, and then provide typical cases to each courtroom, hoping to establish a standard.

"But we also need to know how other courts cope and communicate with them," she said, adding she is looking forward to the guideline.

Since 2011, the intermediate court has dealt with more than 13,000 private lending disputes, among which 5 percent touched upon illegal operations and fraudulent fundraising.

The capital is not the only one facing the challenge. The district court of Nanchang in Wuxi, Jiangsu province, heard almost 891 private loan disputes since January, an increase of 80 percent from last year.

Loan conflicts involving enterprises have also increased in the past three years, Sun said.

"Previously, the private loan often happened between residents, but now more small companies prefer to get financing from people directly, because they can get money easily under simple procedures," she said.

Under a 2011 regulation issued by the Supreme People's Court, Chinese law only protects private lending whose interest rate does not exceed four times the central bank's benchmark lending rate.

"But in reality, many borrowers asked for higher rates aiming to get more benefits," said Li Qi, a specialist with the Beijing Society of International Economic Law.

Serious sentences are a real possibility, she said, citing the examples of Wu Ying and Zeng Chengjie.

Wu, an entrepreneur from Wenzhou, Zhejiang province, was sentenced to death last year for illegal fundraising.

The 32-year-old was convicted of raising 770 million yuan ($126.82 million) from investors between 2005 and 2007.

The Supreme People's Court later overturned the penalty and sentenced her to death with a two-year reprieve, which is usually commuted to a long prison term.

Zeng, from Hunan province, was not so lucky. He was executed this year after a court in May 2011 found him guilty of illegal fundraising of more than 3.4 billion yuan.

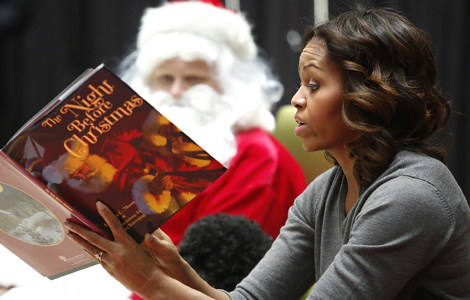

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Kerry offers Hanoi aid in maritime dispute

Kerry offers Hanoi aid in maritime dispute

Cuddly seal enjoys some me time

Cuddly seal enjoys some me time

Shoppers dropping department stores

Shoppers dropping department stores

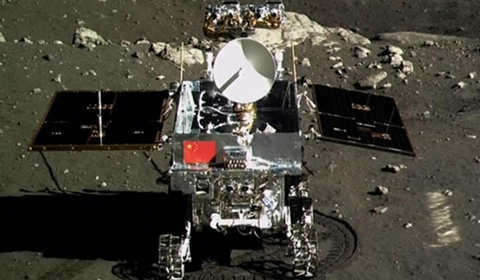

Moon rover, lander photograph each other

Moon rover, lander photograph each other

Snow hits SW China's Yunnan province

Snow hits SW China's Yunnan province

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US budget deal clears crucial vote in Senate

Japan seeks bigger role for military

China hopes trade meeting fruitful

Japan to bolster military build-up

Continuity in DPRK policies expected

China keen on natural gas

China outlines diplomatic priorities for 2014

China's US debt holdings pass $1.3 trillion

US Weekly

|

|