China's economy: slowdown clouds reality

Updated: 2016-03-04 11:11

By Chen Weihua(China Daily USA)

|

||||||||

|

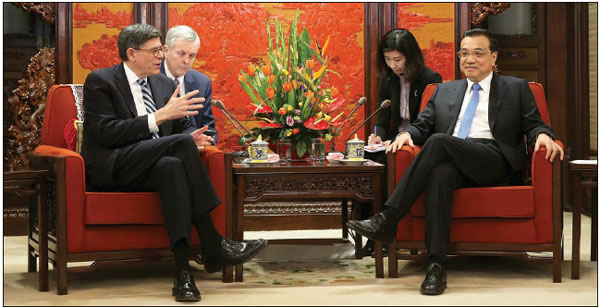

US Treasury Secretary Jack Lew speaks with Premier Li Keqiang during their meeting at the Zhongnanhai leadership compound in Beijing on Feb 29. REUTERS |

China's economic slowdown has sparked widespread concern among the public and financial marets. However, while several economists who have long been monitoring China's economy note problems and risks, they agree that the stock market turbulence does not reflect the real economy, CHEN WEIHUA reports from Washington.

When Premier Li Keqiang delivers his annual government work report on Saturday at the opening session of the National People's Congress session in Beijing, he is likely to draw as much attention outside of China as among the 1.4 billion Chinese.

China's stock market plunge in the last few months has sent shock waves around the world. The depreciation of the Chinese currency, the yuan or RMB, has caused concern about possible competitive currency devaluation in a slumping global economy. The pessimism of a slowing Chinese economy has permeated Western news media and among some investors.

Chinese officials have argued that such doom-and-gloom sentiment is largely a result of misinformation. And while many economists who focus on the Chinese economy have noted a host of problems ranging from the need to reform financial markets to restructuring state-owned companies, none predict a financial crisis. The bottom line is the economy is sound.

At last week's G20 finance ministers and central bank governors meeting in Shanghai, senior Chinese officials, including Li and Central Bank Governor Zhou Xiaochuan, reassured the world of China's steady economic growth prospects, its determination to transition to a more sustainable growth model, its commitment to reforms and opening up and its ability to maintain a relatively stable exchange rate.

Chinese diplomats have also sought to reassure the world. Chinese Ambassador to the US Cui Tiankai wrote an op-ed article in The Wall Street Journal on Feb 16 titled A Prosperous China Benefits the World, while Chinese Ambassador to the UK Liu Xiaoming published an op-ed article in The Daily Telegraph on Feb 27, arguing that "the Chinese economy is still full of power".

In a speech at the Center for Strategic and International Studies in Washington on Feb 25, Foreign Minister Wang Yi talked at length about the Chinese economy.

Still, Premier Li's speech on Saturday is expected to be the most comprehensive about China's action plan this year and in the next five years since 2016 is the first year of China's 13th Five-Year Plan (2016-20).

What's a slowdown?

China's 6.9 percent gross domestic product (GDP) growth in 2015 was the lowest in a quarter century, but China is still the second-fastest growing major economy, surpassed only by India's 7.3 percent. India's economy is one-fifth the size of China's.

GDP growth for the United States stood at 2.6 percent; the European Union at 1.8 percent, Germany at 1.5 percent and Japan at 0.6 percent.

"We should not forget that in spite of all the problems, China continues to be the best performing large economy in the world," said Pieter Bottelier, former chief of the World Bank Resident Mission in Beijing and now a senior adjunct professor of China Studies at the Johns Hopkins School of Advanced International Studies.

The Chinese economy has doubled in size since 2009 to exceed $10 trillion in 2015. That means that a 6.9 percent growth rate is much more than the 10 percent of five years ago, and the growth rate today is comparable to adding an economy the size of Turkey or the Netherlands.

China continues to be the major engine for global growth, contributing 25 percent in 2015 and 30 percent during the 2009-2014 period, according to the World Bank.

As the Chinese government has promised to double its GDP and household income by 2020 from 2010 levels, it would require an average annual growth of at least 6.5 percent.

The International Monetary Fund, however, forecast in January that China's growth will slow to 6.3 percent in 2016 and 6 percent in 2017, which it said reflects primarily weaker investment growth as the economy continues to rebalance.

An economic slowdown had been widely anticipated since the government announced the "new normal" in 2013 to build a more sustainable economic model by clamping down on pollution and energy inefficient industries. The leadership has vowed to accomplish the transformation rather than sticking to what former premier Wen Jiabao described as an "unsustainable, unbalanced, uncoordinated and unstable" old model that pursues GDP growth rate.

New normal

David Dollar, a senior fellow at the John L. Thornton China Center of the Brookings Institution in Washington, believes the Chinese government is moving in the right direction by switching from an export-driven economy to a consumption-driven one.

The service sector, which grew 8.3 percent in 2015, has for the first time accounted for half of China's GDP, reaching 50.5 percent. Consumption contributed to 66.4 percent of the GDP growth, up 15.4 percent from the previous year.

"So this positive transformation is going on. If that continues in a gradual way, that's good for the Chinese people, and if more sustainable, it will be good for the world," said Dollar, who was the US Treasury Department's economic and financial emissary to China from 2009 to 2013 and the World Bank's country director for China and Mongolia from 2004 to 2009.

'Overblown' fears

In his recent talk at the Brookings and in an op-ed article titled False Alarm on China published on Project Syndicate, Stephen Roach, senior fellow of the Jackson Institute of Global Affairs at Yale University, described fears in financial markets about China's economic slowdown as "overblown".

He said China continues to make encouraging headway on structural adjustments in its real economy. "This significant shift in China's economic structure is vitally important to the country's consumer-led rebalancing strategy," said Roach, a former chief economist at Morgan Stanley and its Asia chairman.

Despite the economic slowdown, China has created 13.12 million urban jobs in 2015, well above the government's target of 10 million and on a par with the 2014 level.

The development of the service sector, which can create jobs at a lower cost than the manufacturing sector, has contributed to urban job opportunities, according to Roach.

Roach believes there is a mismatch between progress in China's economic rebalancing and setbacks in financial reform.

While saying such a mismatch does not spell imminent crisis, he noted that the turmoil in Chinese equity and currency markets should not be taken lightly.

In Roach's views, it is bad news for China's impressive headway on restructuring its real economy to be accompanied by significant setbacks for its agenda, which he described as "the bursting of an equity bubble, a poorly handled shift in currency policy, and an exodus of financial capital".

"These are hardly inconsequential developments - especially for a country that must eventually align its financial infrastructure with a market-based consumer society," he said.

Financial reforms

Roach said that China will never succeed if it does not bring its financial reforms into closer sync with its rebalancing strategy for the real economy.

Dollar, of Brookings, believes the Chinese government has got some of the sequencing wrong in its financial liberalization.

"Normally, opening up the capital account is the last stage of financial reform, so I think they should be moving more quickly on interest rate reforms and deepening the corporate bond market," he said. "For example, they should be opening up to foreign direct investment in financial services."

The sudden depreciation of the yuan has been mainly attributed to the exchange-rate reform aimed at meeting standards required for the Chinese currency to be included in the IMF's Special Drawing Rights (SDR) basket.

The reform, which allows the markets to have a big say, has made the exchange rate more vulnerable to speculation. Under the new system, the yuan is linked to a basket of currencies, instead of just the US dollar, and it has so far stayed relatively stable with the basket of currencies.

Senior Chinese officials have dismissed those saying that the government wants the yuan to depreciate to help the export sector.

Larry Summers, the former US Treasury secretary, also talked recently about the contradiction that while the US and others are pushing for China's financial liberalization in order for the yuan to appreciate further against the US dollar, the reality is that market forces are for the yuan to depreciate.

Dollar said there is really no justification for a lot of devaluation, given China's enormous trade surplus. "In the long run you expect the currency to keep appreciating," he said.

While noting the risks of disorderly depreciation, Dollar said the most likely scenario is that the expectation will be stabilized.

Dollar, Roach, Bottelier, Derek Scissors, a senior fellow at the American Enterprise Institute, and most other economists agree that Chinese equity and financial market turbulence does not reflect the real economy.

For example, the Chinese stock market was the world's worst performer during 2010-2013 despite the Chinese economy being one of the best.

China's stock market value accounts for about 30 percent of China's GDP, compared with 100 percent in the US.

The market is still regarded as immature, reminding many of the typical scene in Chinese cities where people, mostly retirees, gather outside brokerage firms to compare notes or share so-called inside information.

In fact, the stock market had soared more than 150 percent in the year before mid-2015 before it declined 40 percent.

Unsophisticated investors

Bottelier noted that a relatively unsophisticated investing public dominates the market in China.

He said the top priority for Liu Shiyu, the new chief of China Securities Regulatory Commission (CSRC), should be to change the system of initial public offerings (IPOs), which Bottelier described as a major source of corruption. Instead of waiting in line for years to go public, some companies have resorted to bribing CSRC officials to speed up the approval of their IPOs.

Bottelier suggested a registration system by which companies decide for themselves whether to offer shares. Chinese authorities announced last year that a registration system is expected to be introduced in 2016 to replace the approval system.

While describing the Chinese economy as "still pretty good", Bottelier expressed concern over a lack of vigorous reforms in state-owned enterprises (SOEs).

In his view, many of the SOEs are good and profitable, but many have become "zombies".

Bottelier said keeping these zombies alive has contributed to China's economic slowdown. "And it's also one of the factors that affect negatively the confidence in the economic management," he said.

Dollar also emphasized the importance of closing down enterprises that are not viable and helping workers adjust to new industries.

He believes that there are still a lot of sectors of the Chinese economy closed and uncompetitive. "Opening those up will create new areas of dynamism," he said.

Scissors, of AEI, pointed out that some problems in the Chinese economy have been brewing for quite a while but many people, including those on Wall Street, ignored them. When the financial market tumbles, they suddenly see it as a crisis as if the problems all surfaced at the same time.

Scissors expressed his concern over the mounting domestic debt which he attributed to the large government stimulus program of 2009.

Justin Yifu Lin, a professor at Peking University and former chief economist at the World Bank, put the total accumulated public debt of the central and local governments in China at less than 60 percent of GDP, lower than most developing and developed countries.

But the McKinsey Global Institute has put China's total debts - everything owned by corporations, households, government and financial firms - at $6.6 trillion in mid-2007 to $31.9 trillion by mid-2015, a figure McKinsey describes as astoundingly high for a still-developing economy.

"Whenever you have growth slow and debt rising, you have a bad situation," Scissors said.

Scissors does not see a crisis or hard landing of the Chinese economy. "I see China heading towards stagnation," he warned.

Addressing excess capacity, downsizing property market inventories, expanding effective supply, helping companies reduce costs and guarding against financial risks are some of the key points laid out by the central government so far in its economic rebalancing.

Roach agreed that that there are a lot of challenges and problems, but he said the economy is not on the brink of a hard landing. "The bottom line on China is that transformation is intact," he said.

He cautioned against underestimating the resilience and capacity of the real side of the Chinese economy to perform much better than most people realize.

Growth prospects

To Roach, even the property market, which has caused a lot of concern about a possible bubble, is not that scary. He said the property-market-led investment in China is a pillar of the structural rebalancing story that rests on urbanization.

The urban share of the Chinese population, which was less than 20 percent in 1980, reached 56 percent in 2015 and is on the way to 65-70 percent in 2025-2030.

That would require another 300 million rural citizens, almost the population of the US, to move to urban areas. That, according to Roach, will keep the investment GDP ratio quite high for the foreseeable future and will require a lot of additional property market construction over the next 10 to 15 years.

Acknowledging that there is some short-term overbuilding, Roach pointed out that the biggest source of creating jobs in newly urbanized areas is in the services required for new and expanded cities.

"China is in the early stages of service-led economic growth. ... There is a long way to go in that area," he said.

Urbanization has been listed by the government as a top priority in successfully switching to the "new normal". The ambitious plan to build infrastructure, such as roads, power grids, water supply and sewage systems, is expected to spur economic growth.

China's strength and economic opportunities are reflected on multiple fronts.

The market of 1.4 billion Chinese, many of whom will join the ranks of the middle class in the coming years, has prompted many domestic and foreign companies to increase investment.

China's middle class of 109 million is already larger than the 92 million in the US, according to a Credit Suisse report in October 2015.

China's household savings rate of 50 percent, compared with less than 20 percent in the US, is among the highest in the world.

China still holds the world's largest foreign currency reserves of $3.23 trillion, despite a shrinkage of $762 billion since mid-2014. A trade surplus and inflow of foreign direct investment is expected to help keep the currency stable.

China's trade surplus in 2015 reached $369.5 billion, up 73 percent over 2014, largely due to the declining commodity prices. In the same year, China absorbed foreign direct investment (FDI) of $126.3 billion, up 6.4 percent from the previous year.

Premier Li said last year that China has ample space to maneuver when facing an economic downturn. Many economists have also made the same argument, citing the Chinese government's decision-making process.

NPC/CPPCC sessions

Dollar, of Brookings, believes the NPC/CPPCC (Chinese People's Political Consultative Conference) session is a good opportunity to fine-tune policies.

He said it will help if there were some macroeconomic stimulus that comes through fiscal policy. He believes China has fiscal space, and it can spend more money and cut some taxes targeting consumption to bolster the economic transition.

Bottelier said although there has been a lot of progress made in the last 10 years in the social security system, he would suggest the government continue to work on social safety.

All the economists interviewed by China Daily emphasized the importance of carrying out the structural reform mentioned in the Third Plenum resolution in 2013.

Scissors, of AEI, emphasized the importance for the leadership to show courage in difficult but necessary reforms.

"You know if China takes some bold steps forward, that's going to give a lot of confidence to Chinese investors and to the world," Dollar said.

Contact the writer at chenweihua@chinadailyusa.com

Boao airport all set for upcoming Asian forum

Boao airport all set for upcoming Asian forum

Snapshots from the 'two sessions'

Snapshots from the 'two sessions'

Turn of virtual reality cameras at two sessions

Turn of virtual reality cameras at two sessions

China's home-made expedition mothership 'Zhang Qian' to be launched in March

China's home-made expedition mothership 'Zhang Qian' to be launched in March

Top 10 countries boosting China's tourist inflows

Top 10 countries boosting China's tourist inflows

Airplane restaurant to open in Wuhan

Airplane restaurant to open in Wuhan

World premiums at Geneva Motor Show

World premiums at Geneva Motor Show

China's top 10 tech startups

China's top 10 tech startups

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

Accentuate the positive in Sino-US relations

Dangerous games on peninsula will have no winner

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

US Weekly

|

|