Deals planned to recover illegal assets from abroad

Updated: 2014-12-29 07:51

By Zhang Yan(China Daily)

|

||||||||

China will strengthen financial intelligence exchanges with the United States and Australia to track corrupt Chinese officials' illegal assets and fight money laundering, a senior official from the Ministry of Justice said.

The People's Bank of China is in discussions with the US Financial Crimes Enforcement Network, a bureau under the US Treasury Department that monitors financial transactions to fight crime, said Zhang Xiaoming, deputy director-general of the ministry's legal assistance and foreign affairs department. Preparations are being made for a bilateral agreement to target assets that Chinese suspects hold overseas, Zhang said in an exclusive interview.

The central bank will also sign a similar agreement with the Australian Financial Intelligence Unit to monitor the suspicious flow of such assets, he said.

"After the agreements are made, China will share intelligence with the US and Australia, which will also offer information to their enforcement agencies to conduct further investigations," Zhang said.

"Once law enforcement officers in the US and Australia identify illegal funds, they will immediately initiate judicial procedures to freeze and confiscate those criminal proceeds in their countries."

More than half the known corrupt Chinese officials have transferred their illegal assets offshore and escaped to the US, Canada and Australia to avoid punishment, the Ministry of Public Security said.

Between 1990 and 2011, more than 18,000 corrupt officials fled overseas, transferring ill-gotten funds of up to 800 billion yuan ($128.5 billion), figures from the Chinese Academy of Social Sciences show.

In July, the Ministry of Public Security launched a special "Fox Hunt 2014" crackdown on economic fugitives who had fled overseas.

As of Dec 4, Chinese police had brought back 428 fugitives for alleged economic crimes from 60 countries and regions, but had seized only part of the illegal funds they had transferred abroad.

"Due to legal obstacles and different legal procedures, we face practical challenges in seizing and bringing back more assets," said Liu Dong, deputy director of the ministry's economic crimes investigation department.

Zhang of the Ministry of Justice said that in many cases, authorities are unable to provide judicial agencies in the US or Australia with all the necessary legal documents, including asset restraining orders that must be issued by Chinese courts to request assistance to freeze and seize the illegal funds.

"Although the US Federal Bureau of Investigation or Australian police have traced the assets and collected enough evidence to identify them as ill-gotten gains, they are unable to take immediate measures to freeze and confiscate them due to the lack of asset restraining orders from the Chinese courts."

- 'Miss Leisure World' candidates play war game

- Metro use drops slightly as new fare hikes kick in

- Record passenger numbers expected for upcoming chunyun

- Children step out of Daliang Mountain

- 1,000 years on, the art of fish hunting is in safe hands

- National Stadium illuminated to greet New Year countdown

Top 10 happiest cities in China 2014

Top 10 happiest cities in China 2014

Children step out of Daliang Mountain

Children step out of Daliang Mountain

New Consul General of China in New York arrives at JFK

New Consul General of China in New York arrives at JFK

Missing AirAsia plane maybe at sea bottom

Missing AirAsia plane maybe at sea bottom

Chinese artists get Times Square spotlight

Chinese artists get Times Square spotlight

Yearender: Best selling Chinese films in 2014

Yearender: Best selling Chinese films in 2014

Top 10 policy changes of China in 2014

Top 10 policy changes of China in 2014

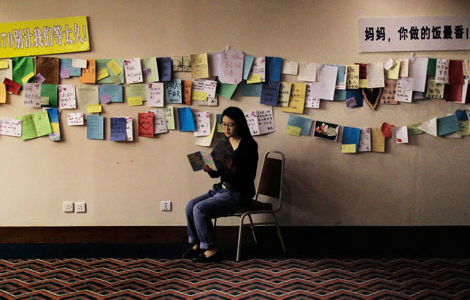

Families of MH370's passengers still hold out hope

Families of MH370's passengers still hold out hope

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Xiaomi's sky-high value also comes with potential obstacles

Bright lights for Chinese artists

Expiration dates on food probed

'New normal' focus for new consul general in NY

Bodies, debris from missing plane pulled from sea

Chinatown rallies to aid slain officer's family

Chinese FM: Against any cyber attack

China says no role in Sony hacking

US Weekly

|

|