A UK 'Brexit' could weigh on China: experts

Updated: 2016-04-26 11:06

By Hua Shengdun in Washington(China Daily)

|

||||||||

The possibility of the United Kingdom leaving the European Union has been troubling its member states since a referendum was put forth in 2015 in the British Parliament, but the prospect holds broader implications that stretch beyond Western nations, experts believe.

"If Brexit (Britain's exit) takes place in June, China will certainly reconsider some of its long-term investments, because it will not have the access to EU markets as if the UK was a full member of the EU," said Philippe Le Corre, visiting fellow at the Center on the United States and Europe at the Brookings Institution.

Le Corre spoke at a panel discussion on China's overseas investments in Europe at the Brookings Institution in Washington on Monday.

"Particularly, the nuclear project might be questionable," said Le Corre, referring to the Hinkley Point nuclear deal between China and the UK, which President Xi Jinping and British Prime Minister David Cameron signed in October 2015.

Hinkley Point would be China's largest inward investment in the history of the UK, with plans to construct at least one nuclear power plant on the Somerset coast and the possibility of two more.

Construction of the first power station, Hinkley Point C, is expected to cost stakeholders $26 billion, create 25,000 jobs and provide enough energy to power 6 million British homes when up and running. China is expected to cover about a third of the cost.

Vital though this nuclear project may be to Chinese outbound foreign direct investment (OFDI), China has various other interests in the region, with OFDI to Europe reaching record highs in 2015.

"If recent trends continue, China will replace Japan as the largest net creditor in the world in the next five years," said David Dollar, senior fellow at Brookings.

According to the Rhodium Group, China has expanded its investments in Europe.

The increasing growth of Chinese OFDI may result in more structured negotiations between China and its European investment targets in the future, something that the US has been keen to establish.

Le Corre said this business of FDI from China is going to take a new step, probably this year, with the signature of a bilateral investment treaty, which is also something that is going on in the US.

Allan Fong in Washington contributed to this story.

- EU pledges 20 mln euros to nuclear safety fund

- DPRK seems set to launch Musudan ballistic missile

- Austria far right freezes out coalition in presidency race

- Chernobyl's 30th anniversary: Living under radiation

- S. Korea denounces DPRK's missile test

- Saudi-led coalition says kills more than 800 al-Qaida militants in Yemen

Human-like robots say 'hi' to President Xi

Human-like robots say 'hi' to President Xi

Animals turn savvy earners from entertainers

Animals turn savvy earners from entertainers

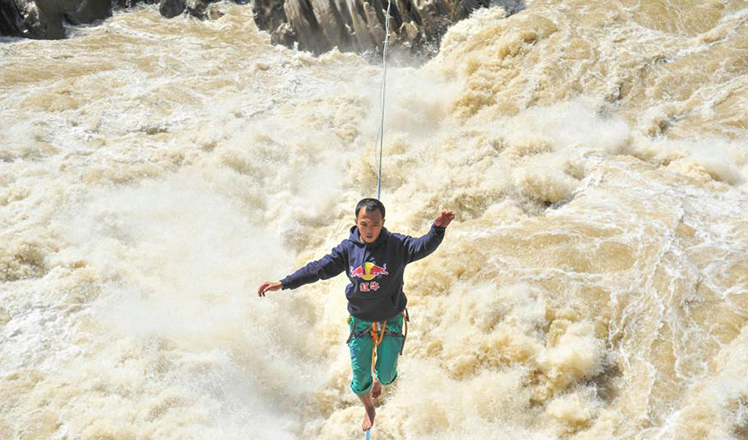

Slackline walker conquers Tiger Jumping Gorge

Slackline walker conquers Tiger Jumping Gorge

Top 6 domestic new-energy vehicles at Beijing auto show

Top 6 domestic new-energy vehicles at Beijing auto show

30th anniversary of the Chernobyl nuclear disaster marked

30th anniversary of the Chernobyl nuclear disaster marked

Shanghai unveils Disney-themed plane and station

Shanghai unveils Disney-themed plane and station

Hebei's poverty-stricken village gets new look after Xi's visit

Hebei's poverty-stricken village gets new look after Xi's visit

Cooks get creative with spring food exhibition in central China

Cooks get creative with spring food exhibition in central China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|