Top News

Economic growth is to be slow but steady

Updated: 2011-04-07 07:58

By Li Xiang (China Daily)

|

|

BEIJING - The growth of China's economy is set to moderate during the next two years as the expansion of investment and exports decelerates but there is "very little risk of a hard landing", the Asian Development Bank (ADB) said on Wednesday.

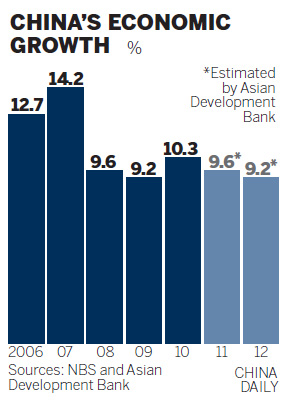

The Chinese economy is likely to expand by 9.6 percent this year and 9.2 percent in 2012, slower than the 10.3 percent growth rate last year that was mainly driven by the rebound in exports and investment, the Manila-based bank forecast in its 2011 Asian Development Outlook.

While fixed asset investment will remain a key driver of the nation's economic growth during the next two years, the momentum of the expansion will decelerate because of the winding-back of the government's fiscal stimulus measures and a tighter monetary policy, ADB said in its report.

Paul J. Heytens, the ADB's director for China, said at a press briefing in Beijing that the Chinese economy carries very little risk of a hard landing because growth momentum remains robust for the medium term.

However, any failure to decisively implement the government's agenda to rebalance the economy may jeopardize the sustainability of growth in the longer term, he said.

"One important risk is whether China's rebalancing agenda will be vigorously pursued," Heytens said. "If it is not, China may find at some point in the future growth could begin to slow significantly."

The fragility of external demand along with fiscal and debt concerns in the European Union, China's largest trading partner, and in Japan, as well as the rapid increase in local governments' debts to an estimated 7.6 trillion yuan ($1.2 trillion) are three other downside risks to China's economic outlook, he added.

The bank also predicted that China's Consumer Price Index, a main gauge of inflation, will accelerate to 4.6 percent on average in 2011 as a result of higher global prices for food and oil, rising wages and robust domestic demand. The pace is expected to ease in the second half of the year because of the base effect, the bank said.

The People's Bank of China on Tuesday raised the benchmark interest rate by 25 basis points, taking the one-year deposit rate to 3.25 percent and the one-year lending rate to 6.31 percent. It was China's fourth interest rate hike in less than six months and was seen as signaling the government's determination to fight inflation and asset bubbles.

Consumer prices jumped 4.9 percent in February year-on-year, exceeding the government's full-year target of 4 percent.

An official with the Chinese central bank was quoted on Wednesday by Reuters as saying that liquidity in the country's financial market remained excessive, making its fight against inflation difficult.

The policymakers face challenges in particular from capital inflows and a large volume of maturing central bank bills and bond re-purchase agreements in its open market operations, the official said.

Yu Song and Helen Qiao, economists at Goldman Sachs, expect that the Chinese government will hike interest rates one more time and raise the reserve requirement ratio - a regular tool to manage inter-bank liquidity - during the first half of the year.

In the meantime, the government will allow further currency appreciation and maintain administrative controls on the property sector to curb the rising risk of asset bubbles, they wrote in a report.

"However, if the government continues with the full-scale tightening during the second half of the year as it did in the first quarter of 2011, the economy will be at increasing risk of over-tightening in our view," they added.

The Chinese stock market on Wednesday responded positively to the latest rate hike by closing above the psychologically important threshold of 3,000 points with share prices of insurance companies and banks jumping on expectations the rate hike will boost investment income and net interest margins.

China Daily

(China Daily 04/07/2011 page3)

Specials

Share your China stories!

Foreign readers are invited to share your China stories.

Fill dad's shoes

Daughter and son are beginning to take over the family business of making shoes.

Have you any wool?

The new stars of Chinese animation are edging out old childhood icons like Mickey Mouse and Hello Kitty.