A golden age for gaming on the go

Updated: 2013-05-06 07:12

By Gao Yuan (China Daily)

|

||||||||

|

A woman playing an online game on a tablet PC as a man watches. Game developers and distributors in China are searching for ways to attract more people to download gaming apps after estimates that the turnover of the mobile gaming market could hit 20 billion yuan ($3.2 billion) by 2015. Provided to China Daily |

|

Four people playing online games on their way to office by subway in Beijing. Playing game apps with mobile devices is now a popular way for many white-collar workers to pass time during commutes. Games command 32 percent of customers' total time in using mobile devices, says a recent study conducted by market research firm Flurry Analytics. Provided to China Daily |

Developers plan more games and different platforms as demand peaks

Protecting her carrot from the hordes of monsters who want to eat it is the foremost challenge for 24-year-old Hannah Liu, a financial magazine editor, as she wades her way through Carrot Fantasy, a popular tower defense game developed by a Chinese startup company, during the hour-long daily subway ride to her office in downtown Beijing.

Liu is just one of many who are playing Carrot Fantasy in China, with its download numbers on the Android operating system alone reaching 20 million by March, according to information provided by software company Qihoo 360 Technology Co.

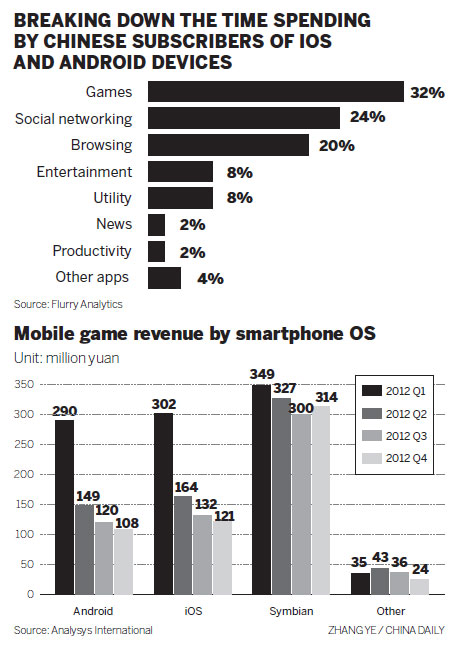

Mobile gaming is one of the fastest growing sectors in China, with estimates indicating that the sector could clock up turnover in excess of 20 billion yuan ($3.2 billion) by 2015. That in turn, is sweet music for developers and mobile gaming software makers in China as statistics indicate that more than 32 percent of the total time spent by a consumer on mobile devices is for gaming purposes. Social networking apps came a close second at 24 percent in the market survey conducted by IT market research firm Flurry Analytics.

"The thriving mobile game sector has fueled the growth of China's smartphone market with mobile game users exceeding 250 million in the fourth quarter of last year," the Beijing-based Internet research company Analysys International said in a recent report.

Earlier this year, China overtook the United States as the world's biggest market for active Android and iOS smartphones and tablets, the Flurry study said. China had about 246 million smart interactive devices, including mobile phones and tablets, by the end of February, it said.

Smartphones based on the Android system continued to be the most used gaming devices in China, according to Analysys International.

Although gaming revenue on the Android platforms increased dramatically in 2012, it still lagged behind Apple Inc's iOS, its long-time competitor, in terms of revenue generating ability.

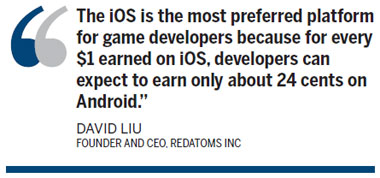

"The iOS is the most preferred platform for game developers because for every $1 earned on iOS, developers can expect to earn only about 24 cents on Android," said David Liu, founder and CEO of gaming company RedAtoms Inc.

From a global perspective, iOS still remains the clear revenue leader across most countries. In South Korea, home of Samsung Electronics Co, the market veers heavily toward Google Play, whereas in Japan the spend is more or less even across both platforms, said App Annie, an international mobile app ranking company.

China was the fourth largest revenue contributor for iOS as of February, climbing from No 8 a year ago, according to Junde Yu, vice-president of App Annie Asia-Pacific.

"Monthly downloads on iOS in China increased 36 percent from February 2012 to February 2013 while monthly revenue surged 221 percent during the same period," said Yu.

Currently most of the top growing apps on the iOS platform are games, said Liu from RedAtoms. He suggested that developers should come out with games that are free to play but need payment for unlocking the premium services as the best business model. About 80 percent of the top games offer in-app purchases in China, said a recent RedAtoms study.

"As of today, high-end players are stuck on iOS. In the long run, Android will become the most significant mobile platform because it is open and it is already making inroads into the iOS market," said David Liu.

China has established a number of trustworthy online payment services, enabling players to purchase more paid content from app stores.

Some developers may find it's easy to get earnings in the mobile sector because of an increasing number of Chinese players who are willing to pay for gaming apps.

"The profit efficiency for mobile games is much higher than developing traditional PC games," said Hang Guoqiang, manager of an Internet industrial park funded by China Mobile Ltd, the nation's biggest telecommunications carrier.

"Chinese players are more willing to buy mobile games than to purchase PC games. Profit efficiency in PC games was around 1 to 2 percent, while the rate was 7 to 30 percent in mobile gaming sector," said Hang, adding that more than a quarter of the players are paying 5 to 10 yuan a month for mobile games.

Young players were more likely to download paid games because they have better intellectual property awareness and are comfortable in making online payments, industry researchers said.

An Analysys International report showed that about 70 percent of the players were below the age of 35.

Stiff competition

Both mobile gaming developers and app stores are, however, set to witness increasingly fierce competition because of the huge number of companies entering the sector, analysts said.

Attracted by the exploding market scale and optimistic earnings expectations, game developers are also eyeing the mobile sector in a bid to lift profit margins.

Perfect World Co, a Nasdaq-listed Chinese online game developer, said it will be "actively developing" mobile games as the sector is showing a strong growth momentum.

"Perfect World will release more mobile and browser games later this year to expand its presence. Although the company's major products are PC games, it will closely watch the mobile sector because of its promising prospects," said Xiao Hong, co-CEO of the company.

With more PC game developers entering the fray, the scramble for market share has become intense, said analysts.

If a game cannot generate enough downloads in less than a month, it will find itself overshadowed by new releases and hence will be unable to garner attention in the future, they said.

Moreover, analysts also warned that China's mobile gaming market might not be as healthy as anticipated. The market is still highly unstable and a further integration could be on the anvil.

The quality of the games in the market also varies a lot with a huge number of poorly developed games flooding the market, according to Analysy International. Poor Internet accessibility will also hinder the further development of the sector, it said.

"The mobile Internet connection fee is high while the speeds are still slow. Users are forced to consume games in the WiFi environment, which may not help in getting the full features of mobile games," the research firm said.

The nation's big three telecom carriers started to install third-generation networks in 2009. The networks now cover more than 200 million users.

With the rapid expansion of three-generation networks and WiFi coverage, the mobile gaming sector will enjoy a more smooth Internet connection in the future, Analysys International said.

In addition, with more Chinese people now using advanced mobile devices such as smartphones and tablets, developers will have a strong market to cater to. Research from Analysys International estimated the smartphone penetration rate could reach 55 percent by the end of 2013.

The other important chain in the sector is the app store because they are more linked to the developers, players and advertisers, analysts said.

Tencent Holdings Ltd, a top Internet firm in China, also runs the country's biggest Android-based gaming store.

Tencent took more than 18 percent of the revenue by operating games running on Android phones. The Shenzhen-based company was remotely followed by China Mobile, which took about 8.6 percent of the revenue. Game.189.cn, an online game store run by China Telecom Corp, was ranked third, taking a little more than 8 percent of the revenue, said Analysys International.

Smaller app stores will find it difficult to generate profit because China's top 10 app stores account for more than 80 percent of the revenue, according to Yu from App Annie. Yu, however, did not disclose the annual revenue for China's app stores.

More than 90 percent of the revenue generated by professional gaming distribution platforms came from selling apps to China's smartphone users, said Analysys International.

According to the Ministry of Culture, the online gaming market is expected to surpass 100 billion yuan in 2015. In 2012, the market was more than 60 billion yuan, up 28.3 percent year-on-year.

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|