Chinese food firms look abroad to improve image

Updated: 2013-12-17 07:34

By Lyu Chang (China Daily USA)

|

|||||||||

South Korea seen as a springboard for companies to explore the international market and win consumers' confidence on safety issues, reports Lyu Chang in Seoul

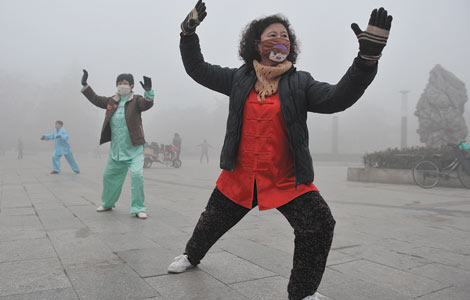

For a number of years, the media has been riddled with reports of the poor quality of some Chinese food and beverages, ranging from infant milk formulas and pork contaminated by cancer-causing toxins or the use of excessive amounts of additives to water drawn from rivers containing hundreds of dead pigs.

But a collection of food companies in the world's largest exporter plans to change that perception and prove that it can match quality with quantity by qualifying for the coveted "Made in Korea" label.

Nine Chinese food companies, including Qingdao Nine-Alliance Group Co, Shanghai TDL Food & Beverage and Qingdao Foods Co, plan to move into a food industrial complex in South Korea to have better access to the food markets both in China and abroad.

Located in Iksan, about 44 kilometers south of Seoul, the complex, known as Foodpolis, will provide food-related research and development facilities and laboratories with services throughout the process of food production from content detection to packaging as well as creating residential areas for workers for more than 160 international food enterprises.

Officials at Foodpolis said they will provide administrative and legal support as well as preferential policies, including conditional 50 years of lease exemptions to Chinese companies to help them relocate to the zone.

Details on their investments have yet to be worked out, said an official in charge of overseas investment at the State-owned agency for Foodpolis, but these companies have all signed memorandums of understanding with South Korea's Ministry of Agriculture, Food and Rural Affairs.

The deals could allow the Chinese companies to label their goods as "made in Korea", a move that the official said is crucial to regaining public confidence in China following a series of food scandals.

Earlier reports said that one in 10 meals was cooked in China using oil dredged from sewers. In 2008, a contaminated milk scandal left six infants dead and an estimated 300,000 sickened.

Experts said the popularity of imported food in China is the driving force behind the move, which has been fueled in recent years by fears of domestic food contamination.

"There's a perception in China that imported foods are of better quality and of a higher standard than domestic food," said Chen Lianfang, a senior analyst in the dairy sector at Beijing Orient Agribusiness Consultants Ltd. "So 'Made in Korea' products have become more and more popular in China and show the concerns over food safety."

Shanghai TDL Food & Beverage Co Ltd, which specializes in vitamin beverages, juices and dairy foods, boasts an annual revenue of $150 million. It signed an agreement last year with Foodpolis, planning to set up a facility there in order to cooperate with a Korean ginseng company.

"We want to develop and produce a ginseng-based beverage. The collaboration will eventually broaden our portfolio and strengthen our position in the Chinese market," the Shanghai-based company, a producer for Japanese brewing and distilling group Suntory, said in a statement.

As South Korean romantic soap operas appeal to more Chinese women, there is also a growing appetite among the Chinese for Korean foods.

"I follow many Korean TV shows every week and am probably influenced by that. Korean kimchi and bibimbap are among my favorite dishes among all international cuisines," said Elena Wang in a Beijing supermarket where all kinds of Korean foods can be found.

Other Chinese companies said they are simply planning to use South Korea as a springboard for easy access to Korean and global markets.

The Qingdao Nine-Alliance Group, one of China's largest producers and exporters of chicken products, said a production plant in South Korea could help them get closer to the overseas food market, taking advantage of the country's advanced technology and trade experience.

"Our presence in South Korea will provide a good opportunity for us to take off as a global food company because South Korea has made free-trade agreements with many countries, which would help spread our products quickly worldwide," said chief executive Wang Heung Hu of the Qingdao Nine-Alliance Group.

South Korea has signed free-trade agreements with 47 countries and is currently negotiating with China. In contrast, China has been building 18 free-trade zones with 31 countries and areas and has signed free-trade agreements with 12 countries so far.

The consequence is Chinese food companies will enjoy a higher competitive advantage than those at home with lowering trade barriers and the better export experience that South Korea has enjoyed with the US and Europe, experts said.

"Chinese food companies could export their products labeled 'Made in Korea' not only to their domestic market but also to other countries to expand their food exports where there is a growing preference for Korean food," said Ahn Chang-geun, senior deputy director of the Korea National Food Cluster Division at the Ministry of Agriculture, Food and Rural Affairs.

A survey of 2,800 urban families in China revealed that South Korea ranked second after France in satisfaction regarding the processing of food in the countries of its origin. And in the UK, Tesco Plc said, the demand for Korean food has increased by 140 percent over last year.

Chinese companies including Shandong Baohua International Group, a major fertilizer maker and Jilin Sky-Scenery Food Co Ltd, which specializes in corn-based products, as well as international big food producers such as Canada's SunOpta Inc, which specializes in the sourcing, processing and packaging of natural and organic food products, and Japan's Jalux Inc, which specializes in meals for the aviation industry, the circulation of food materials and duty-free shop operations, are all on the list.

So far, 88 companies have signed the memorandum of understanding with Foodpolis. Thirty-eight of them are non-South Korean companies, including nine from China. The first stage of the enterprise is expected to be completed by 2015, according to Foodpolis.

It is a commonly held view that many Chinese food makers have much to accomplish in terms of quality management, technological capability and brand image.

The recent deals by Chinese meat producer Shuanghui International Holdings Ltd to buy the world's biggest pork producer, Smithfield Foods Inc, for $4.7 billion in cash, the largest China-US takeover, to Bright Food (Group) Co Ltd's purchase of British cereal company Weetabix Ltd last year, were efforts by Chinese food companies to make a name for themselves globally by acquiring renowned foreign peers, said He Zhicheng, chief economist at the Agricultural Bank of China.

But after years of investment in overseas countries, critics said that China's food sector may have attached too much importance to the overseas market.

"Building a production base in Korea may be one way to compete with food companies on the international stage, but the question is whether they can fully learn the food technology and safety protocols, an essential factor to help them improve food safety and directly affect competition with other food companies. Because the Chinese have become savvy in choosing imported food, food companies can't win them over simply with a label," added He.

The economist added that some Chinese companies in all sectors would be better off channeling their capital and efforts toward their own home market, which has seen a tremendous demand from its enormous population.

His words were echoed by Lian Ping, who said investing in South Korea is a double-edged sword.

Contact the writer at lvchang@chinadaily.com.cn

(China Daily USA 12/17/2013 page13)

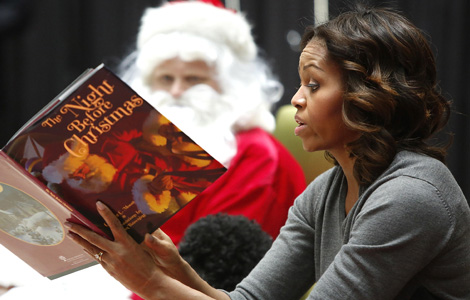

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Kerry offers Hanoi aid in maritime dispute

Kerry offers Hanoi aid in maritime dispute

Cuddly seal enjoys some me time

Cuddly seal enjoys some me time

Shoppers dropping department stores

Shoppers dropping department stores

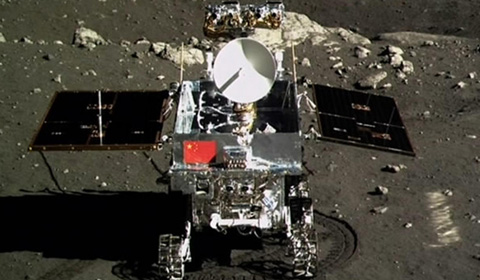

Moon rover, lander photograph each other

Moon rover, lander photograph each other

Snow hits SW China's Yunnan province

Snow hits SW China's Yunnan province

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Continuity in DPRK policies expected

China keen on natural gas

China outlines diplomatic priorities for 2014

China's US debt holdings pass $1.3 trillion

Clashes with US can be avoided: FM

Kerry offers Hanoi aid in dispute

14 terrorists killed in Xinjiang

Warehouse fire extinguished

US Weekly

|

|