Keep forex reserves healthy

Updated: 2014-01-16 07:37

(China Daily)

|

|||||||||

The speed at which China has built its foreign exchange reserves, the world's largest, is alarming. It should now take all possible measures to boost outward investment and increase imports to slow down, if not stop, excessive capital inflows.

Latest statistics show that China's forex reserves reached $3.82 trillion at the end of 2013, $509.7 billion more than a year earlier.

On one hand, the rise of China as the world's largest trading country in goods contributed significantly to the more than 15 percent increase in its forex reserves. Its imports reached $1.95 trillion and exports $2.21 trillion last year, resulting in a trade surplus of $259.75 billion.

On the other hand, the attraction of the world's second-largest economy as the fastest-growing major economy remains obvious for international investors, who largely ignored its economic slowdown in the first six months of 2013. China attracted $105.5 billion in foreign direct investment in the first 11 months despite the decline in FDI worldwide.

The combined effects of being a leading exporter as well as a top destination for foreign investment, to a large extent, explain why China's forex reserves are still growing at such a rapid pace. But that hardly justifies the double-digit growth in the world's largest forex reserves in a year when the Chinese currency rose by 3 percent to a new high against the US dollar.

Admittedly, the sheer size of its forex reserves and the strength of its economy will protect China from the initial shock of the reverse flow of global cheap money that debt-ridden developed countries will bring about. Yet a large forex reserve is not the answer to the potential impact the withdrawal of the United States' controversially super-loose monetary policy will have on developing countries and emerging economies.

Aside from the problem of return on investment, the rapid accumulation of forex reserves may leave China more exposed to a gathering storm of global financial uncertainty.

Therefore, to address its domestic and international imbalance while protecting the value of its forex reserves, China should expedite overseas investment and boost domestic consumption as soon as possible.

Detroit auto show features fuel-efficient cars

Detroit auto show features fuel-efficient cars

Palestinian students show military skills

Palestinian students show military skills

Cristiano Ronaldo wins FIFA best player award

Cristiano Ronaldo wins FIFA best player award

Xuelong carries on mission after breaking from floes

Xuelong carries on mission after breaking from floes

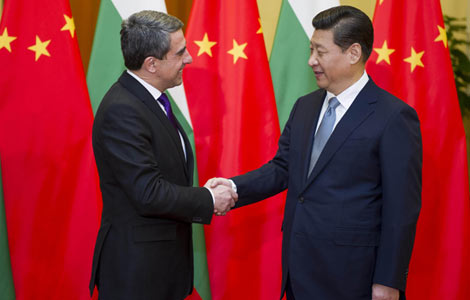

Beijing and Sofia vow new initiatives

Beijing and Sofia vow new initiatives

71st Golden Globe Awards

71st Golden Globe Awards

Bangkok unrest hurts major projects and tourism industry

Bangkok unrest hurts major projects and tourism industry

No pant for cold subway ride

No pant for cold subway ride

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China seeks to calm US fears over missile

Doubt on Tokyo's diplomatic push

China Mobile and Apple 'tie the knot'

Russia battles terror before Olympics

China vows reform to curb corruption

Corrupt officials beware this New Year

Shanghai schools to close on heavily polluted days

Air China ups Houston-Beijing service to daily

US Weekly

|

|