A vital step toward yuan's internationalization

Updated: 2016-10-08 07:26

By Liao Zhengrong(China Daily)

|

||||||||

|

| LI MIN/CHINA DAILY |

The yuan was included in the International Monetary Fund's Special Drawing Rights currency basket on Oct 1. According to the IMF, the US dollar will now comprise 41.73 percent (down from 41.9 percent) of the SDR currency basket, the euro 30.93 percent (down from 37.4 percent), the yen 8.33 percent (down from 9.4 percent), the pound sterling 8.09 percent (down from 11.3 percent), and the yuan 10.92 percent.

Data from the Society for Worldwide Interbank Financial Telecommunications show the yuan is the second-largest trade financing currency, and the fourth- or fifth-largest trade payment currency. And according to SWIFT, the yuan's proportion in global trade is 8 percent, and in global trade payment nearly 2 percent.

Statistics from the Bank for International Settlements show the yuan's share in global foreign exchange trade has doubled in three years, from 2 percent to 4 percent. And its share as a global reserve currency is slightly more than 1 percent.

In other words, the yuan, as an international currency, still has a low market share. Yet the IMF has given the yuan quite a high proportion in its SDR basket. Why?

The SDR is determined by an economy's trade volume. China became the world's largest exporter in 2009 and the largest trader in 2013, replacing the United States. And its exports accounted for about 14 percent of the world's total last year. So it's natural for the yuan to get a high share in the SDR basket.

It also means the yuan is internationalizing fast. But the currency faces structural and institutional obstacles in its internationalization process. The yuan cannot win full trust in the international market and thus cannot be fully internationalized unless it can be exchanged freely.

Before meeting the market requirements for its capital account, the yuan took advantage of China's large share in world trade to be included in the SDR basket. This is a breakthrough and a beginning of the different path for the yuan's internationalization.

The SDR currency basket was established to offer international reserve currencies as an alternative to the US dollar. But the global market has not fully accepted the basket.

In 2009, Zhou Xiaochuan, governor of China's central bank, said at the G20 Summit in London that Beijing was studying the SDR's market application because the US dollar's dominating status as an international currency has been creating serious problems in the market. Zhou's remarks didn't go unnoticed.

China took concrete measures to help expand the use of SDR currencies in the international market. In April, China's central bank started issuing foreign exchange reserves data using both the US dollar and SDR currencies. It is also studying the feasibility of issuing SDR-rated bonds in the country. And given the size and influence of China's economy, this could help SDR currencies play more important roles in the global economy.

The SDR basket is inclusive by nature, and promoting the SDR currencies to help reform the global currency system is a move accepted by many countries. That is why the yuan's inclusion met comparatively little resistance.

Europe's support was crucial. The European Union and the United Kingdom agreed to reduce the share of the euro and pound in the SDR basket. That they are willing to let the yuan play a bigger role in international trade shows the European players want to expedite the reform of the global currency system.

Therefore, this is the right time for China to deepen cooperation with Europe to build a fairer and more reasonable global currency system. By doing so, Beijing can also meet expectations for its role in global financial governance.

The author is a researcher at the Chinese Academy of Social Sciences. The article was first published on guancha.cn on Sept 28.

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

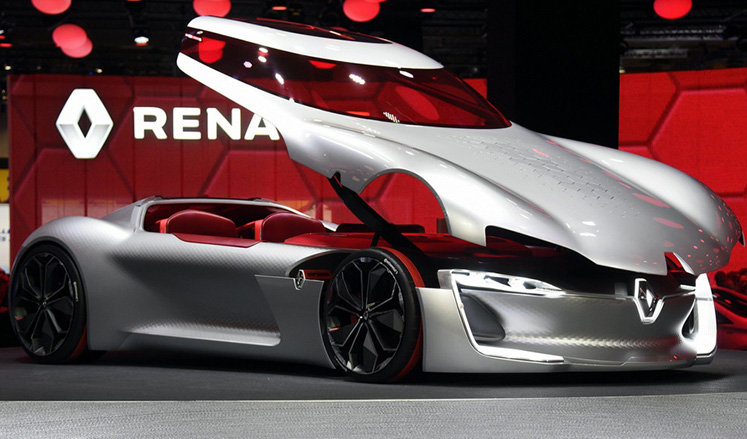

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|