US wheat expanding as oversupply looms

Updated: 2012-01-13 07:46

(China Daily)

|

||||||||

CHICAGO - Farmers in the United States, the world's biggest wheat exporter, probably planted the most winter grain in three years, expanding acreage from a century-low reached in 2009 just as a global supply glut swells to its biggest in a decade.

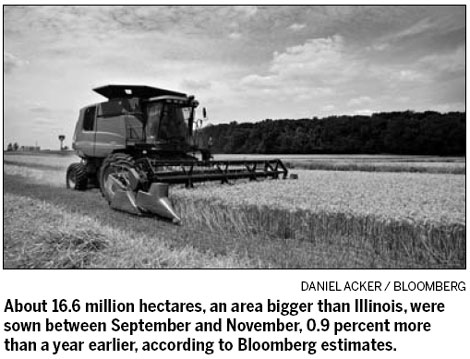

About 16.6 million hectares, an area bigger than Illinois, were sown between September and November, 0.9 percent more than a year earlier, according to Bloomberg estimates. That will add to world inventories that are set to rise 4 percent to 207.7 million metric tons, the most since 2000, the survey showed.

Wheat traded in Chicago fell 30 percent from a 29-month high in February as a 47 percent surge in 2010 spurred more planting. That helped global food prices tracked by the United Nations drop 9.6 percent from a record, easing costs that drove global inflation higher. The second most widely held option gives owners the right to sell wheat at $6 a bushel by February, 6.4 percent lower than now, Chicago Board of Trade data show.

"We have ample supplies of wheat, and we just keep on producing more," said Shawn McCambridge, the senior grain analyst at Jefferies Bache Commodities LLC in Chicago, who anticipates declining prices. "We'll need normal-type weather conditions this spring, but in general, we're going over the winter without really much of a dramatic concern."

Wheat prices are down 1.8 percent this year, closing at $6.41 at 1:15 pm on Wednesday in Chicago. An 18 percent decline last year was worse than the 1.2 percent retreat in the Standard & Poor's GSCI Total Return Index of 24 commodities. The MSCI All-Country World Index of equities fell 9.4 percent and Treasuries returned 9.8 percent, a Bank of America Corp index shows.

The S&P GSCI Agriculture Index of eight farm commodities tumbled 15 percent last year as slowing economies hurt demand for everything from cotton to soybeans. The gauge rose 44 percent in 2010 as drought destroyed crops from Russia to Australia. At the end of 2009, the US planted 15.1 million hectares of winter wheat, the fewest sown since the fall of 1912, as excessive rains swamped fields from Ohio to Illinois.

Russian wheat farmers, once the world's second-biggest producers, reaped 35 percent more last year than in 2010, recovering from the worst drought in more than 50 years, the US Department of Agriculture (USDA) estimates. Ukraine's output jumped 31 percent, supply rose 9 percent in Canada and Australian production gained 1.5 percent to a record, according to the USDA. India, the largest grower after China, harvested its biggest crop ever.

Hedge funds and other money managers have been betting on lower wheat prices since mid-September, having been mostly bullish since July 2010, data from the Commodity Futures Trading Commission show. They are holding a net-short position, or wagers on a decline, of 27,097 futures and options, compared with a net-long position of 51,787 contracts in February.

Growth in world demand this year may still exceed the 4 percent anticipated by the USDA, driving prices higher, as farmers substitute more for corn in livestock feed.

Wheat is trading at a 12.25 cent-a-bushel discount to corn, compared with a premium of about $1.78 over the past five years, Bloomberg data show. Feed use for wheat will rise 16 percent this year, almost 12 times the rate of expansion in food use, the USDA estimates.

As of Wednesday, corn has risen 13 percent to $6.515 a bushel since Dec 15 on mounting concern that dry weather is hurting crops in Brazil and Argentina, historically the largest exporters after the US.

Bloomberg News

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|