China cuts holdings of American debt again

Updated: 2012-02-16 14:53

By Zhang Yuwei (China Daily)

|

||||||||

MUSCATINE, Iowa - China, the largest foreign creditor to the United States, cut its net holdings of US Treasury debt in December for the third consecutive month, according to new data released by the US Treasury Department on Wednesday.

The Treasury International Capital System, or TIC, data shows that China cut its holdings by $31.9 billion to $1.1 trillion.

The data also show that foreign investors overall were net sellers of longterm US financial assets in December. The net foreign capital inflow was $48.2 billion, compared with an inflow of $35.6 billion in November.

Analysts believe that despite the weak US economy, government bonds are still a "safe haven" compared with Euro debt and other investment options.

But David Riedel, president of New York-based Riedel Research Group, which provides analysis on emerging markets, said the trend is changing.

"I think the overall move away from the US dollar just indicates that people are not looking for a 'safe haven' as much as they were in October and November when the markets globally fell hard on concerns about the situation in Europe," Riedel said.

Perry Wong, a senior economist at City National Bank in Los Angeles, however, said the decline of the holdings is "not significant" and can be interpreted as "normal exercises on cashing in or out in position related to maturity of some holdings, or due to yield differentials."

"There aren't many options available if the Chinese government's objective is to diversify its 'savings' in overseas markets. Europe was an option, but no longer a safe and viable option in the short run. US Treasuries are perceived to be safer than its European counterparts," Wong said.

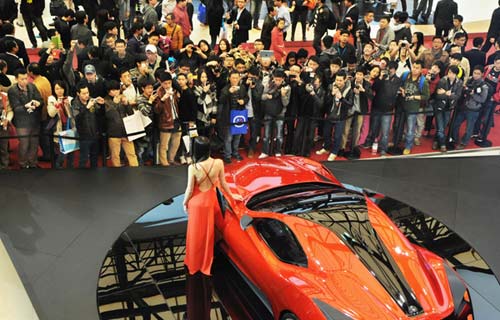

The data was released during Vice-President Xi Jinping's five-day visit to the US. Xi arrived in Iowa on Wednesday where he met with the state's governor, Terry Branstad, and revisited a host family he met during his 1985 trip as a Party official in Hebei province.

On Wednesday, Chinese central bank governor Zhou Xiaochuan said China said it will continue to invest in eurozone government debt. Zhou expressed his confidence in both the euro and in the ability of eurozone members to solve their debt problems.

"Europe is a larger trading partner with China than the US and China needs to do what they can to stabilize the economies and markets there," Riedel said.

"I think the Chinese are boosting their purchases of the euro and other bonds because of the need to help stabilize the economies around the world, which are major markets for Chinese goods," Riedel said.

But Wong said given the global financial environment at the moment, "diversification may not be a good option, particularly in EU area."

"The choices are very limited," he said.

The US hit its $14.3 trillion debt ceiling on May 14. Right before the Aug 2 deadline, Washington reached a last-minute deal to raise the debt limit by more than $2 trillion, although the country's top-notch AAA credit rating was still knocked down a peg to AA+ by ratings agency Standard and Poor's just a few days later.

Much speculation has been going on about the US reaching its debt limit again later this year. Many say it might happen around the elections. Some experts say the tedious debt ceiling talks back in August has hurt investors' confidence in the US economy in general.

"The debt ceiling argument in the US is an unfortunate byproduct of the politics in an election year in the US. It will likely become an area of political focus towards the end of the year," Riedel said.

"I sincerely hope that we do not have a repeat of the damaging and absurd political theater that we all suffered from last year, but unfortunately that might repeat itself," Riedel added.

Wong disagrees.

"The debt ceiling debate in August was not constructive. It did discourage investment shortly, but I don't think there is a long-term consequence," he said.

China Daily

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|