NQ Mobile hits back at short-seller after US stock plunge

Updated: 2013-10-26 05:59

By MICHAEL BARRIS in New York (China Daily)

|

||||||||

NQ Mobile Inc, the Chinese security software maker, released details of its bank accounts and threatened legal action after its US-traded shares plunged on a short-selling firm's claims that the company falsified financial information.

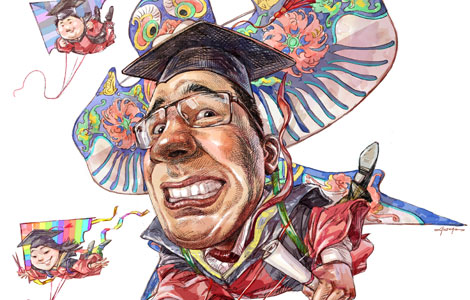

"We know of no better method than to just completely open up the kimono and say, ‘Here's our cash balances by account,'" Omar Khan, NQ Mobile's co-CEO said in an interview with Reuters in Beijing.

In a statement, the Beijing-based company rejected the allegations by Muddy Waters Research Group – known for its harsh reports on Chinese companies – as "false and inaccurate". It also said the Muddy Waters report contained "numerous errors of fact, misleading speculation and malicious interpretation of events".

NQ said it published a list of 14 bank accounts in the Chinese mainland and Hong Kong holding the equivalent of about $295 million, Reuters reported.

Muddy Waters could not be reached for comment.

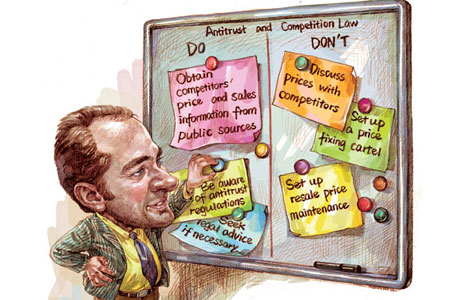

On Thursday, the firm founded by short-seller Carson Block labeled Beijing-based NQ Mobile a "massive fraud", saying 72 percent of its 2012 China security revenue is "fictitious", coming from a shell company that NQ controls.

"NQ's largest customer by far is really NQ," Muddy Waters wrote investors. The company's future is "as bleak as its past" and its "acquisitions are highly likely to be corrupt", the company said.

It said NQ's estimated market share in China is actually 1.5 percent, not the 55 percent the company claims to have. NQ's user base, it said, is "less than 250,000", versus NQ's claim of six million. Muddy Waters also claimed that NQ's antivirus program was spyware.

NQ's shares, which trade on the New York Stock Exchange, dived 47 percent to $12.09 Thursday, their biggest daily drop since the company began trading on the New York Stock Exchange in May 2011. Its stock had surged this year as big investors, including billionaire Steven A. Cohen's SAC Capital Advisors, reported holding significant stakes.

Co-founder and co-CEO Henry Lin started NQ in 2005.

NQ is the latest US-listed Chinese company to be targeted by Muddy Waters and other short-sellers. Typically, the firms short the stocks they report on, making money if the stock price declines. Many of Muddy Waters' reports, which focus largely on Chinese companies, have caused share prices to plunge. Its previous targets have included Standard Chartered PLC, Focus Media and American Tower Corp. One casualty of its reports was Sino-Forest Corp, which filed for bankruptcy in 2012.

The short sellers' aggressive scrutiny has moved dozens of US-listed Chinese companies to desert the US stock market in recent years. With share values depressed and

new capital flows reduced to a trickle, a US listing no longer is a major advantage.

The company has been moving its security software onto smartphones from Verizon and Mexican telecommunication company America Movil. It also sells to consumers in retail stores that carry MetroPCS and Cricket phones.

Last year, the company reported profit of $9.4 million on global sales of $92 million. Analysts surveyed by Bloomberg expect sales to grow to $182 million this year and $247 million next year.

michaelbarris@chinadailyusa.com

- Chinese govt tightens control on mobile software

- IP office denies using pirated software

- Software copyright registrations soar in 2012

- Growth in software and IT services declines

- Governments urged to use domestic software

- China's IT-related consumption hits $223b in Jan-May

- Domestic software sees opportunity in PRISM

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston victim's scholarship fund reaches $1m

Beckham picks Miami for MLS franchise

UN urges end of US embargo on Cuba

IMAX: Coming to a home near you

SUNY recruits students in China

NSA denies reports on US spying in Europe

US approves chemical probes against China

China and the US can learn from each other

US Weekly

|

|