ICBC rolls out first US credit card

Updated: 2016-04-27 11:10

By Amy He in New York(China Daily USA)

|

|||||||||

|

Attending launch of the Industrial and Commercial Bank of China's first credit card in the US on Tuesday in New York are Wang Xiquan (center), ICBC senior executive vice-president; Cai Jianbo (second from left), CEO of UnionPay International; Zhang Qiyue (third from right), China's consul general in New York; and Demetrios Marantis (left), Visa senior vice-president of global government relations. Amy He / China Daily |

Bank to work with UnionPay, Visa in effort to attract overseas Chinese, US tourists

The Industrial and Commercial Bank of China launched its first credit card in the United States on Tuesday, hoping to target overseas Chinese living and working in America, and to promote tourism between the two countries.

The new card will be offered by two networks, UnionPay and Visa. The purpose of working with Visa is to offer newcomers to the US with limited credit history to be able to get a credit card and "acclimate to the culture of the United States," a statement released Tuesday said.

ICBC will offer two card levels for both network brands, with the "Preferred" ustomers earning 1 percent cash back on their spending and "Premier" customers getting VIP benefits and accelerated cash back.

"This is a milestone for ICBC's international expansion, significant to ICBC's credit card footprint and its rising status globally," said Wang Xiquan, senior executive vicepresident of ICBC. "The issuance of the ICBC credit card in the USA is ICBC's major commitment to boosting China-US economic exchange and to serving local customers."

Cai Jianbo, CEO of UnionPay International, said in an interview prior to the launch that Chinese customers who work or live in the US will find the new card useful for its familiarity, as will Americans who travel for business to China and countries near it.

The credit card also was launched as part of cooperation efforts between the China National Tourism Administration office in New York and ICBC for the 2016 China-US Tourism Year.

"We hope that there are more and more exchanges between the two countries, and from UnionPay's perspective, we're hoping to be able to, through our networks, provide more safe and secure payment options to travelers," Cai said.

He said that through its collaboration with ICBC, UnionPay could provide a new payment option for local residents and attract more American tourists to China, supporting the exchange and collaboration between the two countries.

UnionPay is also hoping that it can entice American tourists to use the card when they travel to China, Cai said.

"I think the best proposition [for American customers] is that we can provide the best services to those who are traveling between China and the United States, because so far there's no such product in the market for people in the US that can be used safely and conveniently in the Chinese market," he said.

amyhe@chinadailyusa.com

- Iraqi parliament approves partial cabinet reshuffle

- S. Korea, US sign space cooperation agreement

- Chernobyl anniversary puts spotlight on nuclear safety

- Trump, Clinton widen leads in votings in northeastern states

- EU pledges 20 mln euros to nuclear safety fund

- DPRK seems set to launch Musudan ballistic missile

Human-like robots say 'hi' to President Xi

Human-like robots say 'hi' to President Xi

Animals turn savvy earners from entertainers

Animals turn savvy earners from entertainers

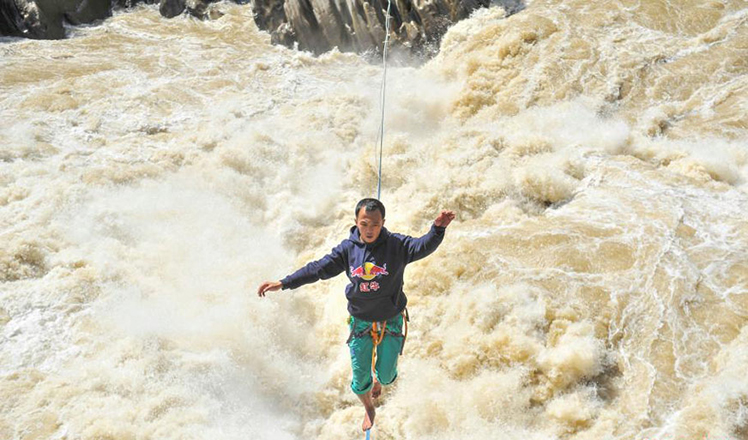

Slackline walker conquers Tiger Jumping Gorge

Slackline walker conquers Tiger Jumping Gorge

Top 6 domestic new-energy vehicles at Beijing auto show

Top 6 domestic new-energy vehicles at Beijing auto show

30th anniversary of the Chernobyl nuclear disaster marked

30th anniversary of the Chernobyl nuclear disaster marked

Shanghai unveils Disney-themed plane and station

Shanghai unveils Disney-themed plane and station

Hebei's poverty-stricken village gets new look after Xi's visit

Hebei's poverty-stricken village gets new look after Xi's visit

Cooks get creative with spring food exhibition in central China

Cooks get creative with spring food exhibition in central China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|