Tough going for foreign retailers

Updated: 2011-12-09 08:18

By Tang Zhihao (China Daily)

|

|||||||||

|

A Best Buy outlet in Shanghai on Feb 22, before it was closed. International retail chains are facing more and more challenges from local competitors and adaptation to local consumers' demand. [Niu Yixin / For China Daily] |

China continues to be an attractive destination for foreign retailing businesses, but not all companies who venture into the Middle Kingdom have found that life was easy.

Many companies had taken on the Chinese market with great confidence, but ended pulling out of the country with their tails between their legs.

In February 2011, for example, the United States electronics giant Best Buy said it would close all its nine stores, along with its Shanghai headquarters, after just a five-year presence.

A month later, Barbie doll manufacturer Mattel said it would close its flagship store in Shanghai, and French decor maker La Maison shut all its seven stores in Shanghai in a complete withdrawal from the Chinese mainland market.

All the companies said the change is part of their development strategies.

Analysts said the potentially lucrative Chinese market is not where every foreign company can easily make a profit, although many of them have advanced management systems.

The Chinese consumer market has been booming over the past decade, particularly since China joined the World Trade Organization in 2001.

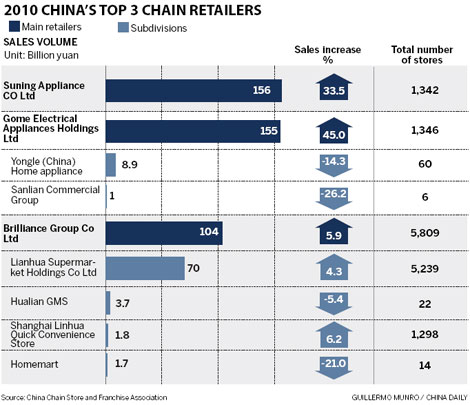

A report from consultant A.T. Kearney (ATK) said sales revenue generated from the retail sector reached 2.1 trillion yuan ($331 billion; 246 billion euros) in 2010, with growth rate remaining at 15 percent.

Figures from consultant Euromonitor International showed sales revenue generated by hypermarket operators in China reached 444.66 billion yuan in 2010, an increase from 39.76 billion yuan in 2001. Revenue from other retail sectors such as home appliances and online shopping, has also recorded tremendous growth.

China's WTO membership and the booming market demand provide tremendous opportunities for global retailing giants.

Liao Yan, public relations manager of French retail giant Carrefour China, said while the company has brought into China some of Europe's advanced retail experiences, the country has become "one of the most important supporters for Carrefour's growth in the world".

Carrefour operates more than 190 stores in China. The company, which entered the Chinese mainland in the early 1990s, is the country's fourth-largest retail giant with a market share of 8.1 percent in 2010, Euromonitor said.

Figures from the China Chain Store and Franchise Association (CCFA) showed that in 2010, sales revenue generated by Taiwan-based RT-Mart reached 50 billion yuan, and the United States-based Walmart generated 40 billion yuan.

The two are the leading hypermarket operators in China.

For most foreign investors, China has become strategically important as any success here would mean they would have strong support for their growth.

Howard Abe, who specializes in consumer goods and retail practice at ATK, said retailers need to control the speed of their growth at a rational level to better control the supply and distribution channels. Companies also need to better understand consumer preferences and better utilize resources, he said.

Swedish furniture retailer Ikea has long had a test-and-trial strategy, and now is on an expansion phase after being in China for more than 10 years.

"We need to understand the market in China and understand what people like," Gillian Drakeford, Ikea China retail president, said. "We need to know the factors that can make us successful. We cannot just come in and suddenly go big."

ATK's Abe said: "No city is the same. Companies need to understand each city and understand consumer preferences."

When companies expand too quickly, he said, they might find it hard to find the right suppliers and maintain sustainable growth.

When competition in the larger cities gets too strong, many retail giants seek opportunities in smaller ones. However, not all have found this easy, with some larger giants forced to close stores in small cities to avoid further losses.

Peng Jianzhen, deputy secretary-general of CCFA, said foreign retailers have been doing very well over the past decade and have strong presence in cities such as Beijing and Shanghai.

However, their expansion might not have been as much as it was when they first moved into regional area, or smaller cities, Peng said.

"Locally retailing companies might have better control over resources in regional areas and some have developed management systems that better fit the local market, so foreign companies might lose competitiveness in second- or third-tier cities," Peng said.

After 10 years of growth, local companies have become more confident in competing with foreign companies and in building business models that better support development in China, Peng said. And compared with foreign companies, local companies might be more competitive in attracting talent.