China growth model 'is fine'

Updated: 2012-11-30 06:49

By Andrew Moody and Su Zhou (China Daily)

|

||||||||

|

The Czech economist Tomas Sedlacek says the only way to solve the global recession is by tackling the addiction to debt. Feng Yongbin / China Daily |

Czech economist believes consumption is good as long as it is not reliant on debt

Tomas Sedlacek says the aim to make China a more consumption-led society might not be the right way forward for the world's second-largest economy.

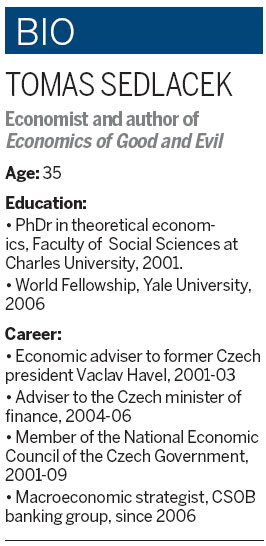

The 35-year-old Czech economist believes over-consumption has brought ruin on the Western economic system. "I actually believe it is fine that GDP is boosted by investment (in infrastructure) and by exports, rather than driven by consumption, as in China," he says.

Sedlacek, a great bear of a man with a bushy ginger beard, was in the lobby of the plush Marriott Executive Apartments, just a few meters from Wangfujing Street, one of China's most expensive shopping areas and renowned for its conspicuous consumption.

He says the Chinese government was not, however, wrong to focus on consumption in its current Five-Year Plan (2011-15) but spending should not be fueled by credit as in the West. "I won't go so far as to say it is a mistake (to focus on consumption). Domestic consumption is fine so long as it is not based on debt.

"Credit, by the way, means faith in Latin. If you want to be pulled by credit, you are pulled by faith. Faith works so long as everybody believes in it. If you rely too much on it, it will destabilize the economy."

Such classical and biblical references regularly occur in his best-selling book, Economics of Good and Evil, which has just been published in Chinese and which he was in China to promote.

He believes economics needs to rediscover its moral basis espoused by Adam Smith, author of the classical economics treatise The Wealth of Nations in the 18th century, and move away from the mathematical theory that has led it astray.

He believes the obsession with numbers led to bankers and others becoming deluded into thinking they were the "masters of the universe" in the last decade before the economic crisis brought them to their knees.

"Banks pretended they had everything figured out. The mantra on the Wall Street was that governments shouldn't meddle but when trouble came they wanted the governments to help them out.

"We were so sure in our mathematical models. We were focused on things like partial derivations to the third degree and transposed matrices that we forgot the bigger picture. We studied the splinter of wood but didn't see the whole tree falling on our head."

He says that the number crunchers had effectively divorced the body of the economy from its soul by their actions.

"There was a view that the purpose of the economy was about selling things and making the country more affluent. There was nothing about morality and such concepts as justice, stability or certainty."

Sedlacek, who speaks with a huge booming voice like an Old Testament prophet (perhaps unsurprisingly since the Bible is one of his favorite texts) was taking snuff over his morning coffee. "Yes, it is very old fashioned. I think I am in certain areas. They used to do it a lot 100 years ago. It is a nice addiction," he says.

The economist is a well-known figure in Prague, where he studied economics in the Faculty of Social Sciences at Charles University.

After university he became economic adviser to former Czech president Vaclav Havel, who was also a playwright and pivotal figure in his country's history.

"He was an extremely humble man. He never showed his power when he walked into a room as a smaller man might," he says.

"After he ceased to become president he would take the whole office out to the pub. The waiter would come round and take our orders and maybe leave him until last and then suddenly realize who he was and be taken aback. That is what was magical about him."

Sedlacek, who speaks Finnish, Danish and German as well as English and his native Czech, currently works as macroeconomic strategist for the CSOB banking group in Prague as well as lecturing at Charles University and at conferences and other forums around the world.

In the current economic debate, he is very much in favor of austerity and reducing deficits unlike others such as the American Nobel laureate Paul Krugman, who believe that economies need further stimulus if they are ever to pay off their debts.

"They basically say you have to increase the level of deficit so the economy starts to grow again, so we can pay back our deficits. If you only take out the middle part of that sentence, you get this idea that you have to increase your debts to pay back your debts, which doesn't make any sense at all."

Sedlacek believes the world economy is in a huge mess and that the only way to solve the problem is by reducing deficits and tackling the addiction to debt.

"The problem with the world economy is not that it is depressed but that it is manic depressed. It is the result of turning our happy period into a mania, over consuming, etc. and we are now having to deal with the consequences."

He believes China has emerged in a strong position precisely because it did not become a debt junkie in the boom years.

When the world went into an economic recession, it had a strong balance sheet and could afford its 4.1 trillion yuan ($660 billion; 510 billion euros) economic stimulus at the onset of the financial crisis without plunging the economy into debt. "China is demonstrating you can even have a budget surplus and invest. They have a much more reasonable balance than the West and they are doing a lot of investment," he says.

He believes China's version of Keynesianism is much more sensible than the "bastardized" version now being deployed in the West.

"What we are seeing in the West is a bastardization of Keynes. He would be turning in his grave at the idea of economies running budget deficits when the economy is growing rapidly. The stupidity we now have is trying to do austerity in a crisis," he says.

The current austerity measures have hit few countries harder than Spain, which has 50 percent youth unemployment, and Greece, seemingly teetering on the brink of euro exclusion every few months.

"If your friend breaks a leg, you come and help him. If your baker breaks a leg, you go and find another one. Europe has to decide whether Greece is a friend or a baker."

He believes the onus is on the richer northern European countries to keep the eurozone intact.

"When California went bankrupt, nobody thought it would help to kick them out of the dollar zone."

Sedlacek says the problem for the West at present is that it is running out of the debt drug it is addicted to.

"The debate today is all about running out of the drug and running out of deficit," he says.

The economist does, however, believe the global economy will survive this brush with meeting its maker, even if the economic outlook for the rest of the decade might be bleak, but what it has experienced might be a final warning.

"What we are going through is different from the 1980s and 1990s because no one was talking about the collapse of the system," he says.

"I am worried that when the next crisis comes and we don't know from where, and we haven't radically decreased our debt, then it could be a whole lot more difficult to solve."

Contact the writers at andrewmoody@chinadaily.com.cn and suzhou@chinadaily.com.cn

(China Daily 11/30/2012 page24)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|