Don't mind the size, feel the quality

Updated: 2013-05-03 08:56

By Zhu Ning (China Daily)

|

||||||||

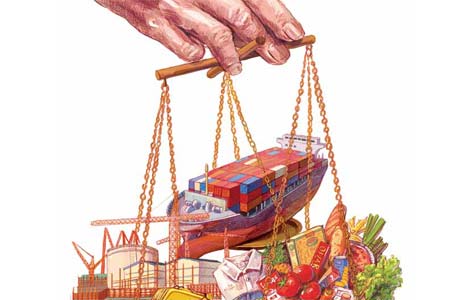

The standard of China's economic growth is more important than its status

I often get asked the following question when I travel outside China: What is China going to do with its status as the world's largest economy?

It's a good question. With such speed and consistency in its growth, few doubt that China will one day surpass the United States in economic status. Even based on a relatively conservative projection of 7 percent annual growth, China's economy is forecast to double and overtake the US within the next 10 years.

Not too many countries have set the speed of economic growth as the main objective, and fewer have managed to achieve it.

Japan is one of the exceptions. Despite its much smaller size in area and population, it even managed to surpass the US as the worlds' largest economy for a while. Unfortunately, due to its economic and demographic structure, Japan has been busy fixing problems that were not properly addressed during its fast economic growth.

So, China should probably soon start thinking about this question too.

In the end, the economy is not just a numbers name. It's better if economic growth is felt, rather than measured.

China overtook Britain, France, Germany and Japan to become the world's second largest economy, all within a decade.

Even at the slower projected pace of 8 percent in GDP growth over the next decade, China's economy will still be growing at twice the speed of most other developed economies. The country's relatively smooth navigation through the last financial crisis has certainly reassured global investors of its ability to manage domestic and international matters during global turmoil.

But as the uncertainties disappear about China's economic growth and size, more questions are turning to the quality of its growth.

The first question is sustainability. All economic growth forecasts rely on assumptions. A key assumption behind China's calculation is sustainable growth.

With the increasing size of its economy come increasing labor costs, decreasing returns on investment and a deteriorating environment, so whether China can sustain growth has become an even bigger question than the speed of that growth.

The state seems to have been driving a large part of economic growth in the past decade. As the World Bank's China 2020 report discussed in 2012, state-owned enterprises showed operating efficiency and investment returns far lower than their international counterparts.

Another major driver of the Chinese economy is the government's infrastructure investment and housing boom. Over the past decades, revenue from selling local land has become a major source of local fiscal income, which is then used to invest in infrastructure projects to further stimulate economic growth.

Real estate policy since 2010 has been far from effective in curbing or lowering housing prices, but it has already had an impact on the fiscal soundness of local governments. Many have had to rely heavily on local government financing vehicles to raise capital with high interest rates to sustain existing projects.

The real estate and related sectors contribute to more than 20 percent of Chinese economic growth. With China's housing prices already higher than those of many developed economies, such a real estate-driven economic growth model puts the government into a policy dilemma of balancing affordable housing and maintaining economic growth.

So far, the government has managed to keep economic growth at an acceptable pace at the cost of housing prices resuming their upward trend. Even before further appreciation, housing prices have increased by so much that this has started to have a chain effect on education, employment and even marriage. How to strike a balance requires a lot of policy wisdom in the coming decade.

As China's economic growth continues apace, it is probably time for it to think more about how to make that growth of more benefit to its citizens, and for it to be appreciated by them - or, in President Xi Jinping's words, "to help each Chinese fulfill his or her China dream".

The author is the faculty fellow at the International Center for Finance, Yale University, and deputy director of the Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University.

(China Daily 05/03/2013 page7)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|