Canadian’s slow to embrace RMB trading hub

Updated: 2015-08-20 05:32

By Wang Ru(China Daily Canada)

|

||||||||

It’s been more than four months since the trading hub of China’s currency, the renminbi, was set up in Toronto, the first one in the North America.

With tremendous potential to boost bilateral trade between Canada and China, the trading hub, however, faces challenges that include lack of support from major Canadian banks.

“The development of the trading hub of RMB needs participants of major Canadian banks and companies, if not so it won’t fulfill the mission to boost the bilateral trade,” said Zhu Mingxuan, president and chief executive officer of Industrial and Commercial Bank of China (Canada), which operates the Canadian RMB hub, launched on March 23, 2015.

In an exclusive interview with China Daily Canada, Zhu said several Canadian banks, for instance the Royal Bank of Canada (RBC), have opened accounts, but “only some small amount of transactions” have taken place. “Without large amount of renminbi transactions through the trading hub, the establishment of such a hub is meaningless,” he said.

Zhu added: “The current transactions of the trading hub are mostly contributed by Chinese banks and ICBC’s branch in New York.”

Though ICBC is the largest bank in the world, its branch in Canada is “a very small bank,” Zhu said, adding that without the business from Canadian banks, the hub will not succeed.

The renminbi hub is seen as an important platform to reduce currency exchange costs, reduce transaction risks, and allow faster and more direct payments for Canadian businesses trading with Asia, which could make Chinese small- and medium-sized businesses favor doing business with Canadian partners.

Zhu hopes that major Canadian banks like TD Bank will realize the strategic meaning of the RMB trading hub for them. He said the Canadian banks should see the trend that China’s RMB will be an internationalized currency in the future.

“We are not here to compete with local banks, instead to create opportunities for mutual benefits in a long term,” said Zhu.

By the end of 2014, RMB ranked fifth as the most traded currency, according to SWIFT's report. Since 2009, China has signed currency swap agreements with more than 30 regions and countries, including Argentina, Belarus, Brazil, Canada, Iceland, Indonesia, Malaysia, Singapore, the ROK, Thailand, the United Kingdom and Uzbekistan

“Compare to American banks such as the Citibank, Canadian banks lack global presence especially in Asia,” said Zhu. “The internationalization of the RMB will have a huge potential to promote Canadian banks as well.”

Zhu said a mature RMB hub needs not only currency trading, but also a series of RMB-related financial products, such as loans, securities and bonds.

An HSBC report showed that only 5 percent of Canadian firms surveyed use the hub in trade, well below the global average of 22 percent. However 37 percent of Canadian firms surveyed expect to use the RMB in the future.

Economists point out that the weakening Canadian dollar is one of the reasons contracts settled in RMB are more attractive to Chinese buyers than Canadian businesses.

Another barrier is suspicion from outdated perceptions about the stability of the RMB.

The key factor driving RMB adoption has been the Chinese government. Chinese authorities have been relaxing cumbersome rules and providing more stability through the introduction of global currency swap agreements like the one signed with Canada in late 2014.

But as the HSBC report revealed, Canadian companies “have not kept up to date with these initiatives.”

David Watt, Canadian economist with HSBC Bank Canada, said in the report that Canada would do well to think of China as an opportunity, rather than with suspicion.

Watt, urging the Canadian companies to think more broadly, said “Canadian businesses, instead of wondering about the US consumer, need to think about the Chinese consumer and the Chinese economy.”

C.J. Gavsie, head of Foreign Exchange Products, Bank of Montreal’s capital markets unit, said in an earlier interview that if the RMB hubs seen elsewhere like the UK and Singapore are replicated successfully in Canada, total trade between Canada and China could double – or even triple – in the 12 months following the establishment of a hub.

The Toronto RMB hub serves as conduit for 24-hour coverage of global renminbi transactions, enabling businesses to convert Canadian dollars directly into Chinese currency.

It is reported that the ability to directly trade in RMB is expected to add as much as $32 billion in exports for Canada and grow the country's financial services footprint in Asia.

“Canadian banks, however, are used to do currency trade via their branches in Asia, where there is a 12-hour time difference with Canada,” he said.“Canadian investors need to know more about the benefits from the internationalization of RMB, especially the RQFII quota.”

RQFII, is the renminbi qualified foreign institutional investor scheme. Launched in December 2011, it allowed a small number of Chinese financial firms to establish renminbi-denominated funds in Hong Kong for investment on the Chinese mainland.

From March 2013, the scheme was widened to include international banks and asset managers with a presence in Hong Kong, paving the way for a host of new products and fund launches.

In 2014 China gave a 50 billion yuan ($8.2 billion) quota to Canada under the scheme as the Canadian Prime Minister Stephen Harper visited Beijing and signed deals to boost economic ties.

“So far the application to use the quota from Canada investors is few,” said Zhu, adding that one of the reasons may come from the concern about investment environment issues such as intellectual property rights and laws in China.

According to the statistics of the Asia-Pacific Foundation, 80 percent of Canadian companies in China are making profits, Zhu cited.

“The bilateral trade between Canada and China have a huge potential, we hope that the RMB hub will make Canadian companies successful in China,” said Zhu.

The changing looks of Beijing before V Day parade

The changing looks of Beijing before V Day parade

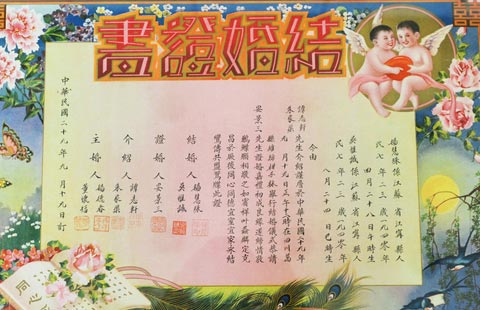

Nanjing displays ancient marriage, divorce certificates

Nanjing displays ancient marriage, divorce certificates

Top 10 Android app stores in China

Top 10 Android app stores in China

Ceremony held to mourn victims of Tianjin blasts

Ceremony held to mourn victims of Tianjin blasts

Silk Road city displays sculptures at exhibition

Silk Road city displays sculptures at exhibition

Top 10 companies with the most employees

Top 10 companies with the most employees

Men in Indonesia climb greased poles to win prizes

Men in Indonesia climb greased poles to win prizes

In pictures: Life near Tianjin blasts site

In pictures: Life near Tianjin blasts site

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Fitch warns insured losses from Tianjin explosions could reach $1.5b

Conflicting reports on possible Abe trip

Hillary Clinton breaks with Obama on Arctic oil drilling

At UN, China backs regional peace efforts

Man in yellow shirt is Bangkok bomber: Police

Beijing dismisses reports of Abe's China visit in September

Anti-corruption campaign 'good for China, US'

Police: Man in yellow shirt is Bangkok bomber

US Weekly

|

|