|

Large Medium Small |

CHICAGO: An industrial hub since the early 19th century, Connecticut’s Naugatuck River Valley has seen thousands of jobs vanish from its cities and towns over the last few decades. However, at least one local employer recently revived itself by attracting investment from China.

The current economic downturn has hit most automotive supply companies hard, and Watertown-based DriveSol Worldwide is no exception. The pedal and driveshaft manufacturer announced last December that it would shut down permanently and lay off some 250 workers.

“It was pretty sudden,” said Tony Roberto, executive director of the Connecticut Development Authority. “Things fell apart quickly in the auto industry.”

The plant’s managers spent the next few months scrambling to attract new investors, since the private equity firm that owned the company only seemed interested in shutting the place down.

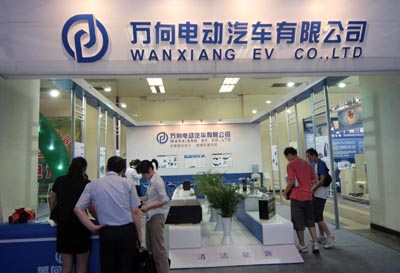

“I wasn’t privy to their internal discussions, but that was certainly the message that we received,” said David Schramm, one of the managers. So to prevent that from happening, the managers successfully convinced a group of investors led by Wanxiang America, a subsidiary of China’s largest automotive supply firm, to buy and reopen the company. DriveSol is now named Global Steering Systems.

For struggling American firms looking for a lifeline, investments from Chinese companies are a good bet, according to Ravi Ramamurti, a professor of international business and strategy at Boston’s Northeastern University. The Chinese auto industry has grown between 30 and 40 percent a year, filling the coffers of companies such as Wanxiang.

“They have the momentum and the financial strength (to rescue other firms),” said Ramamurti. “The likelihood of a US investor doing the same is dim.”

Wanxiang America has taken advantage of this and has made buying or investing in struggling manufacturing firms part of its modus operandi. Since it was founded in 1994, the privately owned company has acquired more than 20 American businesses in Illinois, Michigan, Missouri and other states.

“We now do two or three deals a year,” sometimes with companies already in bankruptcy proceedings, said Ni Pin, president of the Elgin, Ill.-based firm.

For example, in 2008 Wanxiang bought the struggling Michigan-based unit of Automotive Component Holdings from Ford Motor Company. Wanxiang plans move the 300 ACH workers into a new, modern plant. And in 2007, Wanxiang bought a division of the Toledo-based Dana Corp, another major supplier that was under Chapter 11 bankruptcy protection.

Approximately 2,000 Chinese firms have US subsidiaries, and have either acquired or made substantial investments in another 3,000 American companies, said Deng Ping, a professor of business administration at Maryville University in St. Louis. Deng expects these numbers to greatly increase in the next few years.

In 2002, Chinese companies invested about $2 billion overseas, Deng said, and by 2008, they invested about $20 billion with no sign of slowing down. When making acquisitions in developed countries, Deng adds, Chinese firms “really want better technology and advanced management know-how.”

Ni laughs off any suggestion that all these acquisitions are a threat to American business. “We’re not trying to come in and be the boss,” Ni said. “We partner with people who have resources that Wanxiang does not have.”

He adds that when they do acquire companies they try to hang onto their workforce, including the managers and workers. Wanxiang America now has about 4,000 employees, almost all American.

“I believe in American manufacturing,” said Ni. “I believe it has a future.” However, he adds that “we’re not a charity, obviously,” and in some cases, it makes sense to shift an acquisition’s low-skill jobs to China and take advantage of the lower labor costs.

Ramamurti said that those lower costs will help Wanxiang’s new American acquisitions stay competitive.

“If you are losing money, partially due to (lower cost) competition from Chinese companies, the best thing to do is join these companies.” And in the case of auto parts factories, “no one else is even willing to take a risk. (Companies such as Wanxiang) are helping save jobs in an industry that would otherwise shut down.”

Most importantly, he adds, the higher-paying, higher-skill jobs will typically remain in the US since auto supply customers always need certain finely machined components on very short notice.

Global Steering shrank from roughly 250 employees to about 130, said Schramm. But in their case, no jobs were shifted to China and the plant retains jobs at all skill levels. The decline in jobs was “nothing more than getting ourselves right-sized while we’re working through the bankruptcies of the big (automakers).” Schramm hopes to expand the workforce when the economic crisis passes.

But until the economy turns around, Ramamurti expects Wanxiang’s buying spree will continue. The depressed prices for any firm connected to the auto industry means that “this is an opportune time for them to buy.”

Such investments may have helped dozens of companies prosper, but Ni believes it’s time for Wanxiang America to do more than invest. Wanxiang China has begun to branch out into green energy products such as solar wind farms and electric vehicles. Ni’s American subsidiary has followed suit, but the US has few companies producing solar panels, and to grow its green business, Wanxiang will have to build its own factories. This summer, in Rockford, Ill., the company broke ground on its first solar panel manufacturing plant, which could eventually employ about 240 workers.

“Until now, we’ve been preserving jobs,” Ni said, “and now we’re creating jobs. It’s a big difference.”