Global mobile brands find lines busy in China

Updated: 2012-09-24 09:24

By Shen Jingting, Tuo Yannan, Chen Limin and Gao Yuan (China Daily)

|

||||||||

Chinese firms see robust growth in world's biggest smartphone market

China has emerged as the world's biggest smartphone market, attracting mobile phone vendors from around the globe. The country is also the world's biggest mobile phone manufacturing base, with several domestic companies such as Lenovo, Huawei and ZTE rising quickly and threatening the position of more established cellphone makers.

Tougher competition

The Chinese smartphone market is changing rapidly and is fiercely competitive. Some international brands that have performed extremely well in developed countries have not achieved similar results in the Chinese market, Apple Inc being one such case.

|

China is now the world's biggest battleground for Chinese and overseas smartphone producers. Mobile communications is a sector that the most IT companies want to get themselves involved in for future business survival. [Photo/China Daily] |

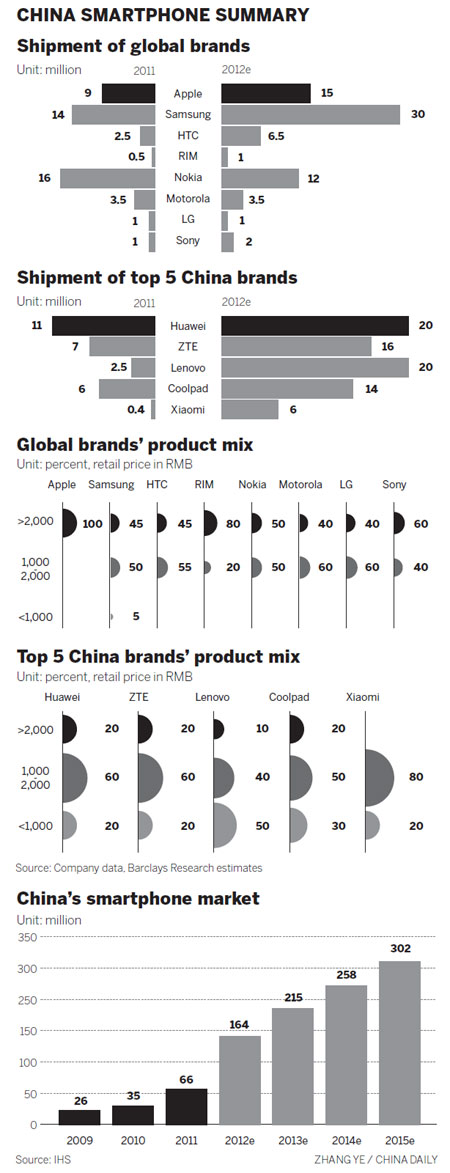

Although Apple swept the North American and European markets as the leading smartphone brand, the company ranked seventh by market share in China during the first six months of this year, behind Samsung Electronics Co and many domestic mobile phone manufacturers.

Apple had shipped 5.2 million smartphones to China as of June, according to a report issued by information and analysis provider IHS. This accounted for a 7.5 percent share of the total smartphone market in China, and was only about one-third of the share held by market leader Samsung.

From smuggling to selling kidneys, many Chinese are determined to get an iPhone by hook or by crook.

Apple has once again excluded the Chinese mainland from the list of first regions to roll out its latest product, the iPhone 5.

Apple pledged to open more brick-and-mortar stores in China years ago, targeting second-tier cities. However the number of Apple stores remains at five on the mainland: three in Shanghai and two in Beijing. The number is less than that of one state in the United States.

Besides having what some critics describe as an arrogant attitude, analysts explained other reasons for Apple's comparative lack of success in China. "Apple failed to make any noticeable achievement in the Chinese market because of its high pricing, simple product line and the company's reluctance to cooperate with China Mobile Ltd, the nation's biggest mobile carrier," said Kevin Wang, director of China electronics research at IHS.

|

|

"For Apple, this is a huge disadvantage," Wang said.

TD-SCDMA technology, the 3G wireless standard adopted by China Mobile, represents the fastest-growing standard for smartphones in China. Shipments of TD-SCDMA-compliant phones are expected to rise 10-fold from 2011 to 2016, he added.

Nokia Corp of Finland, another big-name international player, experienced a rough time in the Chinese market as it shifted its focus to the Windows Phone platform. The company's ranking slipped to fifth place in China, with a 9.1 percent share in the first half. Its decline has been dramatic, having been the top smartphone brand in China during the fourth quarter of 2011, the IHS report showed.

Other international brands, such as Motorola, Sony and LG Electronics, all delivered unsatisfactory results, gaining less than 5 percent in market share in China in the first six months of this year.

In contrast with foreign companies' weak performances, some Chinese manufacturers have experienced robust growth and grabbed significant market share.

Lenovo Group Ltd, the largest Chinese PC maker by market share and second-largest globally, is now the second largest smartphone provider in China based on sales in the first half of 2012.

The company's success is down to its founder, Liu Chuanzhi. In 2008, because of poor market performance, the company sold its mobile business to "concentrate on the PC sector", but Liu decided to buy it back in 2009.

Then the company established a mobile Internet division in 2011 and launched its first smartphone - LePhone. Lenovo presented its second-generation smartphones LePhoneS2 and K800 this year.

"Since Lenovo became the second-largest PC maker globally (in the second quarter of 2011), we have been putting greater emphasis on mobile Internet products and cloud-computing markets," said Yang Yuanqing, president and chief executive officer of Lenovo.

Lenovo reported its smartphone shipments exceeded that of its PCs for the first time in history in the second quarter of 2012. About 6.8 million handsets were sold during the quarter, the company said.

ZTE Corp, the world's fifth biggest telecom equipment maker, has made huge strides in the mobile phone sector in recent years as the company looks beyond the traditional telecom industry for new revenue drivers.

The company has developed into the world's fourth mobile phone vendor and aims to ship more than 30 million smartphones this year, doubling the figure of last year.

Huawei Technologies Co, expressed its ambition earlier this year to ship more than 100 million mobile phones in 2012. Huawei hopes to be among the world's top three mobile phone vendors in five years.

"The major advantage for Chinese handset manufacturers is that they usually adapt quickly to market demand. In addition, being homegrown, they understand the culture and nuances of their Chinese customers," Egidio Zarrella, a partner at KPMG China, said in an email to China Daily.

Unlike Apple, which probably takes a year to research and test a new model, Chinese mobile phone manufacturers have a much higher productivity rate.

"From the idea to the actual handset hitting the market, the fastest Shenzhen producers only need 20 days," said Sun Wenping, secretary-general of the Shenzhen Mobile Communications Association. Shenzhen is a mobile phone production hub with a complete supply chain in South China.

He Shiyou, executive vice-president of ZTE Corp, said the average lifespan for a smartphone in China has become much shorter now, probably between three and six months. "Therefore ZTE has to move fast in order to not lag behind," he said.

However, domestic rivals may not have the knowledge or skills to bring global ideas into the Chinese market to drive innovation - innovation from seeing all ideas and then adapting them to your own market, Zarrella said.

One of the key competition weapons that Chinese vendors resort to is price but price wars lead to lower profit margins and impose negative effects on branding, said Sabrina Ren, a research manager at Germany-based GfK Group.

"Apart from a few manufacturers, currently lots of Chinese brands rely on the turn-key solution from the chipset provider and do not have strong enough research and development capacity compared with global competitors," Ren told China Daily.

Internet companies

While what used to be movers and shakers in the global mobile phone making industry have been going downhill, an increasingly large number of Internet companies have made their way into the business.

Since last year, major Internet companies have come up with their own smartphones employing different tactics, including pre-installing mobile applications, providing mobile operating systems and making the handsets themselves.

|

|

With handsets deeply integrating their services or applications, Internet companies aim to win more mobile traffic. Analysts said that by increasing the exposure of their services to users they get better noticed.

"Applications are key to the future of Internet firms because more of their users access them through smartphones," said Duncan Clark, chairman of BDA China, a consultancy company that follows China's IT industry.

Tencent Holdings Ltd, China's biggest Internet company by revenue, and Chinese Web browser company Qihoo 360 Technology Co fall into the first category. They have teamed up with mobile phone markets to provide mobile phones with their services pre-installed.

|

|

E-commerce giant Alibaba Group and Baidu Inc, the largest Chinese search engine, set foot in the industry with their own operating systems, through which the two companies offer their own services.

"Integrating applications into the operating system of smartphones is one way to improve the speed and ease of use necessary to cement their position," Clark said.

Shanda Interactive Entertainment Ltd and Xiaomi Corp go even further by providing their own branded mobile phones, stretching their reach to both software and hardware.

Compared with mobile phone makers, Internet companies take a different approach.

Lei Jun, founder and chief executive officer of Xiaomi, said he doesn't hope to make money by selling handsets but, instead, by providing software and services, a similar approach taken by Apple Inc.

"The hardware is like a platform. The most important thing is to breed software and services on it. Those are the things that truly generate profit," said Lei. However, he said it will take time for Xiaomi to develop into a profitable company.

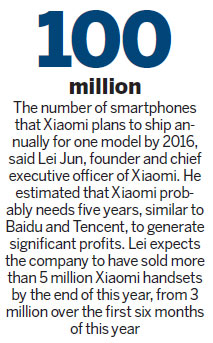

"If you ask when those investments in Xiaomi will finally pay off, it's much like you asking the same question of Baidu or Tencent just after they went into business," Lei said. He estimated that Xiaomi probably needs five years, similar to Baidu and Tencent, to generate significant profits.

Lei expects the company to have sold more than 5 million Xiaomi handsets by the end of this year, from 3 million over the first half, and to ship more than 100 million smartphones annually for one model by 2016.

The rush into the mobile phone industry came when the number of Chinese people accessing the Internet via mobile devices increased to a record high of 388 million at the end of June, out of a total Internet population of 538 million, according to a report by the China Internet Network Information Center.

Meanwhile, mobile phones have become the most widely used devices to access the Internet, boosted by the increasing popularity of smartphones and a large number of mobile applications, said the report.

"It is a great thing for the market with new companies such as Baidu and Alibaba entering the smartphone industry," said KPMG's Zarrella. Because of the participation of Internet companies, there is more industry innovation. "It is the beginning of the 'innovated in China' era and this is the most exciting thing," she added.

However, Kai-Fu Lee, former president of Google China, said most Internet companies providing mobile phones will see that part of their business fail.

"The two industries (Internet and mobile phone making) are completely different with different DNA," he wrote on his micro blog.

"A company cannot win users if its aim is not to satisfy users' needs but to present its own services. It will also be criticized if it doesn't integrate competitors' services that users like into their mobile phones."

There are questions about how well Internet companies can monetize their mobile services, BDA's Clark added.

C.K. Lu, senior mobile device research analyst at Gartner Inc, said the popularity of local services such as Baidu and Tencent's instant messaving service QQ lessens the advantage of global vendors in promoting their devices with complete Internet experiences in the way that the iPhone uses its iOS operating system. "The era of the ecosystem and cloud in fact helps local vendors to compete with global brands," he said.

Operating system

The widespread use of smartphones in China is poised to ignite a new round of competition among mobile operating systems, although Google Inc's Android system remains dominant at present.

The penetration rate of the Android system hit a record-high of 82.8 percent as of the second quarter of this year, data from Beijing-based research company Analysys International showed. The figure excluded the large shipment of knock-off smartphones, a unique product category for emerging markets such as China and India.

Analysts believed if knock-off phones were included, Android's market share would surge because it is the world's largest operating system for mobile devices.

The power of Android is eminent in China. On Sept 13, Taiwan PC maker Acer Inc canceled the launch of its new mobile phone running a cloud-based operating system developed by a division of Alibaba Group because of "direct pressure" from Google.

But, Acer said that it will continue its cooperation with Alibaba.

The biggest challenge to Android is probably the iOS, an operating system especially designed for Apple's mobile devices.

Yet the penetration rate of iOS barely stood at 6 percent in China, said Analysys International. Apple may pick up some market share after iPhone 5, launched widely outside the Chinese mainland this month, hits the local market.

"The release of iPhone 5 will accelerate Apple's shipment of smartphones before the end of this year," said Liu Peng, an analyst at Analysys International. However, the momentum will be limited, according to Liu, who added that manufacturers using Android systems were making moves ahead of Apple in a bid to seize a bigger market share.

As all the operating systems strive to boost user numbers, the only underdog is Symbian, an operating system abandoned by Nokia at the end of last year. Nokia said the Symbian operating system will be obsolete by 2016.

Symbian's penetration rate fell to 6 percent in the second quarter of this year in China, a drop from 32.3 percent a year ago, according to Analysys International.

But Nokia has found a stronger operating system to lean on: Microsoft's Windows.

In September, the Finnish cellphone maker launched its Lumia 920, the company's first device running the latest Windows Phone 8 system. The device is expected to enter the mainland market by the end of the year and will further squeeze the high-end market before the debut of iPhone 5.

During a New York news briefing earlier this month, Stephen Elop, chief executive officer of Nokia Corp, said China has become the largest Windows Phone device market in the world.

The country is also the biggest single-country market for Windows Phone devices manufactured by Nokia, according to Flann Gao, Nokia China communications manager. With 1.06 billion mobile subscriptions, China has great potential in the global smartphone industry, he said.

The powerhouse

China has the world's largest mobile population, with 1.06 billion mobile phone accounts as of July, according to the Ministry of Industry and Information Technology. It reached the billion landmark in March, becoming the world's first country to achieve it, thanks to people's eagerness to connect with each other.

The country took less than five years to double its mobile phone accounts to 1 billion, adding subscribers at a steady pace between 8 million to 12 million a month in recent years.

The huge subscriber base is the most important reason for China rising as a heavyweight in the global mobile phone industry. According to research firm Strategy Analytics, China overtook the United States in terms of smartphone shipments in the third quarter last year.

"China is now at the forefront of the worldwide mobile computing boom," said Neil Mawston, executive director at Strategy Analytics. "The nation has become a large and growing smartphone market that no hardware vendor, component maker or content developer can afford to ignore."

Sabrina Ren, research manager with GfK Group, said China is the strongest growth driver for the world's smartphone industry. The country is expected to achieve a growth rate of 109 percent in terms of smartphone shipments in 2012, almost three times that of the rest of the world's estimated average during the same period, GfK statistics show.

In addition, China, as the largest mobile phone manufacturing base across the globe, has started to influence markets outside the country.

In the first half of this year, China produced 535 million mobile devices, of which about 85 percent were exported overseas to markets such as South Asia, Africa and Middle East, according to the Ministry of Industry and Information Technology.

Meanwhile, with the rise of Chinese handset brands, such as Huawei's and ZTE's, some major market trends in China are having a global impact, said Ren.

"For example, the 1,000 yuan entry-level smartphone success has spread to other countries," she said. By working with foreign operators, domestic companies such as ZTE and Huawei have managed to ship affordable smartphones in quantities to the North American and European markets, she added.

It is not just the sheer scale of the mobile subscriber base that makes China a heavyweight in the world market, analysts say. KPMG's Zarrella said the increasing demand by Chinese people for connectivity and rich mobile functions, together with the nation's huge investment in infrastructure and innovation, have also pushed forward China's handset industry.

"Chinese consumers want higher quality phones at a very good price. Meanwhile, they need mobile phones not just for calls but for video on demand and the use of cloud computing concepts to allow subscribers to store even more data," Zarrella wrote.

Tom Kang, a director at Strategy Analytics, added: "China's rapid growth has been driven by an increasing availability of smartphones in retail channels, aggressive subsidizing by operators of high-end models such as the Apple iPhone and an emerging wave of low-cost Android models from local Chinese brands such as ZTE."

Contact the writers at shenjingting@chinadaily.com.cn