Winter blues for China's textile industry

Updated: 2012-10-27 11:09

By Yan Yiqi and Zhang Jianming (China Daily)

|

||||||||

|

|

|

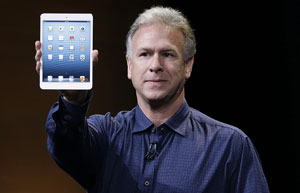

A view of East Market of China Textile City in Shaoxing county, Zhejiang province. Shaoxing's booming textile industry has faced many hurdles in its efforts to expand. [Photo/China Daily] |

Smaller businesses bearing the brunt of global economic woes

For Huang Yan this should be the busiest time of the year, when many Chinese companies are usually inundated with Christmas orders from overseas. But one afternoon early this month, Huang said she had not received a single sales inquiry all day. The newspapers on her desk have been read twice over and having forgotten to put a book in her bag before leaving home, she hopes she can find some unread dregs on a third reading.

The saleswoman next door is chatting with another one across the hall, and one of the main topics, apart from children and husbands, is how rotten business is at the moment.

Huang is a sales assistant at Zhejiang Weizi Textile, which owns two stores in the East Market of China Textile City, the country's largest market for textile products in Shaoxing county, Zhejiang province.

Trade has been this slow for several months, she said, and for small factories like the one she works for the problem is acute.

"It should still be Western customers' Christmas buying season, but you can see exactly what it's like."

This one corner of China's largest textile market covering an area of 3.2 million square meters is a microcosm of the business climate in Shaoxing.

Shaoxing hosts the densest concentration of textile businesses in the country, with more than 1,000 large-scale textile companies generating a total annual turnover of 153.8 billion yuan ($25 billion). Textiles account for 64.5 percent of production in Shaoxing, said He Jiashun, the county's Party chief.

"Shaoxing's economy is bound by a piece of cloth. A quarter of the world's textile product trading in terms of quantity is done through China Textile City here."

But He said Shaoxing's booming textile industry has faced many hurdles in its efforts to expand.

In the first three quarters of this year China Textile City's sales revenue was 59.3 billion yuan, up 7.5 percent year-on-year. Revenue has grown an average of 10 percent in recent years, said Shou Lumin, deputy director of the Construction and Management Committee of China Textile City. China Textile City's average monthly exports in the first nine months of the year were $255 million, an increase of 7.6 percent year-on-year.

While that performance outshines the meager 0.54 percent growth for textile exports nationally, pressure still weighs heavily on Shaoxing.

"We're not going to say shrinking external demand has had no influence on our member companies this year," Shou said. "On the contrary, we have heard many small companies complain about how difficult business is."

Yu Qi is sales manager at Shaoxing Qingwu Textile, one of the small companies that says it has suffered as orders have fallen. Its products are sold mainly in economically beleaguered Italy, and she said sales revenue from there has been particularly low since the end of last year. In fact, profits this year may barely be half of what they were last year, she said, refusing to elaborate.

"It is not that we don't have orders. In the first half of this year the number of orders from foreign clients grew 15 percent compared with the same time last year. The problem is the prices they offered were too low, so we decided not to take them."

Yu said that if she turns down their orders, the decision may come back to bite the company later on, but if she accepts them, it will hurt the company right now. "The more orders, the more we lose."

Yu said her company has around 30 employees, and to save costs they are encouraged not to turn up for work three or four days a week.

"Our boss says he will not cut numbers, even though at the moment we really do not need so many workers, but we are afraid that if things improve we will end up being short-staffed."

For bigger companies, shrinking overseas demand may not be as serious a problem as it is for smaller companies, but the former face great pressure to modernize the production chain.

One such company is Zhejiang Jinchan Curtain Co, whose chairman, Yang Lairong, said its biggest problem is not shrinking external demand. In fact, with a history of more than 20 years and more than 700 workers, Yang's company performed well in the first nine months of this year, when sales revenue rose 20 percent year-on-year.

"We have regular customers with whom contracts have been signed long in advance," he said.

Yang said that what preoccupies him most is how to modernize production in this traditionally labor-intensive manufacturing company.

"To be honest, the nature of the textile industry limits the scope of so-called industrial modernization, because the product itself still requires intensive labor and traditional techniques."

Yang said that although his company invested more than 4 million yuan in upgrading the plant last year, many qualified workers are still essential to the production process.

"The cost of hiring highly proficient workers is growing all the time, and we have to look for cutting-edge equipment to reduce those costs. But as far as I know there is no technology in China that can come up with the equipment needed to do away with the labor-intensive production that the textile industry requires."

He, the county's Party chief, acknowledges that textile industry modernization is something that cannot be achieved in a day, it is a long-term challenge.

"What Shaoxing's textile industry should essentially be heading for is strong innovative design and branding, but those things cannot relieve the industry of the burden of intensive labor, and that may be a hurdle to further modernization."

Another challenge is how to maintain output while at the same time making an effort to protect the environment. For example, Yang said that some of the textile industry's production processes inevitably produce wastewater.

The local government has stringent environmental protection rules, but it would be too expensive and complex for his company to shoulder the burden of solving this problem, which exists in just one or two links of the whole chain, he said.

"So what we came up with was to outsource our dyeing process, which holds the biggest environmental challenges, to other companies that can handle these problems."

Even as small factories battle to survive faced with shrinking external demand, and the large ones wrestle with the task of modernization, Shaoxing appears confident about the future of its pillar industry.

The autumn edition of the China Keqiao International Textile Expo is being held in the city from Friday to Monday, and Shou from China Textile City said local companies' interest in the event is unprecedented.

"By the end of last month 1,309 stalls had been booked, the first time the number has exceeded 1,300."

Shou said she feels that in her contact with the companies their eagerness to reach out for customers has strengthened.

Yu said her company has already booked a 10-square-meter stall at the expo.

"Customers from around the world will be there, and it's a great opportunity to show off our wares. We don't necessarily expect to sign big deals. With the failing European market, our priority is to expand our customer base."

As Shaoxing's textile companies continue to be hit by the slump in orders from the West, there are other markets with great potential, Shou said.

From January to July, 465 textile companies from Shaoxing exported products worth $136 million to Russia, a rise of 25.9 percent year-on-year.

"Russia coming to the fore as the traditional European markets fail us comes as a surprise," Shou said. "With Russia entering the World Trade Organization, that growth will accelerate."

Wei Changjun, president of Shaoxing Mina Textile, expresses similar optimism, saying Russia holds great potential for Chinese textile companies. The company registered a branch in Russia this year, and exports to the country totaled $3 million in the first half of the year.

"In the past, most textile products in the Russian market were from South Korea or Turkey, which they think are of better quality. But most of these products come from Shaoxing, so we are directly connecting with the Russian market," Wei said.

Shou said China Textile City plans to set up a marketplace in Russia for companies in Shaoxing to do business there.

"The marketplace will be in Moscow's Greenwood business park, and we will have a whole building of our own. Five companies are already there, and more should follow over the coming year."

Shou said that as Western recovery continues to be elusive, it is time to turn to emerging markets, with better products and services.

Contact the writers at yanyiqi@chinadaily.com.cn and zhangjianming@chinadaily.com.cn