Moving toward a world without cash

Updated: 2013-02-07 10:57

By Hu Yuanyuan (China Daily)

|

||||||||

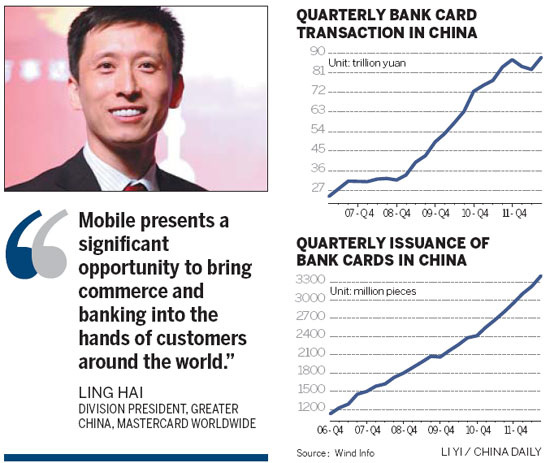

Card issuers look to credit and debit as the financial backbone of the future economy

Ling Hai, division president of Greater China for MasterCard Worldwide, has more than 10 bank cards in his wallet - all bearing the MasterCard logo but jointly issued with different Chinese banks.

At one time, when his company launched its No Cash Month campaign in March 2012, he had almost nothing in his wallet apart from his cards.

The campaign, an internal one within MasterCard's Asia-Pacific region, attracted a total of 1,000 employees from 41 teams. They competed with each other to see which team used the least cash or money options such as vouchers in their daily lives in that month.

It turned out Japan had the highest percentage of non-cash transactions, followed by Taiwan and then South Korea.

"Since last year, we've been committing ourselves to a new vision - a world beyond cash. And all our business strategies will center on the theme of reducing the use of cash as much as possible in today's society," said Ling, 43.

The campaign, Ling said, was a part of that commitment.

"Working in a payment technology company, if we cannot take the lead in using non-cash payment channels, how can we expect our customers, our cardholders to use them?" Ling asked.

The result of the campaign also revealed the huge market potential for the company.

Out of all MasterCard employees in the Asia-Pacific, the Middle East and Africa, fewer than 14 percent pay for goods with cash. Globally, nearly 85 percent of purchases by non-MasterCard employees are paid for with cash, according to the company's statistics.

However, employees found out that not using cash in their everyday lives was not all that easy: There are many places where bank cards are not accepted.

"They pass the information on to their colleagues who are in charge of the bank card acceptance business. Why don't those places accept bank cards? How do we encourage them to accept them? Thinking about this drives their colleagues to develop new products and services," said Ling. "Bear in mind no-cash activities can bring lots of benefits."