Soy slump ending as high demand overwhelms farms

Updated: 2011-10-12 07:52

(China Daily)

|

|||||||||

CHICAGO - The biggest rout in soybean prices in more than two years may be ending as farmers from Iowa to Brazil fail to keep pace with record demand for cooking oil and livestock feed.

The United States, the world's largest grower and exporter, will harvest 7.3 percent less this year, leading the first decline in global output since 2009, the US Department of Agriculture (USDA) estimates. Morgan Stanley expects soybeans to average $14.25 a bushel in the 12 months ending Aug 31, the most ever and 21 percent more than Monday's closing price of $11.775.

While prices began tumbling last month on investors' mounting concern that slowing growth will weaken demand for raw materials, global consumption of cooking oils hasn't fallen during a recession in the past three decades, USDA data show.

"People still need food, even if they aren't buying new cars, refrigerators or other durable goods," said Steven Nicholson, a commodity procurement specialist for Missouri-based International Food Products Corp. Prices may jump 19 percent by April because "production is not keeping up with rapidly expanding demand growth" from developing economies, he said.

Grain companies, processors and meat producers are becoming less bearish after cutting bets on lower prices by 62 percent in the past month, Commodity Futures Trading Commission data show. Their net-short position fell to 109,564 futures and options contracts as of Oct 4, the lowest since July 2010, before a rally that drove prices 62 percent higher to a 30-month high of $14.5575 on Feb 9.

US production may drop 12 percent to a four-year low of 2.944 billion bushels, after dry weather and freezes reduced yields, AgResource Co said. Inventories at the end of the marketing year will fall 55 percent to 97 million bushels, leaving them at a record-low of 3.1 percent of expected consumption, the Chicago-based research company said.

"I'm still afraid we're going to have a major economic crisis", which will erode demand for food, said Bill Gary, the president of Commodity Information Systems Inc.

Processing of US soybeans in the three months ended Aug 31 was the lowest in seven years, Gary said. Importers shifted to cheaper supplies of soybean oil and meal from Argentina and Brazil and palm oil from Malaysia, said Gary, who predicted prices may fall as low as $10 a bushel.

Global soybean consumption surged 47 percent in the past decade, fueled by economic growth in China, India and Brazil.

Over the past five global recessions, demand for soybeans, corn and wheat has grown by an average 2 percent a year, Morgan Stanley analysts wrote in a report on Sept 26. They reiterated their estimate for an average price of $14.25 a bushel in a report on Sunday.

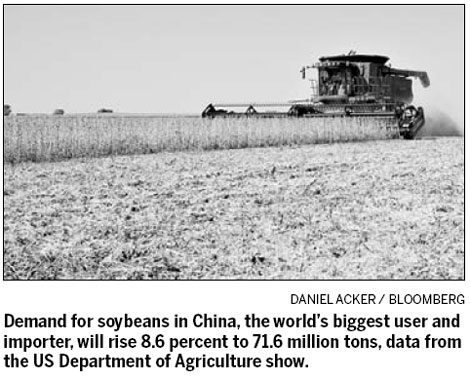

Global soybean consumption will increase 3.8 percent to 262.24 million metric tons in the year ending Sept 30, 2012, the highest ever, USDA data show. Demand in China, the world's biggest user and importer, will rise 8.6 percent to 71.6 million tons. Global reserves of cooking oils will shrink to 6.8 percent of consumption, a record low, the data show.

Soybean production is declining in part because farmers are choosing to plant more corn. A farmer in Illinois, the largest US grower after Iowa, can earn $373 more for each hectare of corn than on soybeans based on estimated costs and yields calculated by the University of Illinois and the price of crops on the CBOT during the harvest, Bloomberg data show.

Bloomberg News

(China Daily 10/12/2011 page17)