CASS urges steady policy course in 2012

Updated: 2011-12-08 09:29

By Chen Jia (China Daily)

|

|||||||||

BEIJING - The government should maintain a stable fiscal policy and prudent monetary policy next year despite expectations for slower economic growth, scholars from a top government think tank said on Wednesday.

|

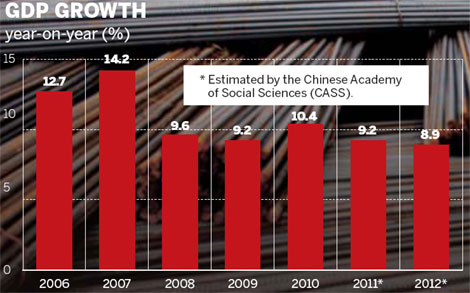

The expansion of the world's second-largest economy is predicted to slow to 8.9 percent in 2012, according to the annual economic blue book released by the Chinese Academy of Social Sciences (CASS).

The forecast rate is still relatively rapid and stable, and it is higher than the World Bank's outlook of 8.4 percent for 2012.

This year, GDP growth is likely to slump to 9.2 percent, 1.2 percentage points lower than in 2010, because of the weak world economic recovery and the end of the government's stimulus policy, the academy's report said.

Expected declines in exports and fixed-asset investments may together drag down growth next year, while domestic consumption is unlikely to dramatically increase in the short term, adding pressure on policymakers, said Chen Jiagui, the director of the academy's economic department.

In 2012, the export growth rate might drop to 17.3 percent, compared with an estimated 20.4 percent this year.

Meanwhile, the nominal growth rate of fixed-asset investment may decline to 22.8 percent from 24.5 percent this year, according to the academy.

"However, the authorities should maintain the current policies. Any further tightening or loosening of monetary policy is inadvisable," Chen said before the government's annual Central Economic Work Conference, expected to be held later this month.

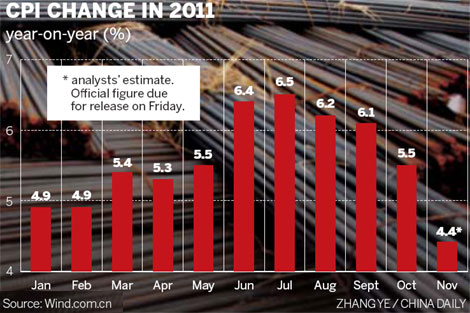

Inflation control may still be one of the most important tasks next year for the central government because of increasing labor costs and a potential surge in world commodity prices, although the consumer price index (CPI) in recent months has indicated an easing pressure, according to the blue book.

The academy forecast that the increase in the CPI in 2012 is likely to fall to 4.6 percent, 0.9 point lower than the forecast of 5.5 percent this year.

The CPI decreased to 5.5 percent in October year-on-year from 6.5 percent in July, according to the National Bureau of Statistics (NBS).

Many economists predicted that the rate in November may decline to below 5 percent. The NBS is scheduled to release the November figure on Friday.

Li Yang, the deputy head of CASS and a former adviser to China's central bank, said that the internal and world economic situations will become more complicated next year.

"Monetary policy may be slightly loosened in the first half of next year, and the reserve requirement ratio for commercial banks will be further reduced," Li said.

More policy changes may emerge in the coming months to facilitate the internationalization of the yuan and promote the free float of interest rates, considering the current decrease in foreign exchange reserves and the depreciation of the yuan, he added.

Some economists from international institutions have also lowered their expectations for China's growth in 2012, reflecting less confidence in the global recovery.

Zhang Zhiwei, chief economist with Nomura Securities (Hong Kong) Co Ltd, forecast that GDP will grow by 7.9 percent in 2012, one of the lowest predictions made among many securities firms.