Car exports and imports help sluggish Nov

Updated: 2011-12-26 17:17

(China Daily)

|

|||||||||

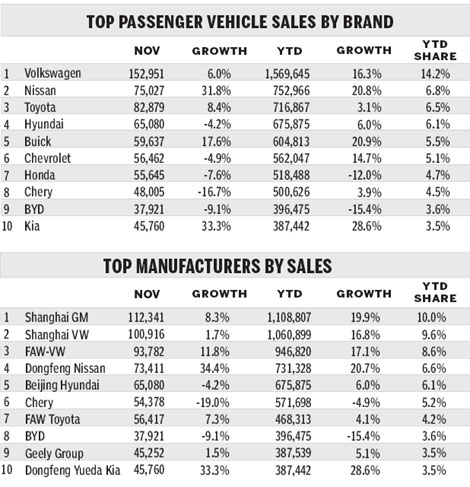

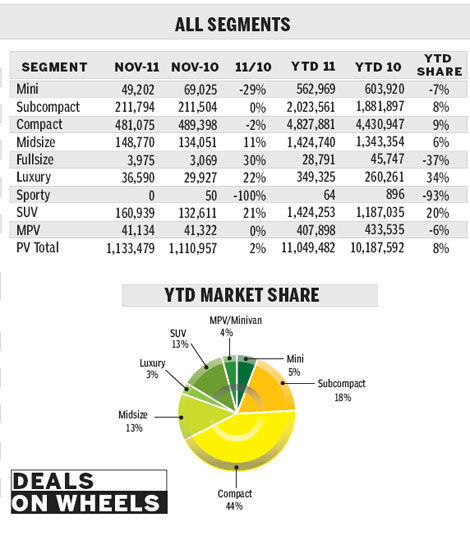

Though the decline was small, vehicle sales fell for only the second time this year in November, down 1 percent year on year to 1.63 million units.

Auto sales grew 3 percent to 1.2 million units, but light commercial vehicles dropped 10 percent to 421,000 units.

|

|

|

|

|

|

Yet when adjusted for seasonal trends, the annual rate hit a robust 19.1 million units, the sixth consecutive month-on-month gain and the third-highest in the market's history.

Extremely high inventories at the end of October slowed wholesale deliveries in the first half of November, but to meet annual sales targets most automakers continued to flood dealers with new models.

In a weak position, the dealers had to accept the shipments and rely on price campaigns to clear the inventory. In many cases, dealers sold cars at a loss to get rebates from manufacturers who wanted to count the sales by the end of the year.

Many carmakers even offered a continued 3,000-yuan subsidy even though their cars have not been on the government's eligibility list since Oct 1.

Exports and imports also boosted the total figures due to expansion in overseas markets and more affordable imports due to the appreciation of yuan.

In November, nearly 80,000 vehicles were shipped abroad, 50 percent more than a year ago.

Some 785,000 vehicles were exported in the first 11 months, up 54 percent year on year. At the same time sales of imported vehicles grew about 25 percent. By November, combined export and import growth hit 470,000 units.

Due to the expiring subsides, sales were sluggish for compact cars and smaller segments compared to the high base a year.

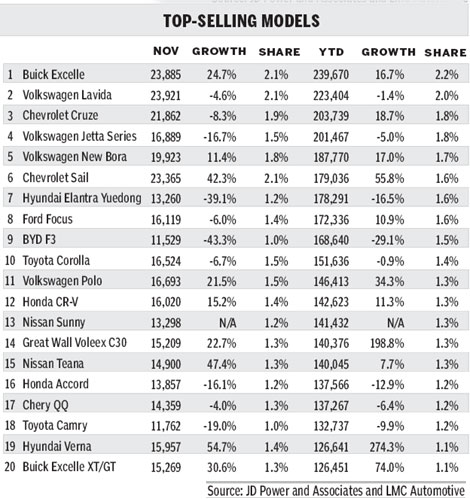

The mid-size car segment managed to grow 11 percent, mainly due to new models such as the Hyundai Sonata YF, Kia K5 and Peugeot 508. SUVs and luxury cars continued strong momentum, both growing over 20 percent year on year with volumes hitting historic highs.

Chinese brands found themselves in the doldrums in November, with passenger vehicle sales falling 5.1 percent year on year.

Their market share declined from 32.2 percent in 2010 to 29.6 percent by the end of November this year.

In the absence of subsidies, a change in strategy by some major domestic automakers played an important role.

BYD and Chery have both given up on the principle of "more models, more sales" and are now focusing on improving technology and quality. The proportion of low-priced models such as the F0, F3, M1 and Qiyun has decreased this year, while the numbers for their of models like the S6, G3 and Fulwin2 have risen.

With the November sales stronger than expected, we have slightly raised our forecast for 2011 to 18 million units, 4.6 percent growth over 2010.

Looking ahead, China's GDP growth is expected to slow to about 8 percent next year from about 9 percent this year.

As the EU is the largest export market for China, it is unlikely to escape the negative impact of the eurozone debt crisis.

But with inflation falling, Beijing's authorities will likely take measures to prop up growth if the economy slows significantly. If that were to happen, vehicle sales may again rise faster than we expect.

The author is a senior analyst at JD Power and Associates and LMC Automotive, who can be reached at MZhu@lmc-auto.com