Life

Time to sell

Updated: 2011-01-06 07:56

By Lin Qi (China Daily)

|

A luxury wristwatch is presented during an exhibition held in Xiamen, Fujian province. Yang Ge / for China Daily |

|

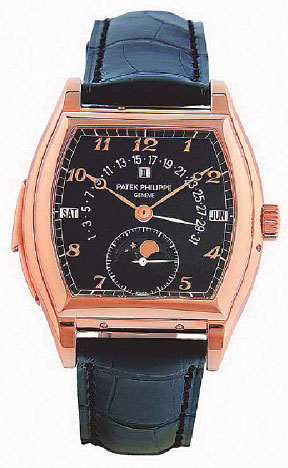

A Patek Philippe at Guardian's autumn auction. Provided to China Daily |

|

Luxury watches are displayed at a preview for Guardian's autumn auction. CFP |

Luxury watches emerge as a primary market among nation's collectors. Lin Qi reports.

China's nouveaux-riches are increasingly eyeing the luxury segment at auctions, and top brand wristwatches appear to be taking the lead. Major auction house Poly International launched its first sale of timepieces, which included 260 watches, at the autumn auction in early December. The sale raked in 42.83 million yuan ($6.48 million), with a Patek Philippe wristwatch going for a whopping 4.48 million yuan, the highest price of the lot.

Rival auction giant China Guardian Auctions also sold a Patek Philippe classic for the same amount in a sale in late November, also its highest price. A total of 110 luxury wristwatches went under the hammer, of which 80.9 percent were sold, bringing in more than 18.71 million yuan.

"The bidding was heated, and the results exceeded our expectations as well as those of the buyers," says Alex B. H. Ooi, general manager of Guardian's department of fine jewelry, jadeite, watches and clocks.

Guardian last included timepieces in its quarterly auction lots more than four years ago. Only 36 percent of the 206 lots in that sale were sold, for a total of 881,000 yuan.

"Driven by the economic growth of the past three decades, China has become a primary watch market in the past two or three years. We now see an emerging community of senior watch collectors with adequate, high quality secured collections (which can go under the hammer). However, we didn't know how big the auction market was," Ooi says.

He says the latest sale shows that watch consumers are not content with just shopping in luxury stores. They also participate actively in auctions where they can find limited edition pieces of historical value and those that are no longer manufactured.

"A bidder told me that one watch put up for auction was exactly the same brand and type of watch that he had bought many years ago to celebrate his first job. He later lost it. He was prepared to bid any price for it, and he did," Ooi says.

The appreciation of watches and clocks was popular in the courts of Qing Dynasty (1644-1911) emperors, since Emperor Qianlong. But it was only 10 years ago that private consumption of luxury watches appeared in China, marked by the sale of top-of- the-range Vacheron Constantin watches in a Beijing store in 1998, according to Kang Weikai, chief editor of fashion and lifestyle magazine Prime and a veteran watch collector.

"Before that, people knew only of such brands as Rolex, Omega, Longines and Rado. The appearance of Vacheron Constantin was the first indication that the Chinese watch market was beginning to be integrated into the world market," Kang says.

"In 2005, Patek Philippe opened its first store in China, in Shanghai. Since then, more blue chip brands have realized that China is an irresistible market.

"The market here has been growing smoothly in the past decade. Despite the financial crisis, some top watch brands have achieved double-digit sales in the Chinese market over the past three years," he adds.

People's enthusiasm for luxury watches has extended to the sales rooms of auction houses not just in the Chinese mainland.

"We have welcomed a wealth of new collectors to this field (watches) in the past year, and witnessed an exponential growth in buyer participation from Asian countries, led primarily by the Chinese mainland and Hong Kong," Aurel Bacs, International Head of Watches at Christie's, says. The auction giant's global watch sales exceeded $91 million in 2010, the highest total ever for this category at Christie's.

Although the market now has no dearth of capital, buyers should be wary about viewing them as an investment tool.

"I don't think watches are as good as stocks with respect to returns. Watches do carry lower investment risks, but appreciate in value only over time and need to be well preserved. Moreover, collectors should be knowledgeable of watches and insightful about their appreciation potential," Kang says.

He says a watch with significant collector and investment value should meet four main criteria: It should be produced by a manufacturer with a history of more than 100 years, feature the watchmakers' indigenously made movement, be made of precious metals and embody several subordinate functions.

Ooi says most bidders at the latest watch sale were newcomers, and they tend to buy watches that feature precious stones, diamonds and enamel decorations, whose lowest estimates run into tens of thousands of yuan. While the bidding was not as competitive when it came to watches with a less jeweled look but with more complex functions, such as minute repeater, perpetual calendar, and retrograde date mechanism, their lowest estimates ranged from 100s of thousands of yuan.

"It's quite natural for a beginner to start with collecting watches with a lot of decoration," Ooi says.

"We hope that after leaving the sales rooms, people will wear those watches for 20, 30 or even 50 years. And they will cultivate a deep bond for the craft of mechanical watches, for the principles of mechanics are closely related to the Industrial Revolution, which has created the modern world.

"Electronic products have become so commonplace and a mechanical watch brings a touch of nostalgia."

Specials

President Hu visits the US

President Hu Jintao is on a state visit to the US from Jan 18 to 21.

Ancient life

The discovery of the fossile of a female pterosaur nicknamed as Mrs T and her un-laid egg are shedding new light on ancient mysteries.

Economic Figures

China's GDP growth jumped 10.3 percent year-on-year in 2010, boosted by a faster-than-expected 9.8 percent expansion in the fourth quarter.