Lunch with Warren Buffett sets new record

Updated: 2011-06-13 10:54

By Lu Chang and Ariel Tung (China Daily)

|

|||||||||

|

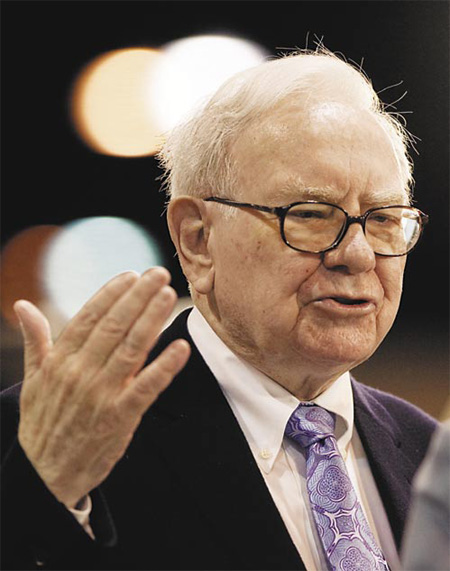

This is the 12th year Warren Buffett has volunteered to have lunch with the highest bidder of an online auction. Provided to China Daily |

|

|

Winner's name withheld, but some suggest top bid came from China

NEW YORK / BEIJING - The winning bidder's willingness to set a record for lunch with Warren Buffett is the latest proof of the glamour of the billionaire investor, as businesspeople are keen to boost their images by building connections with Buffett, experts said.

"For many business tycoons, a private lunch with the 'stock god' can be served as a marketing strategy to present themselves while building in methods to promote their business," said Yuan Wenzhao, deputy general manager of Beijing-based Hanji Investment Group.

When the online bidding war ended Friday night with eight bids, the highest bid fell short of the record, standing at $2,345,678, according to eBay. However, Bloomberg reported that the victorious bidder upped the offer to beat the record by $100, set last year when an unidentified donor paid $2.63 million for the steakhouse meal with the 80-year-old billionaire.

Though organizers didn't release the identity of the winner, there was plenty of speculation that the top bid came from China, since two Chinese business tycoons who attended previous Warren Buffett auction lunches raised more than half of the proceeds at the time.

Plunking down millions for a steak lunch might seem a tad excessive, but combining Buffett and investment strategy, it is unique and always inspiring.

Zhao Danyang, the Hong Kong-based hedge fund manager who won the bid in 2008 with a pledge of $2.1 million - three times larger than the previous record - found that the price of the lunch was a small price to pay to dine with Warren Buffett, the man whose strategy Zhao studied to make sense of the investing world.

"His views will benefit me my whole life," said Zhao.

Each year, millions of Buffett admirers flock to his hometown of Omaha, Nebraska. This is also the location for the annual shareholders meeting of Berkshire Hathaway, a conglomerate for which Buffett is the CEO. People line up for hours to hear him field questions on finance, public policy and life. The winner of this year's auction and up to seven friends will meet Buffett at New York's Smith & Wollensky steak house on a mutually agreed upon date, with free rein to steer several hours worth of table talk.

This is the 12th year that Buffett has volunteered to hold the charity auction fundraising lunch with whomever pays the highest price. The money goes to the Glide Foundation, a nonprofit organization that provides social services to the poor and homeless in the San Francisco Bay Area.

Yuan, from the Hanji Investment Group, said that it's very likely that the winner is Chinese, as there has been a strong "Buffett influence" going on in China and many are keen to use his name to open doors to new business contracts.

But he doesn't think "learning from the master" will make their fortune soar, because "there's only one Buffett in the world that can't be duplicated."

"It is beyond reason to pay such an extravagant sum only to listen a few remarks over dinner. One can always buy the books and extract what is suitable for his own path to financial success," Yuan said.

However, Richard Xu, senior managing director of Genesis International Capital LLC in New York, said he could understand why a Chinese entrepreneur or investor would want to spend some personal time with Buffett.

"Whether from the US or China, a successful investor would want to seek guidance from and talk to the legendary investor about the problems they face," said Xu.

Xu said he admires Buffett for making value choices in his investments. Although Buffett has not made that many Chinese investments, he has been successful in those he has picked, such as PetroChina, a Chinese oil and gas producer, and Chinese automaker BYD.

"Warren Buffett only invests in what he knows and understands," said Xu. "During the tech bubble in 1999 and 2000, he did not make any investments in high-tech companies. Right now, he's interested in China, but he's not too familiar with it. I think he will spend a small percentage of his money on China, but his investments will be focused in the US and European countries."

Calling it a "fine wine" effect, Kevin Pollack, managing director of Paragon Capital LP in New York, said the lunch bid will only get higher and higher each year.

"With each passing year, Warren Buffett has even more experience and wisdom to share," said Pollack who believes that the newest winner will "end up with plenty of valuable advice, investment ideas and contacts, and an experience that they'll remember for the rest of their life".

China Daily