China's pace of exports slumps

Updated: 2011-10-14 10:58

By Yan Yiqi (China Daily)

|

|||||||||

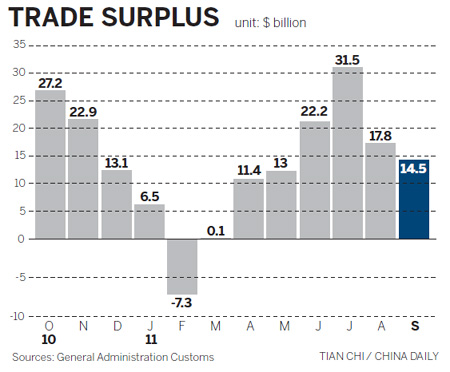

BEIJING - China's pace of exports took a heavy hit in September, according to data released Thursday, as the gradual rise in the Chinese currency as well as the economic turmoil in both Europe and in the United States have taken its toll.

Export growth fell to 17.1 percent over a year earlier, down from a pace of 24.5 percent in August, according to data released by China's General Administration of Customs. Imports rose 20.9 percent, down from 30.2 percent in the previous month. It is China's lowest growth rate in exports in seven months.

The customs bureau warned that "severe challenges" lay ahead for China if the economic doldrums continue for the EU and the US. It also said that the appreciation of the renminbi has weakened competitiveness, forcing exporters to refrain from long-term orders.

Growth in exports to Europe, China's biggest export market, slid to 9.8 percent from 22 percent a year earlier. Trade with the US climbed 11.9 percent in September from a year earlier with exports growing 11.6 percent and imports rising 12 percent.

Still, China's overall exports data is a sign that the worst has yet to come, according to several Chinese experts.

"With the debt crises becoming more and more serious in the US and EU, the economy and the employment rate in (China) can hardly recover. The negative impact will be reflected in trade figures for the fourth quarter and it is foreseeable that the record low export volume in 2008 will reappear in the following months," said

Li Jian at the Chinese Academy of International Trade and Economic Cooperation, which is affiliated with the Ministry of Commerce.

Lu Zhengwei, chief economist with the Industrial Bank, agreed that weak overseas demand, especially in developed economies, has been affecting China's shipments.

"In order to get out of their crises, these countries have to get their deficits under control. The financial deficits of Greece, Germany and France have all reached 3 percent, which will further lead to tightening policies. And the consequent weakening purchasing power will thus affect China's exports," he said.

But many of these experts say China is headed for a gradual slowdown instead of a sudden jolt and that China should be cautious about the decline in exports over the coming months.

After the data was released, Barclays Capital sounded an ominous warning bell, predicting that the decreased demand for China's shipments will slow its exports down to figures in the mid- to low-teen levels in the fourth quarter.

"Import growth will also slow," according to a Barclays report. "We expect the government to closely monitor export growth in the coming months as a factor in its monetary and exchange rate policy deliberations. Although small improvements will be seen during the Christmas season, China's export is still challenged by the debt crises in developed regions and the challenges ahead will not be temporary," said Xu Chengjian, an analyst at China Fortune Securities.

Xu said China's trade with developed countries will continue to shrink.

"The growth rate of trade will continue to see a certain decline in the fourth quarter. In the second quarter of next year, the growth rate might decline to under 15 percent, and we might witness some single-digit growth," Xu said.

One immediate result of the falloff in China's trade with the EU and the US, said Shen Danyang, spokesman for the Ministry of Commerce, will be heightened trade frictions.

"With the intensifying internal crises in Europe and the US, competition will be fiercer in these regions," Shen said.

Eric Emerson, partner at the international law firm Steptoe & Johnson LLP, said Chinese exporters could face more protectionist measures in the next nine to 12 months.

China's slumping trade figures, however, has not deterred US lawmakers from trying to persuade Beijing that it is keeping its currency, the renminbi, unfairly low against the dollar.

On Oct 11, the US Senate passed a bill that threatens to punish China for undervaluing its currency with retaliatory tariffs on imports from China.

Shen said that the US has sent the "wrong signal by escalating trade protectionism" at a time when the global economy is facing serious challenges.

Most analysts believe that the likelihood of a trade war between the two nations is slim, but added that China could still adopt retaliatory measures.

Li Jian, at the Chinese Academy of International Trade and Economic Cooperation, said the appreciation of the yuan has driven international clients away from China.

"Chinese products lost their advantages in relatively low price because of the appreciation of the yuan. Therefore, some European and US buyers will turn their eyes on to other emerging markets like Indonesia and Vietnam," Li said.

Li said the priority for China is sustaining growth in the future.

"One point of what we need to concern is whether China's foreign trade volume can realize a healthy and balanced growth, easing the pressure of yuan appreciation. And the other is how to be less dependent on low cost and energy," Li said.

China Daily