Exhibition streak

Updated: 2011-09-23 08:35

By Patrick Whiteley (China Daily)

|

|||||||||

China's blossoming industry is suffering from a lack of top-quality trade halls and uncoordinated infrastructure

The world's biggest exhibition center stands proudly in Hanover, Germany, boasting 490,000 square meters of state-of-the-art floor space and for decades has been a pillar of the Western trade show industry. The second largest expo site is in the fashion capital of Milan, Italy, with more than 400,000 sq m.

| ||||

The Chinese expo industry has been expanding annually at 13 percent compared to the global average of 0.9 percent, says consulting firm AMR.

With Shanghai leading the way, AMR forecasts that by 2013, China will become the world's third-largest exhibition industry behind the United States and Germany, pushing ahead of France and the United Kingdom.

As traditional media declines, the face-to-face nature of exhibitions and networking potential is attracting increasing levels of sponsorship, says AMR chief executive Denzil Rankine.

But in China, the lack of capable local management, a shortage of adequate venues and regulatory challenges pose problems, says Rankine, who suggests solving these issues and finding local associations or established local organizers to team up with are critical success factors.

Edwin Tan, vice-president of business development at Reed Exhibitions Greater China, says lack of quality space is a concern.

"If you look at it in terms of ratios, and compare it with expo space and halls, for example, in Germany, China is still sorely lacking in exhibition space," he says.

Tan hears complaints from foreign customers about poor transport facilities and the lack of hospitality infrastructure surrounding the venues.

"They (the exhibitors) want to zoom from the airport, get to the halls as quickly as possible, stay in good hotels, and get their business done," he says. "They don't want to get stuck in traffic, and once the job is done, they are out of here."

Barry Clarke, managing directing of publisher Taylor and Francis Asia-Pacific who attended the recent Beijing International Book Fair, is critical of the inconvenient transport systems.

The New China International Exhibition Center is near the airport, on the outskirts of the capital, but most visitors stayed downtown, and had to commute in Beijing's infamous traffic jams.

"The nearest train station is about a kilometer away: a terrible piece of planning unless you are a taxi driver. And the taxi drivers waiting outside the entrance to the book fair were demanding unreasonable rates to take passengers back into the city center.

"Although the quality of the meetings I had this year were as good as always, I will be looking at the impact of next year's fair much more closely. I will certainly stay in a hotel close by, as too much time was wasted this year sitting in traffic jams."

But despite the inconvenience, China's expo market is too important to ignore and its growth has almost followed a parallel path to China's opening-up policy and economic performance.

In 1978, only six international exhibitions were held in China; last year more than 3,500 official shows directly generated more than 16.20 billion yuan (1.8 billion euros), says the China Council for Promotion and International Trade (CCPIT).

The overall economic flow-on effect was even more significant. CCPIT estimates that last year's trade shows boosted the domestic economy by nearly 150 billion yuan. And these figures do not include revenue from the mother of all international trade shows, the 2010 Shanghai World Expo.

New exhibition halls have mushroomed across the country, especially in South China's expo cluster of Shenzhen, Guangzhou, Zhuhai, Dongguan, Hong Kong and Macao, prompting some critics to say there has been too much development, too quickly.

But Global Association of Exhibition Industry (UFI) figures support Tan. China's exhibition industry compared with Europe and North America is still in its infancy in terms of venue space and the number of exhibitions, visitors and exhibitors.

Exhibition square meter space is a key industry barometer and Europe has led the way in sheer size since the 1950s when trade fairs were used to kick-start post-World War II economic reconstruction, especially in Germany.

Every major German state government built a large exhibition hall, and at the same time, built supporting infrastructure (in China, most of the older centers were built and are managed by State-owned enterprises, not local governments.)

Other European countries followed the German model and this forward planning has paid dividends.

According to UFI estimates, in 2009, Europe still dominated the industry with 53 million sq m of exhibition space representing 49 percent of the world market.

It also had the highest number of exhibitions (13,700), the highest rate of visitors (126.3 million) and the highest number of exhibitors (1.4 million).

North America followed with 26 percent of floor space and then Asia with 19.8 million sq m and 18 percent (China represents about 55 percent of the Asian market).

However, UFI Asia-Pacific regional manager Mark Cochrane says all of the key pieces are in place to facilitate additional growth.

"There is a portfolio of modern world-class venues, a strong regional economic growth forecast, a robust and competitive group of international and domestic organizers and finally, support for the industry from governments across Asia," he says.

The China National Tourism Administration says business travelers account for almost 40 percent of all tourists, and Chinese expos are attracting more foreign visitors, who want to show their wares to busy local producers.

"The reason why exhibitions in China are growing so quickly is because of the demand and need to build 500 new airports, infrastructure, buildings, electronics, manufacturing and textiles," Tan says. "China demands newer technology, better machines and a lot of these machines are made by manufacturers from Japan, South Korea, Europe or America."

But China is also producing better quality products, which are catching the eye of Western businesses.

German company Sulky Burel has been making drilling machines and fertilizer spreaders for 74 years and its export manager, Serge Suffissais, last year attended the China International Agricultural Mechanization and Technology Exhibition for the first time.

"We were surprised to see that there were so many products and equipment at such an advanced level on the market. The Chinese government has increased State support for agricultural mechanization and the demand from Chinese farmers for agricultural equipment and machinery was much greater than we expected."

Jim Essink, president and CEO of UBM Asia, one of the major foreign trade fair organizers in the region, says the global economic crisis in 2008 marked a watershed in China's exhibition industry.

"Last year the China exhibition industry achieved 10 percent growth while Europe and America were still struggling with the impact of the economic crisis," he says.

"Due to the economic crisis, the world's major markets have been shifted from the West to the East. We can see how China has benefited from the economic downturn.

"Exhibitors, both local and overseas, find China attractive and increasingly important. With a huge population and a growing middle class, there is a stronger demand for consumer goods shows and the Chinese exhibition market is therefore no longer as dependent on global developments as in the past."

UBM Asia has 55 events on the Chinese mainland and offices in Beijing, Shanghai, Guangzhou, Hangzhou and Chengdu.

In 1998 it was the first international organizer to set up a joint venture company (Shanghai UBM Sinoexpo International Exhibition Co Ltd) in Shanghai with a local private trade fair organizer.

In terms of floor space sold in 2010, the nation's biggest organizer is China Foreign Trade Guangzhou Exhibition Corporation, which holds the famous Canton Fair.

Other major domestic players in ranking order include CCPIT, the Hong Kong Trade Development Council, World Expo Group Shanghai Modern International Exhibition and Dongguan Famous Furniture Association.

But last year, four international companies were included in China's top 10 rankings including UK-based Reed Exhibitions, US-based UBM and Germany companies Messe Koln and Messe Frankfurt.

One German newcomer to China is Messe Stuttgart, which in 2008 opened its office in Beijing and last year opened offices in Nanjing, the capital of Jiangsu province.

Chinese-born managing director Alex Qian says Messe Stutggart is the first wholly-owned foreign exhibition company registered in a second-tier Chinese city. Its formation is the result of sister-province ties between Jiangsu province and Stuttgart's Baden Wurttemberg region, one of the 16 states in Germany.

Qian, a 26-year exhibition career veteran, has worked for both a Chinese State-owned enterprise and one of Europe's leading organizers. After graduation in 1985, Qian worked for China International Exhibition Center, which is a subsidiary of CCPIT, for seven years, and later joined Messe Hanover for 12 years.

He says European trade shows are much better planned.

"The German, and European models rely on the regional economy. The hardware, such as the exhibition centers, are state-owned and so is everything around this center," he says.

"The hotels, conference halls, transport, restaurants, bars and entertainment facilities, and infrastructure are all planned.

"But the government leaves the business to a private management group and management gets very well rewarded if the show is a success. This incentive is not here in China."

According to Qian, the best expo site in China is the 170,000 sq m Shanghai New International Exhibition Center (SNIEC), which is jointly owned by Shanghai Lujiazui Exhibition Development Co Ltd and German Exposition Corp, which is a joint subsidiary of Deutsche Messe AG, Messe Duesseldorf and Messe Munich.

"Although new facilities are being built, they are not up to the same world's best practice," he says. "And issues of surrounding infrastructure near the center need to be better addressed."

He says licenses for trade fairs are also issued only on an annual basis, and this poses problems for organizers planning for the long term. "In Germany, organizers and exhibitioners plan five years ahead, and we cannot do that here."

Over the next decade he expects there will be a period of mergers, acquisitions and consolidation.

"Now many big Chinese exhibitors want to team with international organizers to improve their trade shows," he says. "The better organizers will survive."

Essink says UBM has aggressive China expansion plans and is "probably the most active international organizer in acquisitions" with successful results.

"Our Hong Kong Jewellery and Gem Fair surpassed the Basel Fair in Switzerland and the JCK show in the US to become the world's largest international jewelry fair," he says.

Outside the bigger cities, provincial governments are seeing the broader economic benefits and are expanding facilities.

In Changchun, the capital of Northeast China's Jilin province, almost 700 exhibitions and conferences were held between 2005 and 2010, generating about 5.5 billion yuan.

Government spokesman Song Lihua says the industry now accounts for about 14 percent of the city's service sector by volume, up from less than 5 percent in 2005.

By 2015 the city government plans to hold at least 334 exhibitions and conferences. This is expected to include seven or eight national and international events with estimated revenues reaching 4.8 billion yuan.

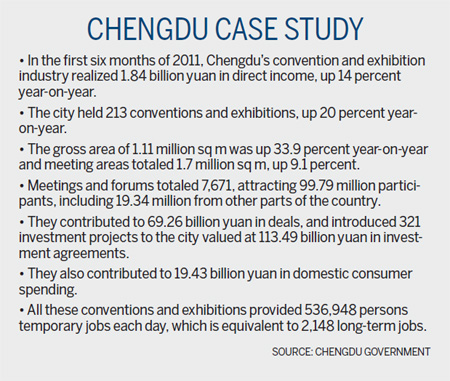

Chengdu, capital of Southwest China's Sichuan province, is another good example of how the expo industry is spreading beyond the bigger cities.

"Our growing exhibition industry should make the city even better. For Chengdu, it should serve the city's high-end industries and economic and social development," says Chen Lin, director of the municipal exhibition bureau.

Suzhou, about an hour's train ride from Shanghai, is taking advantage of its tourism resources and expo facilities in the hope of becoming the new darling of China's fledgling MICE (meetings, incentive travel, conferences and exhibitions) industry.

The city has 24 five-star hotels, and five airports - Nanjing, Hangzhou, Pudong, Hongqiao and Wuxi Shuofang - within three hours' drive.

Johnny Du, director of sales and marketing at the Intercontinental Suzhou, says the city has developed a solid industrial chain, especially with the robust development of the Suzhou Industrial Park. "So many Fortune 500 companies consider Suzhou when hosting conferences."

Michael Chen, CEO of the Suzhou International Expo Center, says the local tourism authority should favor the value-added MICE sector over more traditional tourism campaigns.

"It is only in this way that the overall tourism sector will witness a long-term sustainable development," he says.

However the MICE sector, too, is still lagging behind in quality and, sometimes, credibility.

Essenik says the meetings and conference industry is new to China, and with the exception of high-end international events, tend to be free and mostly of poor quality.

"Some of this was led by the need to fill occupancy, at any cost, in the new venues that have been built in China's larger cities but mainly this was due to the fact that conference activity was driven by sponsorship first and then delegate requirements second.

"This means that conference programs were un-researched, with the focus being on what the sponsors and speakers could get from an event rather than maximizing the learning, information-giving experience of the delegates."

A few conference organizers have also come under criticism for making illicit money by demanding excessive membership fees.

The China Nongovernmental Enterprise Directors Association came under fire from several entrepreneurs, who attended a conference and were asked to pay up to 500,000 yuan for "leadership positions".

"They told me more than 50 ministerial-level officials and 600 entrepreneurs would attend this meeting, but we needed to pay 16,800 yuan admission for one person," an entrepreneur told the Beijing News.

"No official was present, and only 200 enterprises attended."

Most of the attendees were told they could buy titles for 500,000 yuan. "It was like bargaining in the market. If we were found hesitating about the price, they would reduce it to 300,000 yuan," he says.

But these are rare cases, and foreign organizers are now turning their attention to meetings and conferences.

UBM last year set up a conference division in Shanghai to tap into the conference market.

"The feedback from our clients, which clearly shapes our thinking the most, is that they will pay for quality," Essenik says.

"We have found that the Chinese market responds well to established brands and as a starting point for developing our conference business in the region, it has proven to be a highly successful route.

"We were optimistic when we came to China and we are optimistic now."

|

China's exhibition industry achieved 10 percent growth last year. Provided to China Daily |

|

Above left: Alex Qian is managing director of Messe Stuttgart, which opened its first China office in Beijing in 2008. Above right: Jim Essink, president and CEO of UBM Asia, says the 2008 financial crisis marked a watershed in China's expo sector. Photos Provided to China Daily |

(China Daily 09/23/2011 page1)