Finding real wealth in health industry

Updated: 2014-02-17 02:48

By BEN YUE in Doha, Qatar (China Daily)

|

||||||||

Asia is revolutionizing the global medical enterprises with cost-saving and quality measures

It may be the best time ever to be living right now. Over the past four decades, the life expectancy of Asians has increased by more than a decade to more than 70 years, thanks to the development of the healthcare industry.

New drugs, medical equipment, therapies, organizations, policies and healthcare systems have emerged one after another, bringing improvements in people's lives and changes in their thinking about health management.

"In the last century, the biggest challenges we had were communicable disease and infectious diseases. Now we are moving into the new century. Our biggest challenges now are NCDs (non-communicable diseases) such as obesity and mental health problems," says Ara Darzi, chairman of the Institute of Global Health Innovation at Imperial College London and executive chairman of the World Innovation Summit for Health (WISH). The latest WISH seminar was held in December in Doha, Qatar.

Darzi says although the challenges in tackling diseases are similar around the world, adapting to innovations differs. "What's interesting about Asia is that the uptake seems to be quicker in some parts of this region," he says.

China has done a remarkable job in healthcare system reform, he believes, especially in tackling the shortage of per capita healthcare resources.

"The human capital shortage is a big challenge in Asia," he says. "If big countries such as China run the healthcare system the same way Europe does, it will probably take another 20 years to have enough general practitioners."

That in many ways has driven China and some other Asian countries to think in a different way, coming up with "workforce-reducing innovations", which include giving patients technologies to substitute the need for more doctors.

Also, it is practical to use nurse practitioners and other clinicians, rather than purely relying on doctors, he points out.

"Patient engagement will be the blockbuster drug of the 21st century, which will help countries shepherd resources," said Susan Edgman-Levitan, executive director of the Stoeckle Center for Primary Care Innovation at Massachusetts General Hospital, at the WISH meeting.

Across Asia, healthcare costs are rising faster than countries' ability to meet them. Experts argue that the answer to the crisis is not going to come from doing more of the same.

Instead, a fundamental shift toward harnessing the patients and the public who care about improving their own health could be the solution.

In India, patients are helping to combat counterfeit medicine by using free text messaging to verify authenticity through the organization mPedigree Network.

The network partnered with several pharmaceutical manufacturers to place an authenticity code on product packaging so that patients, providers, distributors and manufacturers can utilize the free service to confirm the product's authenticity at the point of sale or transfer.

According to a report published by the Economist Intelligence Unit, the annual average per capita healthcare spending in the Asia-Pacific region has more than doubled between 2001 and 2011, from $150 to $362. It is expected to reach $546 by 2016.

The soaring costs spent on the healthcare sector stimulate the creation of higher quality products with lower costs to suit the demands of local markets.

More global medical giants such as GE Healthcare, Bayer HealthCare Pharmaceuticals and Medtronic Inc have either set up global research and development centers or moved headquarters to Asia to meet the special needs of the local market.

Most healthcare innovations are now made to treat NCDs, with experts believing that Asia is leading the way in innovations to deal with the rising cases.

NCDs such as diabetes, mental health problems and antimicrobial resistance (or drug resistance) are becoming more common in everyday life in Asia, driven by the changing lifestyle patterns and widespread urbanization.

According to WISH, deaths from communicable diseases are dramatically decreasing globally, while deaths from NCDs are projected to increase. The number of global NCD-related deaths is estimated to surge from 28.1 million per year in 1990 to around 49.7 million per year in 2020.

In Southeast Asia alone, more than 7.9 million people die from NCDs every year, according to the World Health Organization (WHO). The number is projected to increase by 21 percent over the next decade.

To make the situation worse, 34 percent of NCD-related deaths in the region occur before the age of 60, compared with 23 percent in the rest of the world.

Cardiovascular diseases alone account for a quarter of all deaths, followed by chronic respiratory diseases, cancers and diabetes.

A report published by Diabetes Research and Clinical Practice shows that China and India now have the largest diabetic populations in the world, comprising around 51 million and 43 million people respectively.

Diabetes prevalence in Asia is expected to rise rapidly by 2030, with the highest prevalence ratio in Sri Lanka, Malaysia and South Korea.

According to the WISH estimates, 44 percent of all counterfeit antibiotics in the world are distributed in Southeast Asia, compared with 30 percent in Sub-Saharan Africa and 9 percent in the West.

Two-thirds of hospitalized patients in China receive antibiotics, when the rate of usage in other countries is 30 percent.

In terms of mental illness ratio, about 17 percent of Chinese people are suffering from mild or severe problems, a figure much higher than the 10 percent world average ratio.

In the medical equipment market, Chinese, Indian and South Korean manufacturers are streets ahead of their competitors.

Although they make products of lower quality than the multinationals, they are more affordable and meet the basic needs of the average healthcare provider, according to a recent report by healthcare market research consultancy Clearstate.

Governments in Asia have actively joined the movements in the industry to build better healthcare systems.

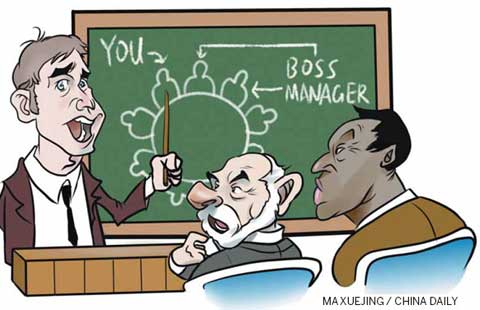

Accountable care, a buzzword in the healthcare sector which refers to delivering integrated healthcare based on patients' real need to improve quality and cut costs, has also proved to be successful in some parts of Asia, the WISH meeting showcased.

Singapore's Agency for Integrated Care (AIC) is a good example. From 2008, the Singaporean government set the AIC system to deal with escalating healthcare demands of the aging population.

By categorizing different patient groups, setting community medical homes to cover relevant patients and transiting patients from hospitals into the appropriate long-term community-care program, it has reduced a patient's chance by more than 40 percent of being re-admitted to hospital within 30 days of discharge, saving more than $11 million a year on the cost of hospital re-admissions.

"A key issue is leadership — to shake up the system," says Jason Cheah, chief executive of the AIC.

The demand to cut costs has brought more healthcare innovations from the supply side to the demand side, said Simon Stevens, president of the global health division at UnitedHealth Group.

Stevens added that fundamental healthcare innovations in the next decade will come from outside the healthcare sector, such as technology developments and inter-sector cooperation.

Many Asian countries have tried to coordinate different government departments to deal with healthcare challenges. For example, in the Sultanate of Oman, the government has developed a collaborative mechanism that enables the healthcare sector to work with the education sector and food industry in dealing with the growing obesity rate in children.

The common use of smartphones also provides opportunities from the new technology, such as phone applications to monitor blood pressure, blood sugar and nutrition condition, in addition to data collecting and analysis that can lead to more efficient healthcare solutions based on daily behavior.

Given the huge population in Asia and shortage of medical infrastructure, the latest innovations are especially promising.

"The healthcare environment has changed from five years ago. The changing environment has changed the way technology leaders invest," says John Dineen, president and CEO of GE Healthcare. The company is now investing to improve quality, efficiency and access at the same time.

For example, GE Healthcare developed Vscan, a pocket-sized ultrasound scanner, that helps assist local health workers to reduce the maternal mortality rate in the hinterland of Indonesia where hospitals cannot afford expensive medical equipment.

He says the settings of healthcare have changed transitioning from hospitals to clinics, to home, to the field.

Precipitation expected to clear up smog-filled skies

Precipitation expected to clear up smog-filled skies

Zhou Yang retains women's 1500m title

Zhou Yang retains women's 1500m title

Renzi set to become Italy's youngest PM

Renzi set to become Italy's youngest PM

Kissing contest celebrates Valentine's Day in Beijing

Kissing contest celebrates Valentine's Day in Beijing

Xinjiang quake damage could have been worse

Xinjiang quake damage could have been worse

US East Coast buried in snow

US East Coast buried in snow

China's Li wins women's 500m gold

China's Li wins women's 500m gold

1 dead, 2 injured in Ferrari accident

1 dead, 2 injured in Ferrari accident

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Finding real wealth in health industry

Canada policy change unfair

Courts try to improve efficiency

Obama signs increase in US debt ceiling

China, US agree to work on climate change

Less progress in Syria peace talks

Lantern Festival fires kill 6 in China

China's new loans reach $216b

US Weekly

|

|