Energy

Power plays

Updated: 2011-06-10 11:26

By Meng Jing, Zhang Chunyan and Hu Haiyan (China Daily European Weekly)

|

Workers unload coal at a port in Jiujiang, East China's Jiangxi province. Rising coal prices have forced many power plants to shut down, resulting in a severe power shortage. Provided to China Daily

|

Higher electricity charges expec to hit business, export inflation

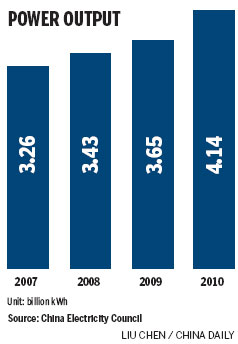

With a great economy, comes great power. When China, then the world's seventh-largest economy, had its worst blackouts seven years ago, other countries could hardly feel anything except a pinch of short-term undersupply caused by suspended production. But this time, the second-largest economy has a robust development and closer trade ties with all the major players in the world. Now when China suffers ?this year's blackout are supposed to be worse than 2004 ?the rest of the world will feel its pain, especially its largest exporting destinations, the European Union and the United States.

Markets in Europe were dominated by low-priced "made in China" products over the past decade. However, the surging labor costs coupled with the appreciation of the yuan has been challenging China's status as the world's factory.

With the arrival of the last straw, the severe power shortage, which has led to a rise in electricity prices and is likely to push up prices of other commodities, it seems impossible for the world's second-largest economy to remain a cheap goods exporter.

Instead, inflation may be added to the list of the country's latest exports, arriving at European ports with even higher-priced Chinese products.

More than 10 provinces in China have been hit badly by the power shortages. Suffering regions include cities in western China, central China and export hubs in coastal China.

|

|

Power cuts and blackouts in the Pearl River Delta and the Yangtze River Delta started in March, several months earlier than usual. The most difficult time is yet to come, when more and more energy-hungry air conditioners kick in with the rising temperature.

The State Grid, China's main electricity distribution company, warned last month that the electricity shortfall this summer may be as high as 40 gigawatts (gW), surpassing the 2004 record.

"Companies will likely respond (to the power shortage) by using diesel powered portable generators, which will add to costs sharply," says Brian Coulton, global emerging markets strategist at the London-based Legal & General Investment Management (LGIM), a leading financial assets manager in the United Kingdom.

Using diesel generators to fill the gaps between low power supply and surging power demand is exactly what manufacturers are doing in Cixi city, East China's Zhejiang province, a chemical fiber production hub in coastal China.

Blackouts happen two days every five days, which usually last about 12 hours a day, each blackout resulting in a 60,000-yuan (6,300 euros) loss and postponed delivery date at Cixi Henghui Chemical Fiber Co.

However, using diesel generators comes at a price. The price of power generated by diesel is nearly 2 yuan for each kilowatt-hour (kWh), which is twice as much as power from electric grid, says Xu Shuhui, deputy general manager of the fiber company.

"We can barely make ends meet when the power price reaches 1.5 yuan per kWh, let alone 2 yuan," Xu says, suggesting the company might have to increase the prices of its products.

Xu's company produces fabrics that are raw materials for textiles and clothes.

The EU is the largest importer of made-in-China clothes, spending $7.57 billion (5.17 billion euros) in the first quarter of 2011, according to Customs data.

Rising production cost in China, partly thanks to the power crunch, will eventually be passed on to consumers in Europe.

"Chinese export prices are already rising quite fast and this will add to inflation in the West. Importers of lower value-added Chinese goods will see the biggest impact," Coulton says.

To ease the pressure of the power crisis, the Chinese government raised the electricity prices for industrial, agricultural and commercial users in 15 provinces in June, encouraging coal-fired companies to generate more power.

China's coal prices are mostly market-based, but the power prices are tightly controlled by the government. The main reason for China's power crunch this year is that the utility companies don't have the will to generate power, says Lin Boqiang, director of China Center for Energy Economics Research at Xiamen University.

Specials

Birthday a new 'starting point'

China's national English language newspaper aims for a top-notch international all-media group.

Room at the inn

The Chinese hotel industry experiences a building boom, prompting fears of oversupply.

Pearls of wisdom

Chinese pearl farmers dominate the world market but now want to work smarter, not harder