Economy

Home away from home investment

Updated: 2011-07-27 09:13

By Zhou Yan (China Daily)

Faced with a slowdown in the nation's real estate sector, some cash-rich Chinese are looking overseas for bargains, reports Zhou Yan in Kuala Lumpur.

Back at the height of China's property boom in 2009, Qiu Liping embarked on a foray into Malaysia's tepid housing market by investing around 3 million yuan ($465,000) to buy a spacious apartment adjacent to the Petronas Twin Towers in the country's capital, Kuala Lumpur.

At that time, Malaysia's property sector was on average moderate, with virtually no growth in terms of transaction volumes. By contrast, China's real estate market rose to a fever pitch during the same period. The sales volume of residential properties, for instance, surged 43.9 percent in 2009 from the previous year.

|

"I had doubts about my first property investment in Malaysia at the time, but I was even more doubtful about China's relentless housing prices after years of skyrocketing increases," Qiu, 45, recalled.

Before that investment, the Shanghai resident had bought several properties in a number of Chinese cities that had registered rapid house-price growth, such as cosmopolitan Shanghai, western Chongqing, and the coastal city of Sanya in Hainan province. But then Qiu decided to stop buying residential properties in China because of concerns that the central government was likely to get a grip on runaway prices and dampen further growth.

Like many well-to-do Chinese at the time, Qiu had abundant cash in hand; the fear that the domestic property market might collapse did not cause them to shun the realty markets, but simply to move their focus outside the country.

"I was considering investing in Australia, but after careful and prudent selection, I chose Malaysia, which is closer to China, and more importantly, people speak Chinese. So I'm planning to live there when I retire," said Qiu, who pumped more than 11 million yuan into two more apartments in Kuala Lumpur in 2010 following predictions that her first tentative investment would generate a return of 15 percent by 2011.

Meanwhile, over the course of 2011 thus far - and as China's house prices have begun to stall against a background of intensifying government curbs - some domestic real estate brokerages have received an increasing number of enquiries from moderately well-off citizens about investing in overseas properties, in neighboring Asian countries in particular.

"This year, we have clients with more than 10 million yuan each to invest in Malaysian properties. That's never happened before," said Sophia Xia, managing director of Super City Group, a Shanghai-based real estate brokerage, which is also the company Qiu used for her overseas investments.

Before 2011, no Chinese customer had spent more than 3 million yuan on a single purchase in Malaysia, said Xia. She added that, unlike previous years, more Chinese have shown an interest in investing in the Asian markets instead of the more industrialized countries, such as the United States, Canada and the United Kingdom, which are the traditional outbound investment targets for Chinese billionaires.

Growing concerns

Since it was established in 1993, Super City's business reach has extended from Shanghai to most of those economies favored by Chinese customers. "In the future, our focus will shift to the Asia-Pacific region in accordance with our customers' preferences," said Xia.

She pointed out that more Chinese real estate investors have expressed concern this year about the uncertainties facing the nation's property policies going forward. "To be sure, they have to find another method of asset increment."

Indeed, many have good reason to worry about China's real estate market.

The credit rating companies Moody's Investors Service (in April) and Standard & Poor's (in June) lowered their outlook for China's property developers from "stable" to "negative" on deepening concerns that tighter credit controls and a string of policies designed to rein in house prices may cause a decline in residential sales.

On June 14, the People's Bank of China, the central bank, raised the reserve requirement ratio for lenders for the sixth time this year to a record 21.5 percent. According to a research note from Barclays Capital, the investment banking division of Barclays Plc, that hike is estimated to have locked in liquidity of about 380 billion yuan in the banking system.

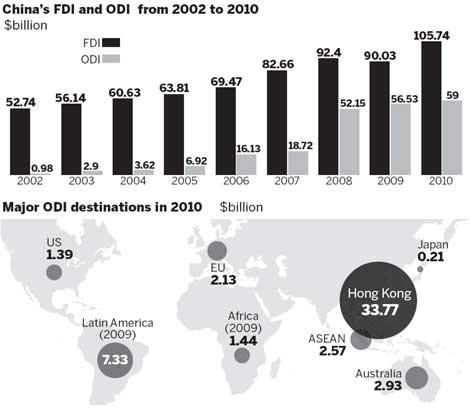

China's housing curbs will trigger capital outflows from the domestic real estate market to other areas, including equities, gold and overseas property, wrote Jing Ulrich, chairman of China equities and commodities at JPMorgan Chase & Co, in a research document published in April.

In addition, residents of the Chinese mainland have surpassed those of Indonesia and Malaysia to become the major foreign group purchasing homes in Singapore, Ulrich said, without citing figures or dates.

"While there is no good data (on Chinese investment in Southeast Asian properties) to track, there is a lot of anecdotal evidence indicating that Chinese investors have a great interest in buying properties in Singapore, and to a lesser extent,Malaysia, largely because of the need to diversify renminbi asset allocation," said Liu Ligang, head of China economics at Australia & New Zealand Banking Group (ANZ).

|

Specials

Turning up the heat

Traditional Chinese medicine using moxa, or mugwort herb, is once again becoming fashionable

Ciao, Yao

Yao Ming announced his retirement from basketball, staging an emotional end to a glorious career.

Financial sector short of talent

Lack of skilled professionals in Shanghai inhibiting the city's development as a financial hub